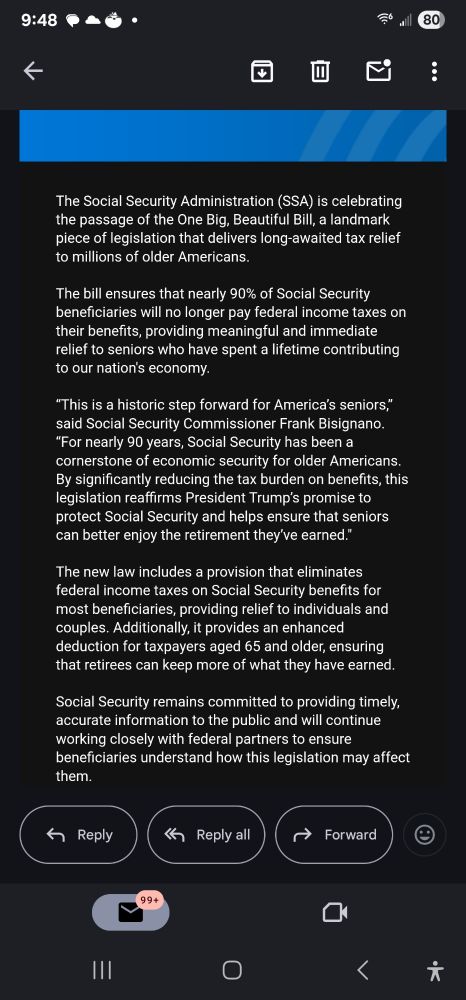

Can confirm this email is authentic — and about nothing in it is true. Social Security income is still taxed. This bill does nothing to change that. It’s willful disinformation on the part of SSA. It’s a lie.

Replies

My husband got this propaganda email and was fooled by it. I had to look it up to find out it's not true. Unbelievable.

There is still income tax on social security. But now you can qualify for a tax credit. My MIL never filed a return because she doesn't make enough money to owe taxes. She will have to file now in order to claim the credit. She is 90.

I'm pretty sure that there are only new deductions, not credits, which is a big difference.

You are correct. My search results included information from IRS.gov on tax credits for the elderly. Not the same thing.

And it will cost her over $300 to hire an accountant to file for her. That's probably more than she would get back.

Look at who is in charge of SSA right now and realize that anything they say is a lie going forward.

Disgusting using Social Security as Trump’s propaganda arm

I got one of those emails

Thanks for the correction. I got the email and immediately deleted it.

...so we can expect WaPo to write about this & inform the public via a topline article, right? ...right??

Looks like they even have SSA lying for them.

I,initially, also reacted with shock that SSA would spread disinformation or put a "spin" on the facts as I know them to be; then I remembered that there is a NEW MAGA SSA Director, Frank Bisignano, a Wall Street hire. Of course, the truth for Social Security is no longer the truth.

President Trump's promise to eliminate taxes on Social Security benefits faced a roadblock due to Senate rules. Instead, retirees will receive a temporary tax deduction called the 'Senior Bonus.' 1/2

The Senate proposed up to $6,000. This deduction applies to all income, not just Social Security benefits, and targets individuals with modified adjusted gross incomes below $75,000 and couples below $150,000 over 65.

The changes from Trump’s bill will reduce Social Security tax by $30b/yr — the trust fund would be exhausted in 2032 rather than in 2033.

The "bonus" is also only for 4 short years.

Got it. 🖕 trump and his presidency

The bills adds a temporary $6k or $12k deduction for seniors doesn't it? It's still a stretch to say SSI isn't taxed, you'd have to be on minimum SSI payment and near poverty for it to be true

Correct

Yes. At $20K total income you pay zero tax now. Still paying taxes above that. You may have lost your SNAP benefits in the process which you qualify for at that income level and will see how Medicare really shakes out in all this to see how much worse off you are.

finance.yahoo.com/news/tax-bre... Tax break for seniors: Trump bill includes additional $6,000 deduction

Propaganda though.... For anyone that has worked the majority of their life they'll get more in SSI than the $6k dedication will cover. It won't cover mine and I only worked on the 23 years total. As I said you'd have to be close to poverty income levels to benefit.

You’d have to be at the low end to be in line with the “ benefits are tax free” . At the $20K level of SS income as the only source you now have a $20K deduction and zero taxes. About 50% of recipients only get $20K.

🫵 are the problem Turtle island discovered lost seamen and their three 🤫🤑👑 Abrahamic Books in 1492. Love and kindness wherever we go! 🌈 #JesusSentUs #AllahSentUs #YahwehSentUs #KindnessMatters #HelpingHands #CommunityLove #SpreadingLove #SmallActsBigImpact

🫵 are the problem Turtle island discovered lost seamen and their three Abrahamic Books in 1492. Love and kindness wherever we go! 🌈 #JesusSentUs #AllahSentUs #YahwehSentUs #KindnessMatters #HelpingHands #CommunityLove #SpreadingLove #SmallActsBigImpact

I was appalled to see this blatantly partisan messaging in my inbox today. Yuck. Never mind that it's all lies.

