I mean I can be your case study, I have savings in the low five figures and they're just in a highish interest savings account on Monzo because 1) I have absolutely no idea what else you should do with it 2) I assume any investment means you may lose money instead, which I don't want

Replies

Rule of thumb: if it's your only emergency money, or it's for a house deposit or something you need cash for soon, that's one thing. If it's for your retirement or something more than, say, five years away, it's worth your while to spend less than an hour of your time at least googling index funds.

give it to me

not, to be clear, an offfer to invest it for you. I want to spend it. for myself

I can see my pension balance on my internet banking because it’s the same parent company, and seeing it crash by nearly £10k because of all the stupid shit happening in America was enough to put me off any kind of stock investing thank you

How is it now

still volatile, thanks for asking

📌

If you are saving long term, expect to double your savings rate on average investing in low risk index funds. Look up FIRE (Financial Independence, Retire Early) people who are people of modest means taking advantage of the system we already live in, because why not. And yes, you will occasionally

see the balance go down, but on average you’ll be much better off. The main thing is that you don’t put the money you may need at short notice into these vehicles, these are for long term savings (5+ years)

2] is my thoughts exactly, why would i invest in stocks when I've lived through at least two, maybe three global financial 'whoops!' moments in my life?

This article by Angry Socialist Blogger Hamilton Nolan is a pretty good overview for the skeptical web.archive.org/web/20191010...

Exact same case here. The idea of loosing some of what we have is just not an acceptable outcome.

Stocks and shares isas are brilliant (important caveat: if you have to file taxes elsewhere as well as in the U.K. consult an accountant and absolutely do not set one up if you have to file taxes in the US because you will get a massive bill). But otherwise, they’re great.

The US tax code gets very aggressive with stocks and shares in non-US companies and it’s not covered by the normal tax treaty arrangement so a relatively small investment can cost you lots of money, as well as a huge amount of paperwork.

This sort of (perceived) complexity and unforeseen circumstance is probably part of the reason why many people just stick to straightforward savings account.

Most people aren’t dual nationals, though.

I know... but this sense of consequence and unknowability when it comes to investing (from the layperson's perspective) is not restricted to dual nationality... it's all 'rates' and 'fluctuations' and 'tracking' etc. It's confusing.

I'd also add the caveat that you should probably be in a position where you think the probability of you having to withdraw from the ISA at short notice is low. My ISA which now has more than £4000 profit was at a loss only this March.

Yes, that’s a fair point. You need to be able to have a lower risk savings account elsewhere as well.

Yes, some cash (ideally 3-6 months of take home pay) stashed away in an instant access account for emergencies.

You are a step ahead of me with this Monzo carry on.

join.monzo.com/c/g9ycmqb2

over in Europe, they have products designed for people like you which offer equity upside with downside risk protection. Unfortunately they tend to be priced based on the psychological value to the customer rather than the technical financial model value, so they don't pass consumer fairness tests

Any thoughts on why US retail investors have been much more eager to invest in index funds than UK retail investors?

Equity culture which is the legacy of long term regulation of sports gambling

In the US? (just to be sure I understand the reply)

Reasons: - John Bogle and Vanguard in the 1970s in the US. Great product, great self-marketer, set it up as a client-owned mutual, conveyed a mission. One of the top 3 fund companies globally now. - Also 1980s legal cases on fiduciary duties for managers gave a bigger incentive to consider low-cost

I think those are some, but not all of the reasons. Great Depression killed US equity culture for 50 years. It recovered in late 1980s early 1990s. Vanguard has $ trillions in AUM but so does Fidelity, Capital Research, BlackRock, etc. 36b cases were all won by the asset management industry

some might call this another example of economist brain ignoring commercial reality, ensuring that people end up with inadequate savings but protecting themselves from being blamed. but not me, I like it.

(I should probably write a blog post on this, but basically the intellectual history goes: efficient markets theory -> very strong belief in index funds -> general suspicion of profitable financial products -> some admitted misselling scandals -> ever tighter regulation of products -> ...

