It isn’t and wasn’t a tax break. My question was lot well-framed. Why do you think all private school parents are millionaires? They are not. Not by a long chalk.

Replies

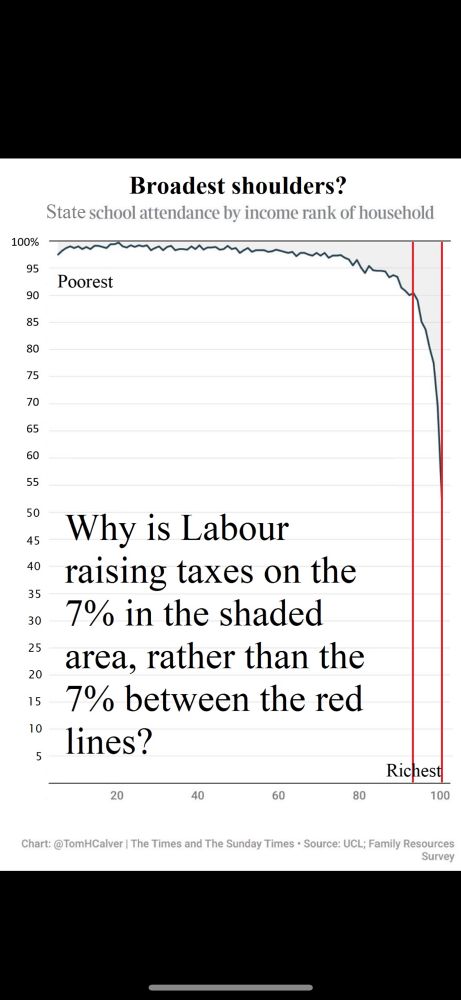

It is a tax break. Private school fees were VAT-exempt, now they are not. And I'm sure many private school parents aren't millionaires; however, they are generally in the top 7% of earners.

They are not the top 7% of earners at all. That is a myth you have fallen for.

Education was VAT exempt. It still is, bar an exception to that exemption for children aged 5-18. Most private school parents aren’t millionaires. 1/3 are outside the top two income deciles (broadly equivalent to basic rate tax) that’s 200k of them. 12.5% are on median income and below.

It's the principle of buying privilege that stinks. The rest of us don't have a choice. Even if you can afford private you should care about the quality of state education, it's literally the future of our country.

Many of “the rest of us” could afford to but don’t. The vast majority of the rich use state schools. They buy a house in a nice catchment and get you to pay for their kids’ 1st class state education in a school most couldn’t dream of accessing.

That isn't good either. I live in Southwark and there is a minimal gap between schools. It should be an aspiration. I work in Bromley & the gap is so bad you can buy a house next to the best school & still not get a place. Gone on for decades but nothing is done about the other schools.

I’d like to ask you about “buying privilege”. What do you think about parents taking kids on educational trips / holidays, buying them books, joining them up to sports clubs, tutoring etc.? They are all buying an advantage over those that can’t afford to.

Of course and VAT is paid

But does it “stink”, this buying of advantage?

It stinks that Dulwich College, Eton et al, are multi-million £ businesses claiming charitable status tax exemptions. I am not doffing my cap to that abuse.

I see. You don’t like Eton and Dulwich so the entire diverse landscape of 2600 private schools in the uk, mostly small and medium sized local day schools that are nothing like elite public boarding schools can go hang. There’s a word for that. Bigotry.

Of course people buy advantage but why should private school access be exempt from VAT it's nonsensical?

Because it’s education and all education should be exempt as it’s a merit good. It’s fiscally nonsensical to tax it.

Not on books, most tutoring or museums, galleries, zoos, art exhibitions.

Or sports clubs.

I work in a borough where the council pay for private school places because their SEND provision is woeful or non-existent. It would make more sense for the state to fund the provision and places allocated based on need not privilege. Eton etc could be excellent residential specialist provision.