Anyone we can fire?

Replies

I can think of one name

Fire me please

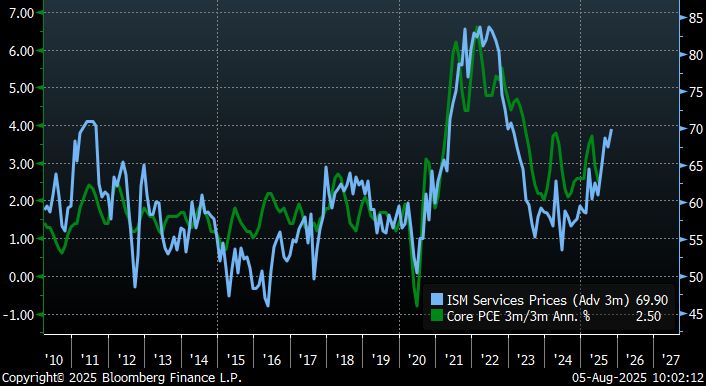

So what you’re telling me is the Fed is going to have to pick one part of its dual mandate over the other No, can’t believe this, who could have predicted

Powell ain't lowering rates

Wouldn’t do my good imo. Capacity to increase residential investment isn’t there

I think you've got this precisely backwards FWIW.

You think high interest rates are what's holding back new housing starts?

My logic is: housing starts are falling even as housing prices are hitting new records - indicating a supply side issue

New home prices aren’t at a record tho, and that’s where the investment decision is calculated.

Also national existing home prices are down three months in a row.

Personally they probably are holding back housing starts somewhat as cheaper loans will always make building easier. But I agree it would have MUCH less impact than normally as there are fewer people to hire with deportations, and less raw materials to use with tariffs.

At 4.2% unemployment lower rates will mostly just increase inflation.

Even if he did it wont save us. Just kicks the disaster can down the road

A recession is priced in now, yes; the question is when

priced in where?

*gestures widely*

The two of you are in opposing camps re: how much weight to put behind the “subprime auto loan delinquencies mean we’re cooked” thesis

Amongst other things, yes

I'm just asking where to see it in market pricing, because its not there.

Term structure of interest rates, credit spreads, equities, commodities...none are priced for a recession. Full stop.

Is current market pricing more right or wrong?

When the market was less retail oriented, you might be able to make the argument that the institutional investor has weighed the risks and accounted for it in their investment decisions. That’s not the case from 2020 onwards.

1) It's not up to just Powell 2) Yes they will lower. Not as much as we need for full employment, but there are too many risks not to do it at least one in Sept & likely one later. The Fed is going to have to fingers-cross that the courts override the tariffs, removing a big inflationary factor.

#RemindMe! 12/31/25

Be sure to let me know how I did -- I'm pretty confident, but you never know!

Look I'm not dancing on the tables about this

I'm sure. The Fed doesn't have a magic button to fix this, as the problem is caused by people & factors well outside its control. I'm just commenting the rates are coming down, a bit. That will help somewhat, but we are still in bad shape due to a command-and-control, chaos-based Trump team.

If the Fed lowers rates because of a threat by the executive, you're in a hellava lot more trouble than you'd think

I don't think that's the case. If the Fed were giving in to threats, they would have lowered earlier. They'll lower in Sept bc that what the data is showing. The problem will be once new Fed govs are appointed. Then we will lose a valuable independent backstop, making a bad situation worse.

The very fact that you have the president threatening and promising to do away with the independence of the Fed is all that is needed, not whether or not they lowered rates right after the threat. The threat alone signals something much more dire.

OK, but think about the impact of that...the Taylor rule rate is like 420 bps, EFFR is 433. There's really not a lot of room to get to neutral. Cut a quarter and you really don't get much of a boost of anything other than inflation AND you piss off the bond market.

Divine Coincidence bros in shambles.

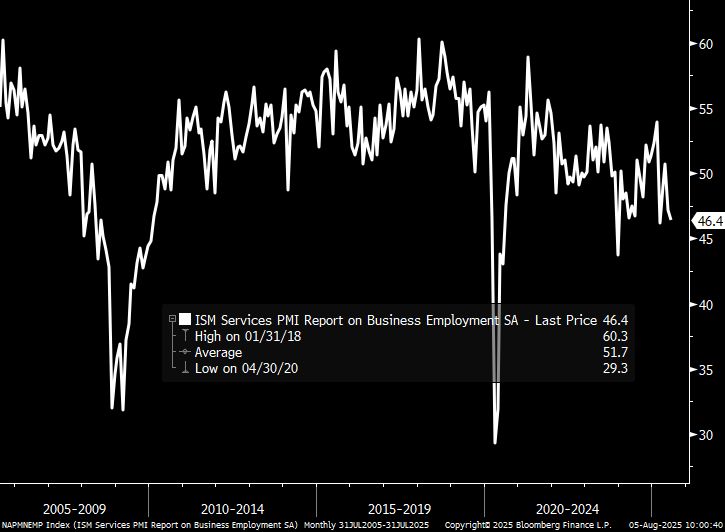

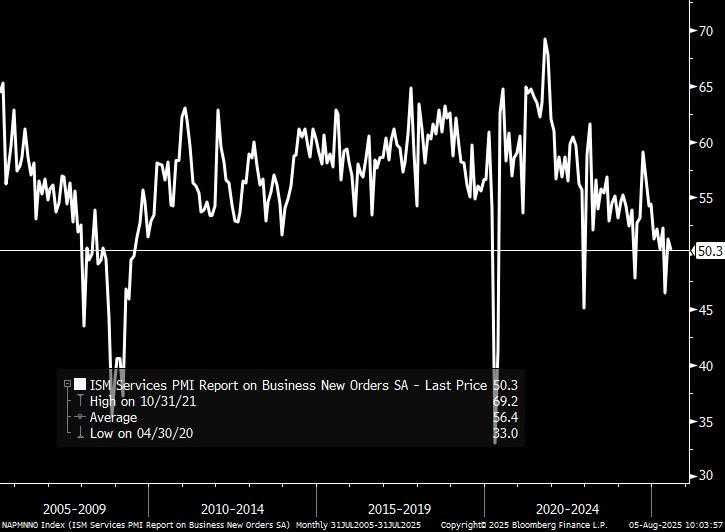

I don't follow ISM report super closely, but how bad can a still over 50 report be?

The mood in the US service sector unexpectedly clouded in July. The Purchasing Managers' Index of the ISM fell by 0.7 points to 50.1 points compared to the previous month. The value is thus only slightly above the growth threshold of 50 points. Economists had expected an increase to 51.5 points.

S&P Global and ISM seem to have been showing pretty different pictures on PMI in recent months

@simonowens.bsky.social More 👆 I think we’ll see more and more of this drip, drip, drip until we realize that famous Hemingway line is staring us in the face: “How did you go bankrupt? Gradually… then, suddenly.” www.marketwatch.com/story/bigges...

are you deep diving this report? would like to hear more analysis, thx!

Time to fire ISM

Fine line between “bad numbers, they have to cut 🎉” and “bad numbers 💀”.

www.youtube.com/watch?v=yuOH...

“YES BUT WE ARE BUILDING A NUKULAR REACTOR ON THE MOON IMAGINE HOW MANY JOBS IT WILL CREATE”

Yes but alligator alcatraz memorabilia so it’s all worth it

trumps a senile loser and republicans can’t run business unless they’re stealing