This was sent from the Trumpenfuhrer Reichsministerium für Volksaufklärung und Propaganda

I believe that a word for this is propaganda.

Thank you, just got one of those. Just another lie.

I received it too, there are some me good changes for SS recipients, I will give them that. $6k deduction for those making under $75k single/$150k married is much better than what was there before, but that email is lying when they say 90% of people wont be taxed on SS.

The $6k deduction bonus is only for the next 4 years and then goes away altogether. So, seniors really get nothing from this besides a few short years of owing slightly less in taxes.

Oh I missed that, so every cut for the people is temporary 🤦🏻♀️

Yep. Ends at the end of his miserable term. Likely just to make him look good

Why not send SSA an email expressing your "joy"? secure.ssa.gov/emailus/

I too just received this bogus email. This is what an Authoritarian Regime looks like.

Good, but complex summary: #SSA #NoKings #impeach www.msn.com/en-us/politi...

Why not send SSA an email expressing your "joy"? Happy 4th of July secure.ssa.gov/emailus/

Thank you for the link.

1984, we have arrived.

Of course ...always lies.

Yep. For those who don’t already know, roughly 90% of seniors this bill was designed to protect from being taxed on their Social Security already paid little to no federal tax on those benefits before its enactment. (“Fast Facts & Figures About Social Security, 2023” -SSA)

Yeah, I think their fuzzy math includes the income shift with the expanded income deduction for seniors. That extra deduction will help a few on the margins, but not make up for the deaths from the Medicaid cuts.

Exactly this! 👆

That’s exactly what they’re doing—pretending the extra deduction for seniors in essence wipes out taxes on SS benefits. It will for a few, but it won’t affect SS benefits taxes for most, and it’s a flat-out lie to say the bill is eliminating SS taxes.

And the deduction ends in 2028 - meanwhile Medicare will be more expensive and more difficult to qualify - Yes the BBB does affect Medicare as well

If the BBB dies increase the deficit I have heard that "pay go" will cause automatic cuts to all programs, including Medicare.

I’ve heard the same and I don’t see how a) paygo is avoided and b) that wasn’t part of the plan all along - except it will be interesting to see how they exempt the military from the mandatory cuts 🤷♂️

I thought paygo didn't include defense spending. It is protected as part of the discretinary (appropiated) funds. It also doesn't affect the Post Office or Social Security trust funds, but would affect Medicare. But Congress could repeal paygo. govfacts.org/explainer/un...

You are correct, I was thinking about the sequestration under Obama due to the BCA, which apparently expired in 2021

I was appalled to open my email this morning and see this official government propaganda. Just another line we’ve crossed.

I agree with you. I thought it was a joke when I read it and verified that the email address was indeed a SSA email account.

Lies!

America thought it could deport the hands that feed it and still stay full. The food shortage timeline has already begun: 🥬 Late July: fresh produce 🥛 Fall: dairy & meat 💰 Winter: prices through the roof This isn’t fearmongering — it’s math. 📊 [infographic] #July4th #JulyForth #starvation #fascism

I thought it was fake. My husband did, too. Amazing how many lies are in it, that unfortunately, a lot of people are willing to believe.

I immediately threw that email in the trash after a few expletives this evening.

Sorta a lie, you pay no tax on social security you don't receive

I marked it as Spam

Me too.

I replied, LIARS

I would have, but still need to receive other correspondence from them. It's just sickening. Trump is poisoning every single Federal agency. We can no longer believe anything we're told.

I don’t think SSA sends emails. At least in all these years of being on Social Security, they have never sent an email. Notifications ALWAYS come in the mail. Those emails rank up there with text messages saying I owe Texas tolls- in other words, bogus.

they do, but they are usually check your social security balances this year (I am not of collection age)

I got this email tonight.

I doubt it’s real. It is so easy to fake an email address.

You can request emails instead of paper notices from SSA, which is what I do.

I got this email about an hour ago. I do occasionally receive email from SSA, but it's usually to tell me of a change and I need to log into my SSA account to read whatever it is they need me to know, ie., COLA raises, annual benefits verification letter, etc.

I got the email as well — and having worked more than 10 years for a railroad, I don’t have any direct dealings with Social Security. My SSA benefit is coordinated with and paid through the Railroad Retirement Board.

I laughed when I saw this email this morning, but really, there is nothing funny about it. Just a confirmation that Dumpy gave orders to Social Security, and that people do not know how to resist from within.

It’s from an unmonitored account (cowardly), and I hope they get a lot of unsubscribes like mine.

www.newsweek.com/social-secur....

I was about to ask the same! Woke up to that email.

None of it is true. Because they don’t give a rats ass about us.