... -> everyone involved has economist brain and doesn't understand marketing at all -> the products that have been designed to address people's actual wants and fears aren't very like index funds at all -> financial services marketing withers on the vine as an industry -> here we are now ...

... basically, the only products that you can get to market in the UK are ones that look really unattractive without a lot of advisory hand-holding in the sales process, and British people absolutely.will.not pay money for financial advice. Let's have another government ad campaign!

(the big problem being that although you might think phrases like "the sales process", "consumer wants and fears" and indeed "marketing" would be familiar to economics graduates, the way it's taught today they really aren't. And it's difficult to get a central bank job without an economics degree.

I Vote for to write up that blog

Monzo has 14 pre made funds you can pick from. My rule of thumb is if I need/could need those savings in the next 6 months they stay in savings. If they can sit longer into an investment. My savings get 4%. Investments 16% in the last 3 months.

I've opened stocks & shares ISA twice; once was just before Truss became PM and once was just before Trump announced his tariffs. Lost money on both almost immediately as stock markets crashed and took months to get it back. It's hard for me to think "I should just check back on this in five years"

A Monzo-specific thing: open a stocks & shares ISA and set up "round ups" i.e. whatever change you would get from any transaction gets put in that account. Rather than moving your savings significantly towards investments you'd just have a little investment that grows on its own without risking much

All investments involve risk. Savings accounts are seen as "risk-free", but you still take on risk by a) losing the value of your money to inflation and b) missing out on the opportunity cost of investing. The S&P has an average ~10% growth rate in its history. Isn't it a risk to miss out on that?

I don't know what "the S&P" is lol

US equity index. The key point here is that it entirely depends on what the money is for. If it’s a separate nest egg for retirement then absolutely stick it in equities. If however it’s an if stuff goes wrong reserve then keep it in cash.

In that regard I think what can be helpful is to split your savings into multiple pots and have both cash and stocks savings. But I get people don't always want the hassle of managing things in that way

Technology has made it almost hassle free, monthly automated payments and broad passive funds ftw

Absolutely re the different pots

This but also limit the size of the cash pot to maybe a month or two of income (if you’re in a job). I think people massively overestimate their need for *instant* access to cash.

yeah it's a mix of the latter + money for if I end up eventually getting knocked up (inshallah!) while still self employed, as there's basically no mat pay for people not in jobs, so I guess I should prob keep it close at hand?

We can talk about if pff main if you like. And while it’s true that you lose a little money via inflation etc if you think you might need the money in the reasonably short term then equities are less attractive because of higher volatility (ie risk of going down).

also I guess it depends how you define risk - I'm not necessarily entirely wedded to my way of things but I won't lose any cold hard cash right now, and that inherently feels more low risk than maybe getting more money but also maybe getting less

But you literally have. The cold hard cash you have right now is worth less than it was worth a year ago.

yes I know how inflation works but my point is that if I make a bad investment then surely I'll lose more than if I don't invest at all, that's my point about seeing risk differently

I wasn’t trying to explain inflation…. It’s not about choosing a bad investment, you don’t have to stock pick. Just choose literally any tracker fund managed by eg Vanguard and like that’s absolutely fine.

Concentrated risk that then is amplified into the biggest Ponzi schemes through market cap increases - i.e. what will suffer most when the market turns. No one should invest in any asset that has rallied multiple 100% in a short space of time. Just put in bids -50% / -75% etc and wait

Everyone has different risk tolerances, for sure. There's a wide gap between investing in crypto (high risk) versus a speculative growth stock (EV battery maker) versus a blue chip company (Apple) versus an index that pools together 500 of those blue chips (S&P).

Generally the higher the risk, the higher the potential reward. But indexes generally provide stable growth, with the exception of massive downturns (recessions, god forbid a depression). Even so, historically if you haven't sold during those times, the markets have recovered over the long term.

