Lulz the pro-superannuation tax rorters still wheeling out the line about how many will be affected in 30 years time. 30 years ago the top income tax rate threshold was $50,000. Oddly it is now $190,000. Bizarre. I thought these things are not able to change in 30 years!

Replies

Whilst indexing or raising can be done later, I really don't see why it can't be indexed now, especially as this is one of the key issues being used against it. I genuinely don't see why it wouldn't start as a progressive tax on high wealth individuals and be indexed to stay that way.

Indexing robs governments of the chance to offer a tax cut in the future. That's why they don't like it.

I mean raising tax thresholds is the politically easiest thing for a govt to do, I’m sure some govts will do it.

They're clutching at straws when the well off start sounding concerned about the poor....

The 0.5% of SF owners with >$3M invested are desperate to convince the other 99.5% that they will be crushed by the change. For some reason the media has jumped on board.

are they also complaining about the submarines we might possibly be getting in 30 years time? don't tell me..... that might also change in the next 3 decades?

Monique Ryan is taking this line, which just goes to show, scratch the teal veneer and you'll find the blue undercoat.

I am still amazed that few in Australia are up in arms that the median balance in supers for women is noticeably less than it is for men. Whereas, in most countries, the system is set up to provide more overall retirement benefit for women---since they live longer.

business profit Pre EOFY into super to reduce tax

Do you think the unrealised gains tax could or will extend to property?

No.

What about if you have a self-managed super fund and part of your investments are in property?

For the portion that is greater than $3M you will be taxed on the unrealised capital gains as I understand it.

See answer above to your earlier question… atm it’s all poorly thought out & in danger of meeting the same wall of righteous concern as were the hamfisted 2019 proposals re negative gearing, the CGT discount & franking credits, which tragically effectively nixed otherwise justifiable reforms

There was nothing justified about Labor’s 2019 franking policy. Other than it was rejected, of course.

