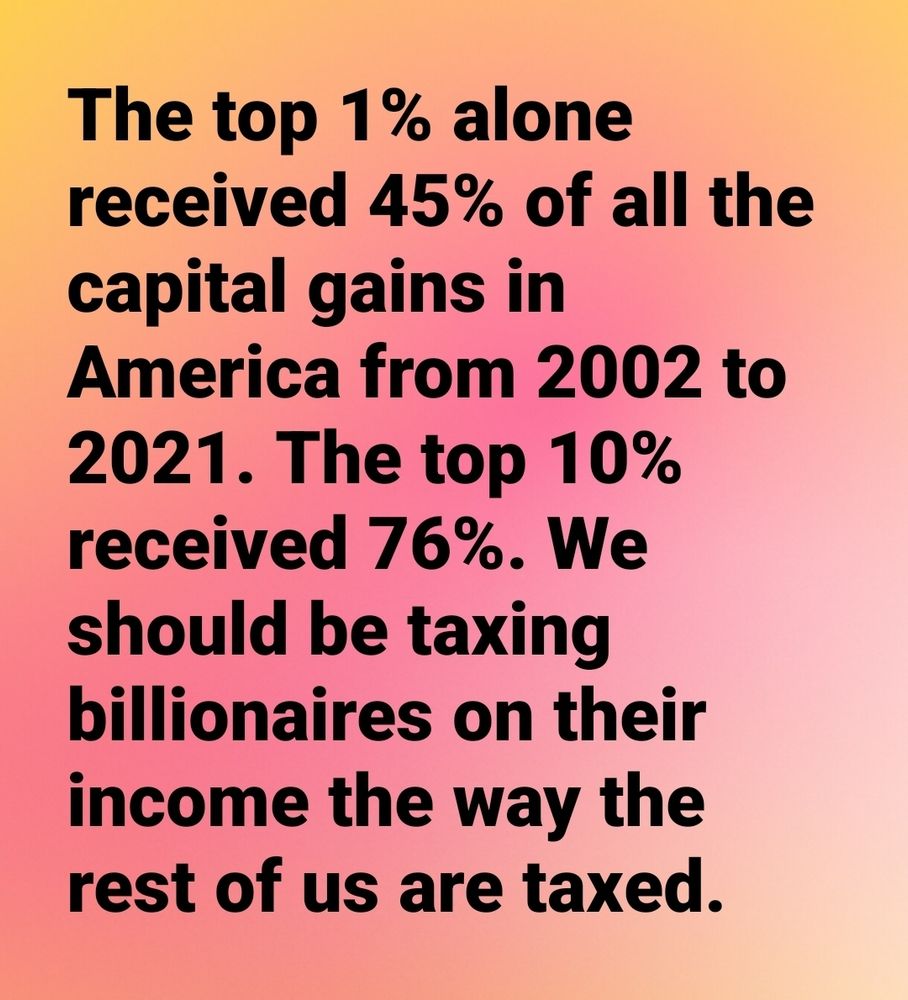

Since dictraitor won’t, states need to tax the rich to make up for the shortfall.

Replies

YES!!!! That's what I've been saying, too!

Absolutely

The federal gov't doesn't have the authority to tax unrealized capital gains. However, the states do have that power through personal property taxes. Most states only tax real property, like vehicles and real estate. They have the ability to expand that to stocks, bonds, and other financial items.

One thing the wealthy do is to borrow against their wealth and live on that. If they have $100 million in investments, they use that as collateral on a multi-million dollar loan. If the investment is growing faster than the interest rate on the loan, then it's cheap for them. They pay no taxes on

the loan. We should tax these loans as ordinary income if they are used for living expenses. For example, if you take out a home equity loan and pay off a car with it, that should be taxed as ordinary income. I don't believe it is taxed at all, but I could be mistaken.