Am I right in saying that there has never been a 20 year period where markets have ended lower than they started? That might be specific to the US. Not sure.

While this is technically true, the answer is to invest in a globally diversified index fund. If *those* end up as "bad investments" that don't recover in time for retirement, the entire world has imploded and savings of any kind would be the least of our concerns.

You'd be surprised how quickly a small bit of money a month into a S&S ISA has enough growth that you'd need a really massive drop to lose more than the growth. And try not to "invest". Use nutmeg or a service where you can specify risk level and they invest in tracker funds for you.

If you want a simple recipe. 1. Build Savings like you have ✔️ 2. Open an account with Degiro or similar. 3. Every month buys some ETF like “FTSE All-World”. Even small amounts but keep doing it. Repeat. Bonus points start a pension. That’s it.

If you’re buying in regularly and your investment goes down 30%, keep buying. You own the shares/etfs you’ve bought. If they drop in value you still own them you haven’t lost a penny. You gain or lose when you sell.

A 30% drop in share prices to a young person is a thing of joy. It means you’re buying at a discount. “30% off at the stock market”. Who doesn’t love a sale!

Quick note. In the UK there are options we don’t have here like ISAs. Talk to someone about those. Might be a better place to start. But the recipe above will work. But if you just keep saving regularly and build up cash. That’s fine too. Regular saving has a bigger impact than investments

Apologies for my appalling type it must hurt your eyes. Typing fast.

Especially since the same people pushing into investments "now" after a 16 year 700% rally in the S&P 500 were warning of dangers back then. It is the "definition" of a Ponzi scheme right now, and good for people to see it. Of course, I am not saying one should not buy when the market drops 90%

It mostly matters in terms of time horizon - if you only want to save for a couple years then use it, carry on doing what you’re doing. If you’re saving long term, odds are you will end up with less if you keep it in cash.

But I think the time horizon is the part that most people struggle with? They/we know what inflation is, but there’s a whole big murky space between “I need to buy a car next year” and “retirement” they’re trying to plan for.

Basically all of the financial advice you get as a young adult is ‘how to save for a house deposit’ so not really a surprise that people flounder with other savings.

100% this. It’s so frustrating.

I tell people to set up multiple train tracks. One is for your pension. Set it up and pay in. Job done. Separate to that is saving for maybe I’ll buy a house or car. Don’t try to think short term and long term at the same time.

That’s definitely true and remember having the same issue when I was younger - being asked “what do you want to do with this money? When do you anticipate you’ll need it? And just being like, I have absolutely no clue.

Having a pension is investing in stocks and shares, isn't it?

Yes, but per all the research done around 2012, most people don’t realise that. Previously was one of the biggest contributors to ceasing contributions when they found out. Also vast majority of uk pension savers are totally inert.

I'm definitely 'inert'. I just engage with documentation when I need to fill out my tax return. V. interesting re: pension opt-out. Think I remember that - I do remember, also, having banking friend who said all colleagues opting out of pensions but maybe to invest in stocks/ shares independently?

Maybe, but would suggest they’d either be wealthy enough to not want/need employer conts or just dumb. We’ll see it more with HNWs because of IHT. But for the vast majority of people they were/are just doing nothing. Hence AE.

Opting out of pension to invest outside a pension makes very little sense. You pass up employer free money. Tax man free money on your salary. And more taxman free money on the gains in the pension. Honestly if pensions didn’t exist nobody would believe they’d ever be created.

I think the fact pensions are provided by big, well known institutions helps. Investing feels much more wild west.

Maybe, but would suggest that a bigger driver is simply people not really knowing who their provider is and what their money is doing.

Sure you already know, but there's different funds with differing risks. My bank S&S ISA offers a range, with their "low risk" fund being 75% bonds/cash and 25% shares. You can mix funds in their ISA too, so you can have £1000 on high risk and £2000 on low-risk.