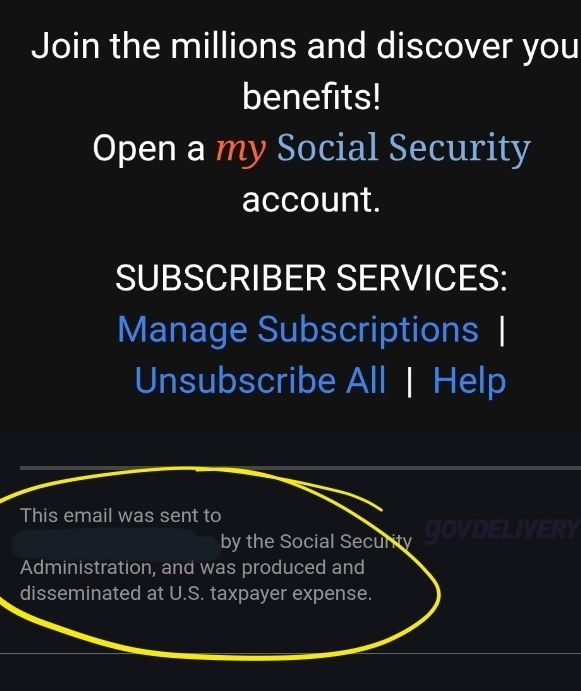

Oh, I’m afraid at least one part of it is all TOO true…”produced and disseminated at US taxpayer expense.” We are paying for the rope they use to hang us.

They are rubbing our noses in the fact that WE are now paying for their propoganda.

They sent it again today ( the next day)

Our whole government has been taken over by this Regime.. nothing still works for the American people.

SS recipients are getting fucked, right?

Gaslighted.

I was sick when i read that propaganda!!

This is ... a story.

It’s a lie Not willful disinformation Stop sugar coating this shit

Did you stop reading? He literally called it a lie

1: Willful disinformation *is* a lie 2: He literally said "it's a lie"

distinction with no difference

Willful disinformation? They lied Stop sugar coating this shit

I received that email. It was shocking to see how manipulated and twisted the message was. And... knowing it was teed up and ready to hit send so fast... the gaslighting has reached a whole new level. Sick.

I get phishing emails from North Korea with more credibility

It’s Goebbels propaganda. Get used to it. I would have said Nazi propaganda but that seems to piss some people off even though it fits 1000%.

geez. what a maze of misinformation for seniors to wade through. I'm so glad mom allows us full access to help her.

I hope your mom alerts her friends that this is one big beautiful lie. This can/will cause panic 😔

And the email was "produced and disseminated" using taxpayer money 🙄

I received this, it hit my in box around 2:00 a.m. I know a lot of people on S.S. are going to believe this crap.

Everyone I know thought it was a fishing scam. No one thought it was real. Now that we know it IS real, there is universal disgust. The last thing pissed off old people tolerate is fucking around with our benefits.

Will you try to get a statement from them explaining why they are lying their asses off? I got this email and was dumbfounded!

I got one. It’s total bs!! Propaganda!

Marked mine as spam/junk.

Govt agencies using official govt emails to spread lies and propaganda. This is some Pyongyang level bullshit.

Thank you for using the worn LIE! Thank you.

I was just coming here to see if others received the ominously political and MAGA-leaning email from SSA praising the bill. Could DOGE somehow be behind it? (Big Balls is at SSA now)

what?

I got the SSA email too. I looked into it. The details: bsky.app/profile/alaj...

www.pbs.org/newshour/pol...

Oh good grief everything is being sabotaged. What a nightmare

📌

Yea I got that, saved it for posterity- all a lie

I received the same email from Social Security. As a retired FED who retired under CSRS, I am not eligible. I deleted it.

Geez

It actually HAS changed it somewhat - just not totally and not for all people. Here's what it does: www.cnbc.com/2025/07/01/s...

I got it this morning. It made me realize that no federal agency has escaped the infection.

Yep. Blatant lie. There is no "provision" that addresses tax on SS in the bill.

Check out the details - pathological lies - www.whitehouse.gov/articles/202...

Actually, it's partly true, but that doesn't change how much I resent that it came from the SSA! I believe people over 65 will get an additional $6000 in deductions. I don't know/understand yet whether this is only for those who itemize or an addition to the standard deduction. (1/2)

This is from the CT Mirror, an independent publication. ctmirror.org/2025/07/03/b... (2/2)

And is a deduction or tax credit? A deduction is worth much less than taxes on Social Security

It's definitely not a tax credit. Just not sure what it's a deduction against. Plenty of people in that age range don't even collect Social Security (yet). That bill was passed with so much haste that it will require hundreds of clarifications.

