Pensions: - there to ensure more people have a secure retirement - not there to support tax planning

Replies

Am astonished at how many people don’t understand this basic concept. You get tax relief (at your highest rate) when saving & pay tax (after 25% of the pot being tax free) when you start to take it at retirement. Any thats left over when you die should of course be taxed.

Absolutely! Tax relief is just there to avoid double taxation; the tax people pay on their pensions should depend on how well off they are when they receive & can spend it, not when they lock it away. People should also pay higher taxes on unearned income (like inheritances) than earned income.

Pensions: - there to smooth people's earnings into their retirements in a tax-neutral way (although some tax freebies have been added on, like the tax-free cash lump sum) - don't change the fact that it's right people are taxed more heavily on unearned income (e.g. inheritances) than earned income

I think Tom’s hoping to replace Ferrari when he retires/explodes with anger! Already playing to that audience.

This is how Labour need to fight back, I heard you are getting promoted in The Times, if you could also help that newspaper from turning into right wing tat that would be useful aswell 👍

Mr Bell - you're great. You just need to slow down your delivery.

The very last thing I was thinking about when putting hard earned salary into my company pension scheme was whether there would be any left over when I die. I was rather more focused on having enough to keep myself alive after retiring!

Pensioner benefits already do a good job enabling survival to be fair, private pensions are more about maintaining (or, in a not trivial number of cases, increasing) living standards following retirement. But the purpose is absolutely not to reduce tax rates on our kids' unearned income.

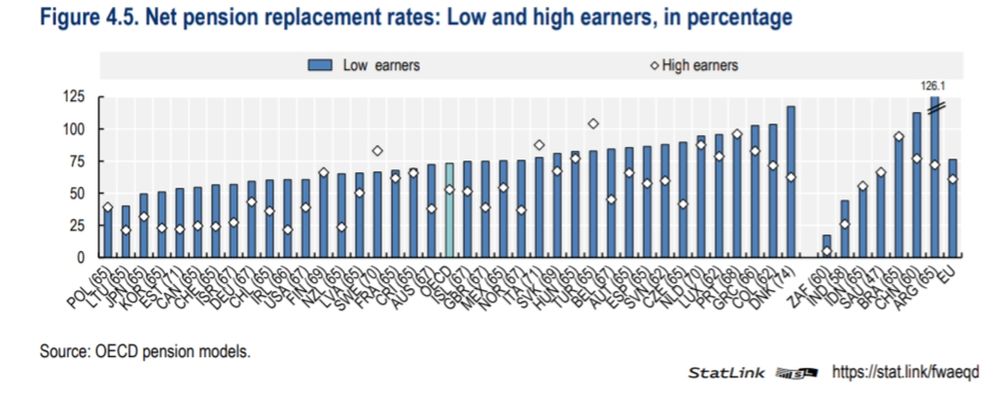

Current state pension benefits do no such thing, unless one considers living under the poverty line ‘a good job’. IIRC, we have the least generous retirement benefits in Europe. My small military pension reduces my state pension as it was, apparently, ‘contracted out’. 1/2

Our state pension provision (which does include auto-enrolled pensions) is about average vs other developed countries. Our pensioner benefits are however more generous than our non-pensioner benefits, contributing to lower pensioner than non-pensioner poverty rates.

Thanks for the info. Just going to add this before we close: UK has 2nd largest GDP in Europe. We are 11th in the relative generosity of our state pension provision.

The UK's about 18th highest in Europe, in terms of GDP per capita (on a PPP basis, ie adjusted for the cost of goods in different countries). But replacement rate figures above are a % pre-retirement earnings, so already allow broad differences in how well off different countries are.

Thanks. 1&2. ‘Net replacement rate’ means nothing to me. 3. ‘May’ is doing a lot of heavy lifting as the slide tells us nothing about distribution. 4. Housing costs are real for pensioners too. I don’t own property.

Net replacement rates are post-retirement income as a % of pre-retirement income. A bit of a crude measure, since post-retirement income usually doesn't need to be as high (eg lower childcare costs). The third slide shows the distribution of incomes. Third & fourth slides address housing costs.

In particular, for those of us with rent/mortgages, the third and fourth graphs deduct those costs from our incomes before comparing. So eg if someone has £20k income but spends £8k on rent, they'd show up as being on £12k, as that's what they've got to spend after putting a roof over their heads.

Thanks

Thanks

My private pension is the buffer between what I will get and what I need to survive increased living costs in later life, for example medical (when NHS goes private), later life care (bc if I can pay my way I will). /E

Well done Torsten. Impressive, assertive appearances on the morning round today. It’s about time every Labour MPs adopted a more robust attitude towards these ‘clickbait’, ill informed, largely RW journalists. Can you train them before the Autumn season?