I'm not qualified to give financial advice but general sentiment is it's good to keep some cash set aside (~6-12 mos) for emergencies and invest the rest depending on your risk tolerance. But the point @stephenkb.bsky.social is alluding to is without investing, you are likely to end up worse off.

You could lose cold hard Euros by having your savings in Sterling (or vice versa). [There's no way to fully protect against that risk - you can technically hedge it, but you'd need seven digits of savings for that to be legal and eight digits for it to make sense].

This was my view for ages too then I realised that 1. I kept getting stuck in old interest accounts that were effectively losing money and 2. Even 4% interest when inflation is 5-10% I was losing money

I slowly started moving money into S&S ISA's and quite quickly you've made enough growth to weather even quite big drops (and every time I did a big move it dropped - I time terribly - but recovered) I try view "normal high interest" for emergency cash and all ISA's are now S&S for longer term.

Don’t worry too much about inflation, S&P or any other terminology. Everyone has different attitudes to risk and many have an “I have other shit to think about” attitude. That’s fine. Don’t let anyone tell you your attitude to risk is wrong. When you’re ready it is less hassle than you think.

The only thing I can PROMISE is that you don’t need to become an expert on ANYTHING finance related to put yourself in a much better situation long term. You may find that if you do take steps in that direction you naturally get more interested in it. You’ll be boring people before you know it.

Shorthand for the S&P 500 - an index of the top 500 companies listed on US stock exchanges. It's updated regularly so that better-performing companies are included and worse-performers drop out. Essentially takes a lot of the guesswork out of investing for people that don't want to stock pick.

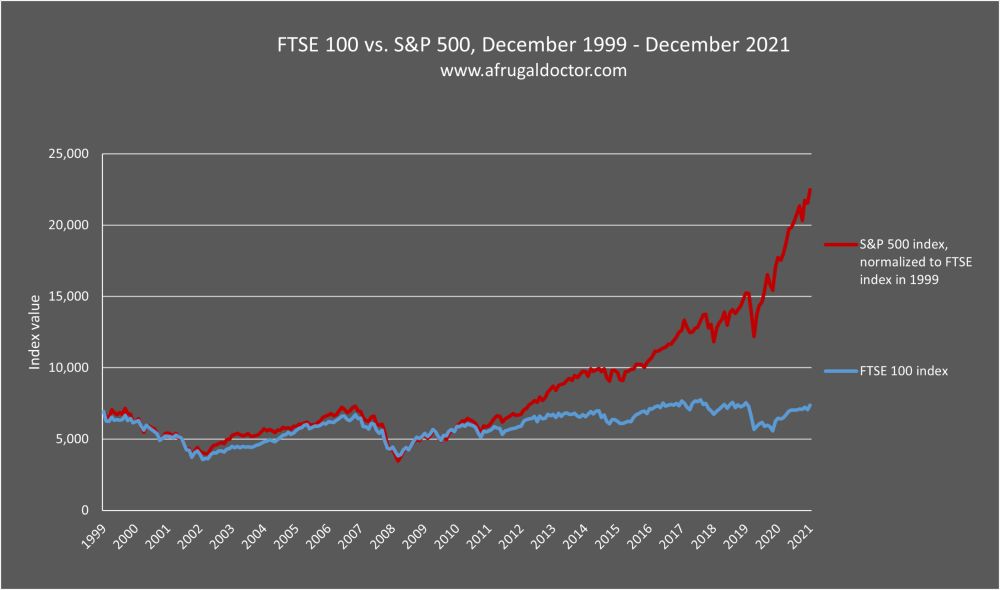

Meanwhile, in blighty. If you're not going to convince ~50% folks to take on FX risk (you're not), then? UK perceptions around investment risk, loss aversion are a problem - but it is true and shit that S&P is the outlier at one end, and UK stocks/equities at the other. (Which is linked ofc 😅)

Even in the UK, even in our lost two decades, a stocks and shares ISA has outperformed cash.

