Conforming mortgages for existing homeowners are so tightly underwritten at this stage that it’s a trivial step-up in default risk tho.

Replies

Agreed in full. Things have changed a lot in the underwriting business over the past thirty years that most folks don't understand.

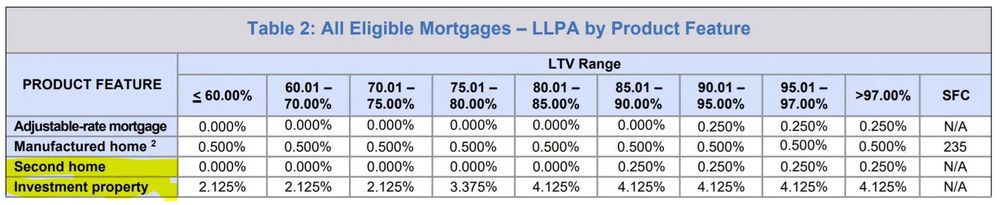

I'm not sure second homes even get higher rates than primaries as a rule. Don't think people appreciate how none of this matters to the underwriter with sufficient debt coverage and 20%+ down.

The market has changed quite a bit, this is from 2021 when Cook took out the mortgages at issue

Are these LLPAs based purely on risk, or do they also effectively cross-subsidize mortgages on, e.g., primary residences?

The current second home adjustments, especially

That's not insignificant

Keep in mind that this is fee, as a rough estimate divide by 4 for the change to rate

Yep

Thank you!

Right, like presumably this is available to lenders?

if it mattered they would know