It's not clear at all! I don't know if it's a deduction against the amount of Social Security income or a tax deduction. If the latter, it's meaningless for almost everyone (especially those 65 and older). If the former, it's still almost meaningless. (FWIW, I have an MS in Accounting)

88% of seniors don't pay federal taxes on their ss: total income is below the taxable thresholds standard deduction covers most of their income Many seniors have Social Security as their primary or only income source Only about 12% of seniors currently pay taxes on their Social Security benefits

It's a deduction. Either way, MOST people won't benefit from it due to the standard deduction. It will benefit wealthy people. Like the rest of the bill. Most people receive little on SS and they won't pay taxes anyway. Scam!

I thought it started to phase out at $75K/$150K, so it really just applies to a narrow income band. Probably won't cover the Medicare premium hikes

I think most people in that income range don’t itemize, because of the SALT caps. And the changes in those caps won’t have much impact on people 65+ in those ranges either. It’s just a Potemkin village of a change.

But that’s still not eliminating taxes on Social Security payments, which is what the email said: “The bill ensures that nearly 90% of Social Security beneficiaries will no longer pay federal income taxes on their benefits, providing meaningful and immediate relief to seniors…”

Correct. It eliminates taxes on Social Security payments for some of the people who currently pay tax on some of their Social Security payments. It does not provide meaningful nor immediate relief. The amount is meaningless to those few, and it doesn't put immediate $$ in anyone's pocket.

And, to be clear, most people who collect Social Security haven't paid income taxes on any of that money before this new bill.

I received one…BTW, don’t make enough from SSA to pay taxes, anyway…

While the email is grossly inappropriate political propaganda, after reading coverage of what's in the legislation and the claims of the email, I don't think it's accurate to state that "acount nothing in it is true." Please be more specific about the lies, quoting from the email.

😂 classic Frank, what a piece of 💩

This is a complete lie. Ask any CPA.

Or ask an informed senior that does their own taxes since most of us were completing tax returns manually before personal computers and tax software existed. Just saying...

"In all likelihood, no chocolate at all had been produced."

I got the email too!

They think we are stupid they are using EXISTING tax deductions for new math www.whitehouse.gov/articles/202...

I just overheard two 20-something year olds talking. One explained to the other their paychecks will go up with this new bill because they “now don’t have to pay Social Security & medicare taxes anymore cuz social security tax cut & Medicare cuts that probably start next week” Some may be stupid.

🤦♀️

I got one this evening. OMG

I unsubscribed then blocked. Not putting up with this bullshit.

Senior Bonus, huh? Sounds like a clever workaround, but I'm sure some folks might see it as a Band-Aid solution. What do you think, is it a step in the right direction or just a temporary fix?

I replied to the email with my thoughts. (It did go through). Then I unsubscribed my husband and I from all communications.

Fascist propaganda of the GOP Seig Heil Nazis regime

This email does nothing but praise the king. There is no information on the changes or any word of future updates.

I receive this email, too. I knew it was a lie because I try to keep up. But I bet a lot of ppl will be fall for this wilful misinformation. Shameful.

Is there anyway this can be reported to some legal team? Because there is NO WAY the SSA can be allowed to do this.

The Junta is in charge now. They can do anything.

When you consider the SSA is likely being run administratively by one of Elon's 19 year old flunkies this makes perfect sense.

Is this a blanket deduction or does one have to itemize to receive the deduction?

The Senate proposal approved Tuesday would eliminate Social Security tax liability for seniors with adjusted gross incomes of $75,000 or less or $150,000 if filing as a married couple. It goes away after 3 years. apnews.com/article/trum...

@4til7.bsky.social FYI

Political propaganda

I too received that appalling, misleading, overtly political email from the SSA last night—classic propaganda. If it is legal, Congress had better get busy writing a law to prevent further use of propaganda by our government agencies, before our democracy becomes a distant memory.

Good, but complex summary: www.msn.com/en-us/politi...

our democracy is fucked. we just haven't caught up to how bad it all is.

WE ARE POST DEMOCRACY FOR A FEW MONTHS STOP THE STEALING OF OUR DEMOCRACY IS THAT NOT WHAT TRUMP RAN ON what a liar, fraudster maybe we can replace July 4th with trumps birthday seems right to trump the biggest bestest never seen before lying fraudster citizensimpeachment.com

Too late

It’s bullshit from the kid with spots from doge. All official communications from Social Security go directly to my inbox. This one was in the junk mail. My email server knew exactly where it belonged.

That’s positive that it went to junk.

My email provider also marked it as "Spam" and deleted it. My guess is that it detected the typo in the subject line (a space in the middle of the word "Legislat ion")

Must have fixed it. No space in word Legislation in the email I received and Gmail did not put it in my spam folder. Although that’s where it is going now!

Mine had no typeographical errors… But my email server knows junk when it reads it.

Congress could write a law. The executive branch would ignore it. SCOTUS would allow it.

The Hatch Act makes this email illegal. But of course nobody enforces laws anymore.

Glad to see a reporter call out a lie as a lie instead of some obtuse sanewash language like "appears to be inaccurate" or some other hogwash. Earned a follow.

🤬 Here we are in 1984.