I mean imagine if it didn't? 😅 Just pushing back a bit on the default opportunity costs for UK savers being in the order of 10% a year S&P - it's v real, but not quite that for anyone much under 45.

The 10% average is totally a shorthand, and that's a historical average over the past ~100 years (and assumes relative stability in the US market/leadership, which, well...) But if you want to reduce risk further you could split between US equities and international, etc.

I appreciate you're selling the long view here - and acknowledging 'past performance, future returns' etc 😊🙏 I'm just saying for an average person who read the same 100 year stat in 2000, and sensibly invested in a nice high street available index - he 'you're an idiot not to' factor is 🇺🇸>🇬🇧.

Brits can invest in the US market, so I don't see the issue. Though what with Trump tariff nonsense, US equities have definitely become riskier and generally more volatile in the past 6 months.

People who arent financially engaged want 2 save in something simple and close. For UK, S&P a complexity too far. It's one of the reasons S&P is so successful - a massive pool of Americans doing the default! Trying to shift UK saving norms via the opportunities of US return is a tough route (imo).

I believe you only get £85k back if the savings outfit goes bust, too. Small risk, perhaps, but those who lived through the 2008 crisis will remember how real and in our faces that risk became. And a chancellor siding with those in the financial sector seeking deregulation makes my hands go clammy.

I've done very well ethically investing in Green bonds, through Abundance, and Fidelity's GIA.

Yes, there are vast numbers of funds to choose from and you pick the risk profile you want. Great for cautious or newby investors.

But having said that, I moved my cash ISA savings to a Stocks and Shares ISA a few years ago, and I definitely do not regret it. It has done a lot better than any savings account - and the gains are tax free. The essential thing, of course, is to get good independent advice when you start out.

it's 85k if the money is held as *savings* as a bank deposit in cash ISAs - if your money is in stocks and shares, your *investment* is segregated/ringfenced so it's not affected if your bank crashes.

Agreed, my sincere apologies if I gave that impression!

No worries, and sorry if I gave the impression of "correcting" you, which wasn't intended at all.

Not at all, it's a very valid point to make.

I hear what people are saying about this and they're probably right, but I think a lot of people find ANY financial risk a source of anxiety? I just looked at the five-year performance on the stocks ISA my bank offers and they all took such a hit in 2022 I'd have been stressed to fuck by it.

Yeh I’ve not idea what I’m doing and, especially with a massive personal expense myself and my partner have done, I’d be terrified of risking the little we have left. Not that long ago where the rent was a worry like.

I simply don’t trust fund managers. I’ve been through 3 recessions. I accept I have to trust my two pension providers to invest on my behalf, and both have a derisk period as they approach maturity. But that’s as much risk as I’m willing to take.

The cultural issue is that housing is the most dependable investment but is increasingly beyond reach. If most of your income goes on having a home, you’re not going to invest in something like shares whose value may fall as well as rise. Cash feels safer.

Obviously, property values can go down as well as up. When I bought in 1996 it was in a slump so I got a two bed house for a £3K cash deposit and paid less than the seller had for it. I suspect that same £3K put into stocks would not have returned roughly £100K over 28 years, given market crashes.

And there’s a class dimension. If you look at the social grade demographic in the full results, you can fear of the risk is significantly higher in C2DE. No amount of middle class “but it’s *fine* can override a fear or precarity. ygo-assets-websites-editorial-emea.yougov.net/documents/In...

The thing is, the “fear of precarity” is not the problem here! Those people are right to save in cash! The problem is that British middle class people save in a less sensible way than the American working classes do.

It’s a worthwhile thing to get young people sensibly knowledgable about. My savings life transformed once I siphoned a chunk off to investments. There obviously have been big dips. But it’s an amount I don’t need imminently, so can afford high risk funds.

Which will be for a range of issues, including how it is reported* and the lack of financial education. *I frequently despair of hearing “the markets” on the news as if they are strange godlike forces. It’s alien.

