Why is compounding wealth so people can pay for their own retirement a bad thing? All generations should be maximizing compound interest and investment. I mean, would putting LESS money in my own 401k be more moral?

Replies

No one thinks that's a bad thing. Younger people today can't do it because they don't have as much money left over after paying their bills, because everything is comparatively more expensive than it was in the past. This has been said repeatedly here. I don't know how else to say it.

It's compounding at the expense of others. It's not growing wealth. It's taking wealth from others because the system works that way. That's the point I've been making. Wealth is concentrating upward at the expense of younger families.

So, if I buy $100 worth of stock for my retirement, how is that at the expense of other people?

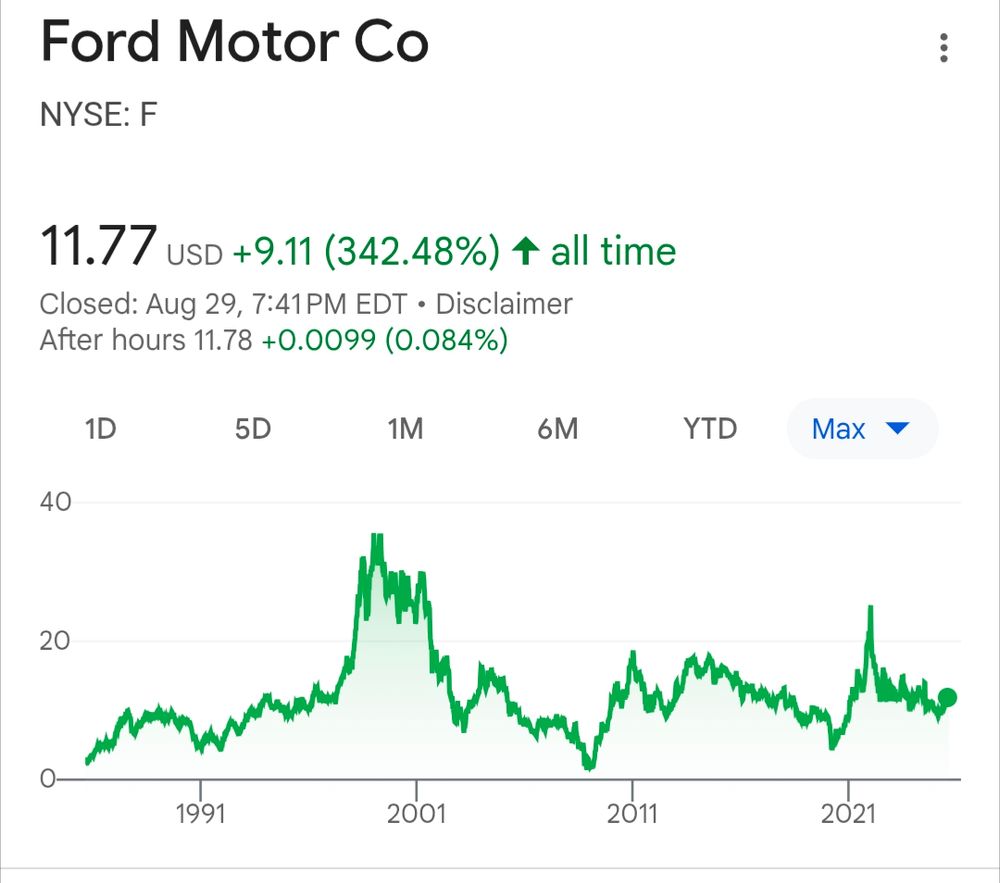

You buy $100 stock with your savings. Next person needs to pay $101, therefore costing the subsequent buyer more. You gained $1 in wealth by doing nothing (passive income) That next person maybe borrowed to buy that stock, so with interest it will actually cost them $105, you still make $1.

You didn't do anything wrong, but the event repeats over and over across many people. Those with assets get more and it get more and more expensive to start at zero. Wealth moves up, rock bottom gets harder and further away from financial stability.

But stocks for successful companies have always gone up. And those companies use that money to make new products.

Actively trading stocks is different from the macro discussion on wealth consolidation. Boomer vs GenX vs Millennials is culture was, when really the issue is class. Boomers just happen to be the the wealthy ones as well. 1/2

The generational discussion is to point out that "our children" will have it harder than the generations before. Most societies would consider this a bad thing. Ultimately, the issue is wealth consolidation in the 1% (not when you were born) and showing the cost on younger generations.

I don't think so. Young people have lots of technical skills, more ability to change locations and adapt than ever before. The young people I work with (engineering) are very impressive and they'll be earning a lot more by the time I retire.

You're ignoring all the evidence presented to you. Young people (on average) have to work harder and earn more the achieve the same level of financial stability of older generations because existing wealthy people continue to accrue more and more wealth quicker than it can be earned.

Personal income has been going up for decades. How is that less stable?

And there are always new companies to invest in. It's not like America is going to run out of stock.