I got one about 10pm CDT.

misinformation by the lying fraudster rapist my maga neighbor said no way Trump promised us he would not touch our social security😅🤣😂 he cashed the check for the hat and flag and the bible and he got your vote you mean nothing to him now He has been rolling this way forever citizensimpeachment.com

I hope every senior confused about this calls their reps for explanation

This entire administration that Trump installed are criminals and liars Shameful that they’re using official email to send lies to people

The entire administration deserves to 😵 😵 😵 😵 😵

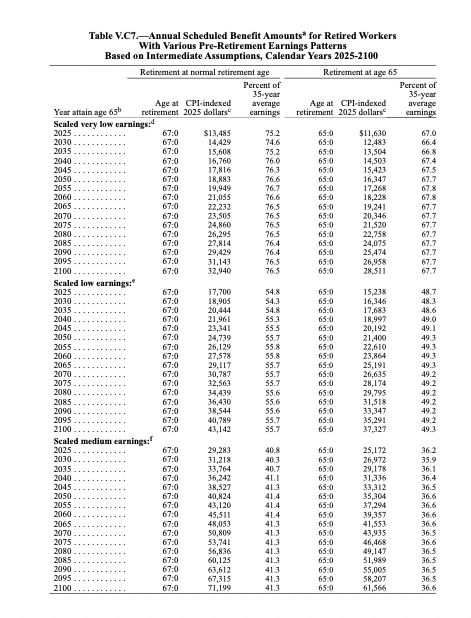

The 6k "bonus" is coming straight out of the Social Security trust fund. Seniors are on pace to lose a quarter of their benefits in *six years* now. This SUCKS.

However, even with the cut, benefits will still grow faster than inflation. It’s a “cut” in the growth, not a cut from what today’s retirees receive.

Not sure I follow? My understanding is that the cut will effectively be a cliff once the trust fund is depleted and they're limited to distributing payroll tax income.

The system will fail in that benefit growth will not keep up with income growth as originally intended. But real incomes will grow fast enough that the reduced benefits will still be larger than today’s benefits. So, still fine as a safety net. See p159 in the latest trustees report:

R’s want everyone to think the system is broken so they can privatize it, and D’s want to prove they will defend it, so nobody is coming out and saying it’s probably just fine the way it is.

But that chart is *scheduled* benefits. From page 6 of the 2025 annual report: "The OASI Trust Fund reserves are projected to become depleted in 2033, at which time OASI income would be sufficient to pay 77 percent of OASI scheduled benefits. "

Correct. That chart is showing the model they used for FULL Sox Security benefits. The point is that the current system can't pay all of that, only about 3/4 after 2031 under Tax Scam 2.0. Of course, we could just borrow to pay for full benefits, or make rich people pay same % as the rest of us.

Social security trust fund can't borrow money. If they were going to use regular treasury dollars to pay you would need a new benefit created by congress. Don't see that happening.

Sure it takes an act of Congress to pay some of the benefits with general tax dollars. But we do that with highways right now. Do you really believe that they'd just allow seniors to have their Social Security income cut off in 6 years? Only question is how they'd pay for it.

With what the current administration is doing to Medicaid and Medicare, unfortunately I absolutely do believe they'll fuck over Social Security. They desperately want to gut SSDI because they're eugenicists.

Page 3: "The combined reserves are projected to decrease from $2,721 billion at the beginning of 2025 to $214 billion at the beginning of 2034, and are then expected to become depleted during 2034"

Page 6: "maintaining 75-year solvency through 2099 with changes that begin in 2034 would require: [...] a reduction in scheduled benefits by an amount equivalent to a permanent 25.8 percent reduction in all benefits starting in 2034"

Thanks, I read “scheduled” to mean projected under current law, without any changes. But I think you are right. So, there will be a dip in real benefits from 2035-2045. By 2045, the real benefit reduced by 77% will exceed today’s benefit.

Consumer Price Index is rigged. Social Security will always lag inflation.

"Rigged" might be overstating it a bit, but we as a society have a nasty way of having breakout cost increases in things like housing, medical care, etc. that it doesn't adequately capture.

I try to push back against rhetoric that can be weaponized to undermine Social Security because it's a great program! But it is only part of the big picture - we need Medicare For All, universal basic income, etc. to have a safety net without any gaping holes.

The party in power may destroy Medicaid, ACA/Obamacare with this new bill. Make it harder for people to qualify, millions drop off, costs increase for smaller pool of people, more people drop off. Vicious cycle.

That's the game, yeah. Say "government doesn't work" then sabotage it until they're right.

yeah, but changing the formula benefited the government to pay out less. there was a motive behind changing it from decades previous. Regardless, it's detrimental to people collecting Social Security.

I just got the email. What's it all about?

I totally disregarded it. Delete. Nothing that comes from the current administration has a single iota of truth.

I was so pissed when I opened my email this morning to find the propaganda sent to me by the SSA. Never in my life have I had the government send me anything like this.