Also on the news - layoffs etc in various industries to boost shareholder value. Not terribly keen to grab a slice of that action tbh.

I wrote a short story about this very thing last year!

Those child trust funds the Blair government did should have been 100% equity-only. Spending the first 18 years of your life watching a basket of equities would teach you a lot.

Yeah, agree. In an ideal world would bring those back and part of the curriculum ask would be 'at 18, school leavers are equipped to make useful decisions about their nest egg'.

I was surprised to see my bank doesn't appear to offer any kind of mixed ISA, and it strikes me if you want to encourage people to invest, that would be an easy way to do it? Let you adjust how much of your savings you want to put in stocks and shares.

I mean you can just have... 2 ISAs?

I genuinely didn't know whether you were allowed to do that.

Afaik the only limit is the total amount you can pay in each year.

Yes, but tbf one would be more convenient, and there isn't really a persuasive argument against allowing them that I've seen

If you don't trust fund managers (you're right not to - none of them justify their fees by outperforming the overall market over the long term), you can take them out of the equation by investing in index funds/ETFs.

I think this, combined with people's general lack of savings, is probably the reason - "I haven't got that much money, I might need it and there's a chance it won't be there" sounds like a powerful deterrent. Plus, recent headlines about the stock market probably don't help.

yeah that's where I stand too I think!

The minimum period to consider investment for is five years, 10+ is much better. Ideally you want to drip feed money in so you are more insulated from and can even make the most of dips (pound cost averaging) and then NOT look at it (assuming you use an index tracker). Best of all get real advice

A good financial advisor is like a good accountant, they earn you much more than what they charge (and free advice off people on the socials is worth what you pay for it)

since I have a mail from my IFA to hand, here's the last 3.5 years in a FTSE tracker (pink) versus the funds my IFA manages for me (red): cumulative performance is 28-29% for both over 3 years, 21-22% over 3.5 years and 51% for the FTSE tracker over 5 years (managed fund hasn't run that long

but if you look over different periods, you see the impact of a market slump; over 3 months it's 7.7/10.9%, over 6 months it's only 0.67/6.94% - v poor return from the FTSE and you can see the advantage of a managed fund.

on the chart you can see a number of times when the returns are negative - but they recover and over the long term returns remain high

the discrete performance - how it does within a single year rather than since the beginning of the investment - is smaller numbers: 4.7/8.4% in the first year, 13/12% 2nd year, 8.9/5.9% 3rd year, -2%, 20% -11% years 4, 5,6

that doesn't mean the investment is down overall - just that it went up, up, up, down, up, down (this is a great article on why you want to know that as well as the cumulative performance - consistently good versus occasionally brilliant)

investing *is* gambling; you're betting that the stocks will go up more than the interest you could get from a bank which pays you out of what it makes by lending money/investing itself* but at a rate matching what a central bank says is fair given the economy.

My first financial advisor started cracking a joke after the 2008 crash; remember, the value of shares can fall as well as plummet!

But again, getting a financial advisor (or an accountant) feels like it something *other people* do.

It feels like something that costs money, and we're only having this discussion because we don't have enough in the first place

financial advisors don't (usually) charge you money up front; they make a small ongoing charge (maybe 1.75% compared to the 0.9% a pension fund charges or the 0.4% a stocks and shares ISA charges, so they all cream a little off). that reduces your return slightly rather than you handing over cash

but then you also have to find a reputable financial advisor. And not feel ridiculous going to them.

they're regulated and fairly well regulated; if you don't know someone who already uses one they'd recommend, in the UK you can go to Unbiased and get a list of local financial advisors and get a free session with them to get a feel for whether you feel comfortable with them as well as what they do

if you don't know enough about investing to feel comfortable having that conversation, you can start at the FCA site to get the basics. is the feeling ridiculous thing imposter syndrome? because *everyone* deserves to get professional advice to make more of their pennies, not just the rich!

changing that view would be the best way of making investment more accessible to people; it should be right up there with starting a pension (I have an accountant because I have a company, most people won't need that as much)

The thing is: in the long run, cash is actually the worst investment possible. You don't have the yo-yo thing but you also (a) barely follow inflation (b) every ~100 years a country just fucks its currency up and if you're holding cash you're left with nothing. Long term, stocks are...safest.