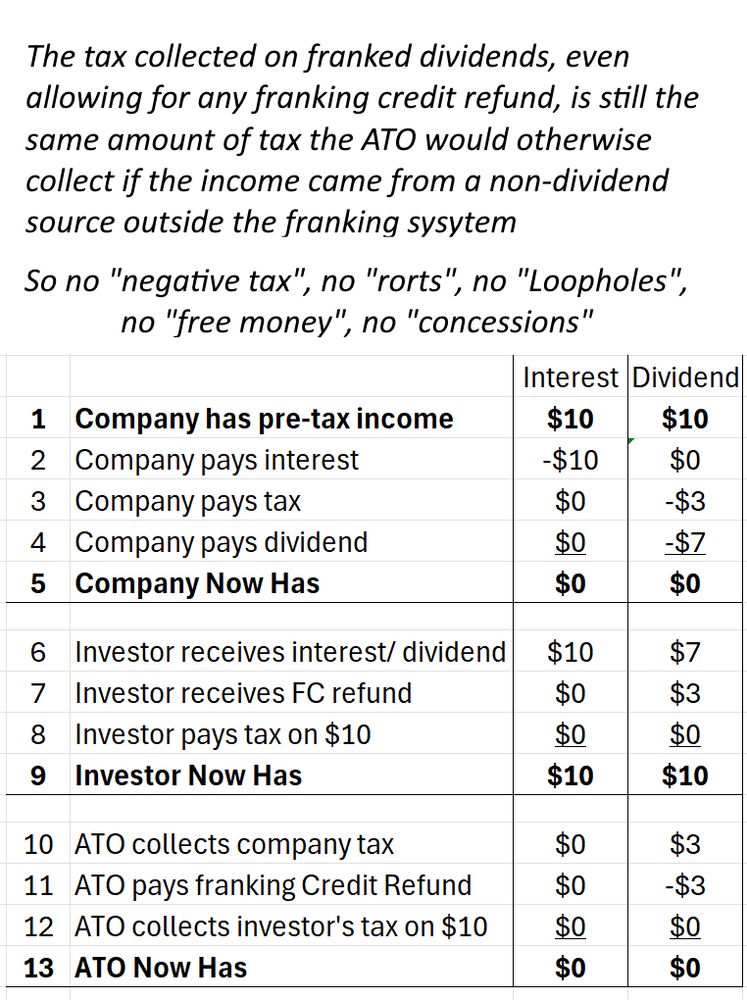

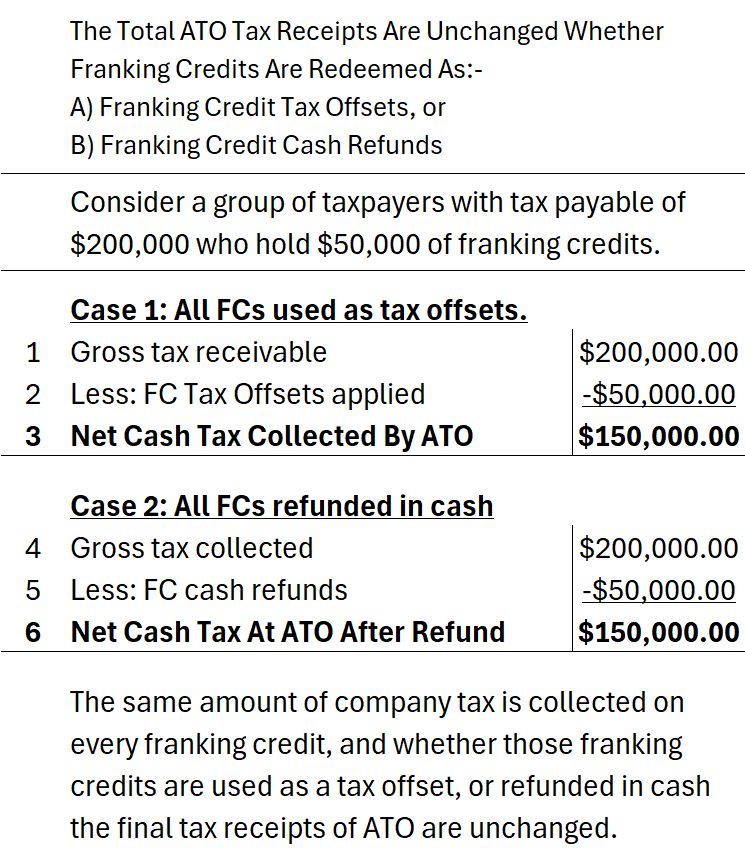

There was nothing "justified" in Labor's 2019 franking policy. As dim as they are, it's possible even they know that now. The same tax is collected on franked dividends, including where there is a cash refund, as would be collected on any other income received from outside the franking system.

Furthermore, the tripe they carried on with claiming that franking tax offsets were OK, but franking credit cash refunds were not, just puts a spotlight on their innumeracy. It is self evident that a $1 refund has the same effect as forgoing $1 of current tax.

Conceded & I admit I tiptoed around that one specifically

Nice of you to say so :)

That's not me btw lol. I barely own my car. Just curious

I own my car but certainly not me either.

Atm it will in the case of farms & for family enterprises this is big. It threatens to push more off the land in favour of corporates … the current crucial role of SMSFs in supplying sorely needed private equity incubator investment is also apparently being overlooked ie a simplistic pro argurment!

So many people are desperate for tax reform... but not like that... or that... oh no, you can't do that... oh shit... definitely not like that. But yes, we really are serious about the need for tax reform. O_o

It’s amazing how many people’s only objection is “but it’s not indexed!” like that’s some super-unique feature that is designed to trap them personally in 2055.

The other point that people are screaming about is the unrealised capital gains.

Tax reform now!* *unless I have to pay more. Am I going to have to pay more? What if I suddenly have $3 million in super, oh no, I’m going to get an $85k tax bill on money I don’t even have.

I think they want somebody to first raise taxes on the poor so there is plenty of money available for 'tax reform'. They will then happily come in with all their suggestions! P.s. The poor don't need to worry about this - it will all trickle back down to them apparently

We index just about everything. Why are there hard and fast rules for taxes? They just encourage bracket creep. To change the tax system seems a no-brainer...................... oh.......... that's the problem! Those that are in charge are in the negative when it comes to economic IQ.

Just like so many people are desperate for more housing... but not there... or there... definitely not in my potting shed... or over there... why can't it go in Brisbane... what do you mean they said no it has to be in Sydney... no definitely not there. But we really need more housing.

just tax people and stop people avoiding it please, thats all we ask

In the Money section of today’s Age: “Can I withdraw from my super to avoid the proposed $3 million tax?” Disgusting that Nine papers regularly print these entitled, privileged readers’ letters.

Top tax bracket is $60 trillion annual income for 1 person globally USA pays that person 25% of US GDP and they pay nothing in taxation because all of the payments are on government debt owed 1 person US Treasury Department Wealth Distribution Report 2024 Reported 1 person paid 25% of USA GDP 2024