I’m irate too. I printed it out and I’m taking it to Rep. Stansbury’s office Monday morning.

bsky.app/profile/cozy...

Yeah, I just got it. And I'm not collecting yet. And the"enhanced deduction for taxpayers aged 65 and older" doesn't look like it'll affect the ones who need it most and it phases out in a few years. Misrepresentation of the facts. Typical. finance.yahoo.com/news/tax-bre...

I did my mom's taxes for her this year and she paid nothing at all in taxes. I assume most seniors, unless wealthy, pay no taxes on their SS income.

Another benefit for the rich really

Oh it gets better here is the SPIN - www.whitehouse.gov/articles/202...

So that's a double poke in the eye. I got the email. You say nothing changed.

Disinformation kinda like a lie or untruth?? Trump lies like a rug….

I'm on Social Security and got this untrue email from SSA last night. I put into trash, was going to unsubscribe but that might give someone info. They don't need. Just trash it!

Yes - I received this email this morning! Was stunned about the lies.

👀 SMDH "Social Security remains committed to providing timely, accurate information to the public and will continue working closely with federal partners to ensure beneficiaries understand how this legislation may affect them."

OMG yes. You should see my reaponses (plural) to the supposedly unmonitored mailbox.

I will get an deduction on about 2 months of my SS income. I’m thankful they didn’t increase my tax, although they will bankrupt my country!

📌

Yep. I got that email.

It is no coincidence that Trump’s Social Security Administration sent us all propaganda on Independence Day. These are dangerous times.

jesus christ

Got one and refused to read it because its now controlled by 🤡. 🤬

They are using our tax dollars to lie to us.

Yeah, my husband and I each received these emailed letters and as soon as we saw the subject line we immediately deleted them without opening them. We won't enable their blatant lies.

Everything is a lie and distraction from this administration.

Must have been written by Kristi Trump Noem.

Isn't it also correct that the tax on SSI goes back into the SS system. So cutting the tax would actually lead to insolvency sooner?

It is indeed correct.

That tax is still in place. Instead, for three years there is an unrelated 6000 deduction for people over 65 with incomes up to 75/150. How this affects the SS revenue is unclear.

Can we sue social security for deliberately sending lies?

The good thing is that people won't actually see the results of this deduction until they file their 2026 taxes in 2027 which is after the 2026 elections. So no good news seen for GOP candidates before the 2026 election.

Many tax implications start this year

I'm talking about the Social Security deductions.

I also received that email and just replied with one word. "LIARS"

When donald j. trump & his DEI hires repeatedly make false & misleading claims, they're setting themselves up for class action False Claims Act lawsuits. The benefit trump & his minions are hoping to receive is more votes to receive more federal pay & benefits. www.youtube.com/watch?v=hkRV...

It's been the republican dream for decades to turn the US government into a sleazy company that takes advantage of you, instead of an entity that protects you from scams.

Isn’t this merely a temporary increase in the standard deduction for seniors? Social Security will still be taxable, but with a slightly larger standard deduction.

Is there a particular provision that they are misrepresenting? Or are they just completely making it up?

as i understand it, because you can’t lower taxes in a reconciliation bill, they instead have people over 65 an extra big deduction which will have the effect of zeroing out taxes on SS

(though the deduction starts going down at income levels above a certain level $75k individual/$150k couples? or something like that)

Interesting, thanks!

I guess the CPAs are happy bc it's good for their big business clients.

From AICPA: "... However, it provides a temporary $6,000 deduction under Sec. 151 for individual taxpayers who are age 65 or older. This sr deduction begins to phase out when a taxpayer’s MAGI exceeds $75,000 ($150,000 in the case of a joint return). It will be in effect for the years 2025 - 2028."

Funny how this carve out almost exactly matches the maga demographic Hope my tax accountant got the memo too

I'd like to see the numbers on just how many people will actually benefit from this and how much $ difference it will make. So many don't even pay much tax in the first place, and then it gets adjusted if they do make over $75k somehow. ??? It's freaking weird. Big talking point, little benefit.

But don't get used to it - it's only good through the current administration's term. Goes away after the 2028 election, did you notice? They're such chicken-shits.

I got it. it's a crock o'shite.

It is US GOVT issued PROPAGANDA to retain power. MILLIONS will believe it.

I thought the email was delivered from a propaganda website. I was directed to the website to unsubscribe only to find it was delivered from the government’s official social security website, which is apparently now a propaganda website.

This was at the bottom of the propaganda email. This email was sent to *******@aol.com by the Social Security Administration, and was produced and disseminated at U.S. taxpayer expense.

I got this email too. I knew it was bullshit but I’m sure lots of gullible people will think it’s true. The gaslighting is off the charts

I’m hoping they notice it’s a lie. Most people on a fixed income know precisely how many dollars they receive every payment. If they’re told that there’s a huge tax cut, and then the same amount as always shows up, they might be curious.