It usually depends on your timeline for using the money invested: "not going to touch it for five years or more" is reasonable for a stocks & shares isa but usual advice is to keep 6 months costs in cash before you think about that.

They have recovered, but the "low-risk" one has ended up paying more or less what their cash ISA does over the five years.

The fun thing about our modern world is that we now seem to fairly regularly have massive shocks to the financial system which mean you can be quite unfortunate with anything stocks related, another slightly offputting reality

Risk is correlated with reward. The issue is if you hold a diversified portfolio for long enough the chances of loss are very low indeed.

This thread is moderately depressing as it hammers home the gloomy reality of my pecuniary situation, which is essentially the same as when I was about fifteen. No mortgage, no savings, no investments, nada. I will therefore wish you all well and look ahead to the first drink of the day.

The standard advice that I got when I started working was: Make as big a pension contribution as you can afford up to the maximum that is tax-advantaged.

lmao I don't have a pension

Yeah, I long for the days when my lack of one was a major worry. Or a worry at all.

You’re far from alone in that. You’re also most DEFINITELY far from too old to start. If you’re self employed like a lot of journalists are, it might make even more sense. Plus think of the columns you could write about the whole experience.

Put three months post-tax income in a savings account; if you're self-employed or freelance, make that six months. Do not do any other investments (except the pension) until you have that; if you have to dip into it, stop adding money to investments until you have refilled.

Put the rest of your investments in some sort of long-term diversified stocks and shares fund with the best tax advantages you can (this is currently called a "stocks and shares ISA"). You need to be able to forget about the money in there for years. Only look at this every 3-5 years.

Note: if you put money in the day before the 2008 crash, you'd still be up today by more than putting the same money in a savings account - and that's after investing on literally the worst possible day in the 21st century.

r/ukpersonalfinance 👍

If it helps, the official policy stance of the FCA was, more or less, designed to make you feel this way

open a stocks and shares isa, buy ftse 100 etf, keep dripping money in , yes you may lose money short term but over long term if you keep dripping money in should beat bank interest/inflation

1) You should invest it in something that returns more than a high interest acct. That usually means equities 2) If you invest in 1 equity (e.g. M&S, or BP), then you only lose (all) the money if that company goes bust. If you invest in a portfolio, you only lose (all) the money if they all go bust

There is a well-known and well-evidenced phenomenon by which people take too little risk, and therefore have too little return Basically when you're young, take risk because the higher return pays off over time. When you're older, take less risk because there is less time available to regain losses

The basic version I've heard a lot of variants on is: the further away the purpose of the saving (house, retirement, etc) the less should be in cash To minimise risk, diversify, which for a non expert means find a tracker fund with low fees But yes, can go down as well as up, just look at April

You have access to so many people that would love to explain this to you. I respect your commitment to refusing to let men enjoy themselves.

:)

Finance bros are THE WORST.

If it’s emergency funds in case you have a low patch work wise or need a deposit, that’s not necessarily a bad thing as you can actually access it

If you invested $10,000 in a total market index fund like Vanguard Total Stock Market Index (VTSAX) in 1994, and held it until 2024, the average annualized return would be approximately: ~9.7% per year

Rule of thirds. 1️⃣One third in the market in a fund like VTSAX 2️⃣One third in a short term high interest CD LADDER that provides liquidity opportunity every Quarter 3️⃣One Third Emergency Cash in the highest interest bank account you can find.

As a minimum, put it in an ISA so you are not paying tax on that interest.

Bunch of good finance youtube channels out there. Also a bunch of terrible ones. Do you want some links?

A lot of people can't afford to lose their stake AND more importantly might need access to it in a hurry.