I was going to say, won’t people notice when they get their checks? I mean I know what to expect with my paycheck & would notice if nothing changed.

1. Federal income taxes aren't withheld from your Social Security payment unless you request taxes be withheld. 2. The 'senior bonus' is available to seniors 65+ even if they aren't receiving SS benefits yet. 3. The 'senior bonus' is an additional tax deduction taken when filing a fed return.

Thanks for the explanation.

Then is Newsweek in on it too? www.newsweek.com/social-secur...

It's fake news

Sounds like a FOIA request is in order for I find out what clown ordered this to be sent out

I just contact my congressional rep and asked her to look into it.

wonder what it means if I didn't get one

Likely you’ve never signed up for the Social Security website and created an account so they have your email.

I thought I did but apparently I never finished it

At least in this instance, you were lucky.

Interesting that you received the email from SSA while not a recipient. I had started to think a mail list was created from the data DOGE stole from the SSA. This admin is pulling names & data from more than one stolen source. This is propaganda sent after the BUB was passed by the House.

When they don’t have any more money, they’ll find out.

Exactly!!

Written by Big Balls

Related tax question on the bill, but does anyone know if the no tax on tips changes the Social Security tax element? Does that still get withheld and do employers still have to pay the SSI employer portion based on tip income? For most tipped workers that is the main federal tax they pay.

No SSI payments no benefits in retirement. That's my understanding.

Pretty sure it doesn't impact FICA taxes. Just income taxes.

So there will be a lot of confused tipped workers in the near future getting paystubs who dont understand that no taxes didn't mean those taxes.

Here’s another wrinkle - what if someone has multiple tipped jobs? Could result in underpayment.

I thought so as soon as I read it. Sounds written by a propaganda machine. The level of on-your-face cruelty and lies is off-the-charts:

I got mine just before midnight pacific last night

Yep - figured it was all a lie. Immediately deleted that POS

Isn’t the larger issue that it’s a Hatch Act violation?

We have reached North Korean levels of knee bending in very short order.

And soon speaking out will land us in Alligator Auschwitz Alcatraz. I am stunned to receive this. It is terrifying.

I got it too. The worst part of it is that "new" SSA made it and sent it. It promised tax relieft to the elderly like never before. Sound familiar?

And they are gunna be shocked when they pay just a tiny bit less than last year….

The BBB includes a $6,000 tax deduction for Americans 65 or older getting Social Security. It raises the number of SSI benefit recipients who will not pay taxes from 64% to 88%. With an earnings Cap of $75K single and $150K joint and it expires on January 1, 2028. The tax is not paid for.

So if the percent of people not paying taxes on SS benefits goes from 64% to 88%, how many actual people is that?

About 14 million additional seniors will benefit from the change. tinyurl.com/3nvfak24

The SSA email says the bill has a provision "that eliminates federal income tax on Social Security benefits for most beneficiaries" IN ADDITION TO the temporary enhanced deduction for Americans 65 or older. I can find no such additional provision in the bill, and I believe the email is a lie.

The Senate put the provision in the bill. If the letter was sent by The SSA it's misleading at best. The new tax credit doesn't cover all SSI recipients and is not permanent. Today Trump will say he eliminated taxes on SSI benefits which is a lie.

Agree - the increase to 6K for individ deduction for 65+ appears to be what will eliminate Fed Tax. Email seems to refer to this twice so why "in addition to"????

Is posted on SSA website as well: www.ssa.gov/news/press/r...

I got it, read it and deleted it. SSA is no longer a reliable source, even about their own policies.

Email from subscription.service@subscriptions.ssa.gov SSA is now a full fledged MAGA propaganda operation.

Could this be considered entrapment? Not that entrapment is illegal. But this is … not good.

Happy Fourth! But first, some bad (albeit entertainingly presented) bad news. open.substack.com/pub/ohhistev...

In another era, we would have called this government propaganda.

I received this email and knew it was from SSA but all in it was false. Unfortunately there will be THOUSANDS who won’t be skeptical. Thanks, Repubs. Lies, Lies, Lies.

Yep. I got one and I replied with a fuck off with your big, fat lies. All the agencies under Trump lie and only work to do harm to citizens. I may go on a list, but I don't give a fuck about these assholes.

My partner and I got it as well. Wtf

There IS a $6000 TAX deduction available for over 65s in the bill...only applies if you actually pay taxes, though...and has zip to do with Social Security, as I hear it. So, it will mostly affect those with higher incomes...won't help many of us at all.

More for the wealthy

Yep, I got that email tonight too and didn't know whether to laugh or cry about it 😡

This qualifies as wire fraud. A class action suit could be filed. Difficult to win with the current SC where it would undoubtedly end up but that's not the point. We're talking about millions of Americans and the media exposure of the fraud would be huge.

None of it!

I am almost daily. I live on my Social Security and I’m paying almost $300 a month out of my small check to add towards Medicare because they don’t cover crap for you and if I have to go to the hospital, I would lose everything I own because of the bill from them! So don’t brag ever about it

www.pbs.org/newshour/pol...

It’s complete gaslighting. And they didn’t even mention all the #disabled who are probably going to die because of this will do to us. I have SSDI because I have #MS and several other autoimmune diseases and I’m only 46. By only addressing seniors they cut out huge swaths of the population

Someone sent the message to my college group chat. I had to spend time explaining to the group how untrue it is. I guess the plan is just disinformation 🤷🏿

Note that WE paid for these lies to be sent: "This email was sent to [my box] by the Social Security Administration, and was produced and disseminated at U.S. taxpayer expense."

That email was terrifying. He has complete control over them. They never send emails like that. And the public WILL believe it, because of the source of ssa.gov source of the email.

Do they not think that the seniors living pay check to pay check won’t notice that their Social Security checks have not increased and taxes are still being taken out?

That’s why they said 90% of the people will not have to pay taxes. When everyone sees taxes being taken out of their check they will assume (wrongly) that they were the 10% who were taxed. When in reality were all the 10%

Social Security recipients control how much federal tax is withheld from their monthly payments. It doesn't work the same way that wages do. Lower-income seniors don't pay taxes on Social Security and don't have any taxes taken out. Nothing changes.

Yes they think they won’t notice. Propaganda warps the mind.

The fact that this shit went out TODAY, hours after they passed that horrible, life-ruining bill, tells you all you need to know. It’s pure propaganda.

Yup, I was preached this by a Trumper today. He still won't believe me.

The stupid shall inherit the world 🤦♀️

Tragic but absolute truth

When the info from the federal gov't can't be verified or is wrong refuse to pay any federal tax until they get it right and release an official set of guidelines. DO NOT PAY FED TAX UNTIL THEY ARE UNDER CONTROL.

It explicitly states the SS income is no longer taxed and *additionally* there are new deductions. So now everybody who owed taxes previously alters their withholding or estimated payments and gets a big surprise next April.

It's not true. Poorly worded propaganda.

My 27 year old daughter got that email

Odd…

Not odd. I'm not retirement age but I signed up with SSA to check my annual numbers etc., and I get a few emails a year reminding me to (ironically) watch out for scams and such.

The mentality is that the extra 6K standard deduction will make SS tax free for most of us. The Orwellian double speak is getting masterful.

Mail fraud?

I got an email. That's wire fraud & I wish somebody with money would sue them over it.

God can you imagine the absolute nightmare SSA employees are about to experience as soon as beneficiaries start getting checks that still have tax withholdings. Just an onslaught of anger and never ending phone calls.

They don't withhold it from your SS check - you have to save it yourself to pay when you do your taxes (if it turns out you owe the IRS)

True!!

No taxation without representation. James Comer refuses to represent anyone but felon 47

That's good to know but also...really dumb. So this is now just a time bomb waiting to go off. Brilliant.

Looking into a bit more, you can apparently request to have taxes withheld (which I assume many do) out of your SSA payment. I also assume that will continue causing some wave of complaints to SSA by folks who don't remember setting that up.

Both hubby and I have taxes withheld from our SS checks every month. Will have to check into this further…

That's correct. You just print out a form W-4 online and send it in to the SSA. I know because I did it.

My husband and I both have Federal tax withheld from our monthly SS checks. Me because I still work part-time, he because he works contract with no taxes withheld. Wondering if anything will change?

You control those withholdings. If you don't update them, nothing changes. It's actually a very convenient way to make payments to account for other types of income.

Love that by signing up to monitor my retirement, I'm force fed propaganda...

I unsubscribed from the mailing list. Despite the statement on the unsubscribe page that “your account will be deleted”, your SSA dot gov account is not deleted if you unsubscribe from govDELIVERY. Your govDELIVERY account is also not deleted as you can log back in later and resubscribe to emails.

Let’s see if they honor the unsubscribe. As you can file a TCPA claim if the don’t honor your request. I wouldn’t put it past them not honor it to push propaganda.

It would be very useful to lots of us if you or someone else could tell us what shred of language in the bill SSA hung that email on. I got it and it **sounded** good. I'd love a reporter to dig into this.

It would be nice if the AARP actually advocated for seniors and their issues instead of trying to sell crappy Medicare Advantage plans.

They have been bombarding me with activist emails to sign petitions, send emails, call my rep, etc. I think the problem is that most people opt out of their email campaigns. I'm not sure what they are doing in other avenues.

Do you see the word "Republicans" even once in this article? They are a right wing organization that preys on vulnerable elderly citizens. No different than the Republican party. www.aarp.org/government-e...

Here is the fucked yo rationale - www.whitehouse.gov/articles/202...

I recd an email from Turbo Tax celebrating the passage. Look at this bullshit…

TurboTax is ecstatic that they’re deep-sixing the free filing tool.

Exactly