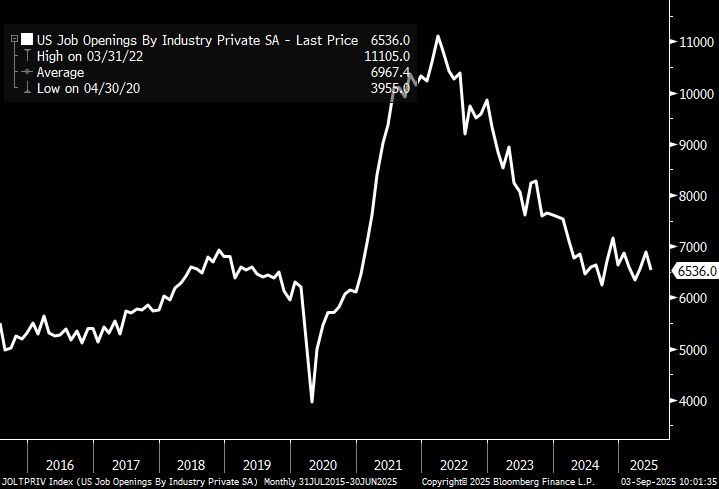

Any insight on methodology? “Openings” on its face would seem to be less reliable or less meaningful than actual hirings

Replies

The methodology is a survey asking businesses if they have job openings. Openings are not a better indicator than hiring but they're a cleaner one to assess labor demand; you can have a job opening regardless of what's going on with the supply side of the labor market, not so for hirings.

What about all those tech jobs that post fake openings - not intended to every fill the position

There's no real way to account for businesses lying to the BLS tbh, but this is a survey based on asking them officially, not scraping job boards or something like that.

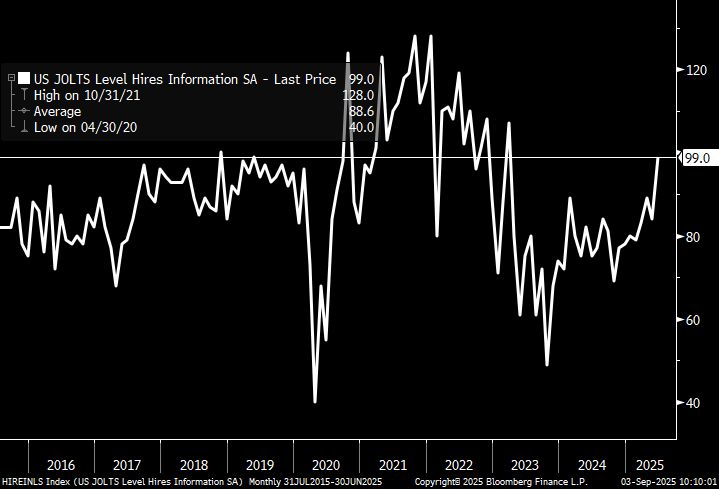

Also Information industry openings have ramped up recently with hires also rising and quits starting to perk up. Pretty strong confirmation that tech labor demand has inflected higher lately.

No bears in sight.

Question is: stable or unstable equilibrium? Can it be tilted with a small push or how robust is it?

Tell that to Waller lol

Despite the AI narrative, tech labor demand has clearly inflected higher with improved openings, hires, and quits.

The thing about $30trn economies is they have a truly staggering amount of inertia, especially when their households have lots of borrowing capacity and their fiscal deficit is running over 6% of GDP.

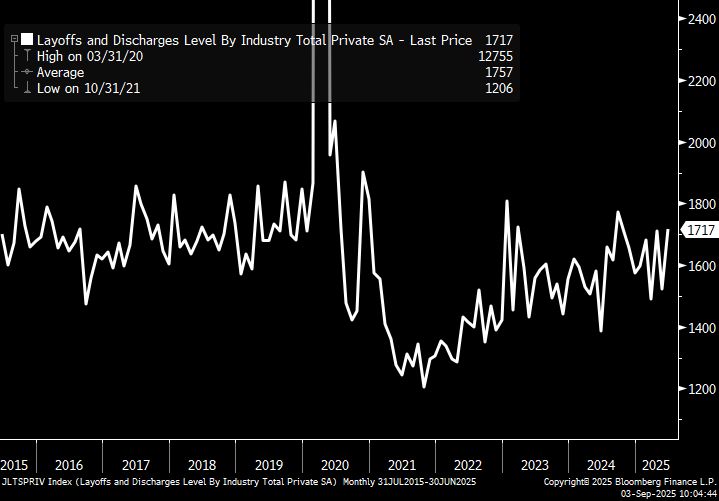

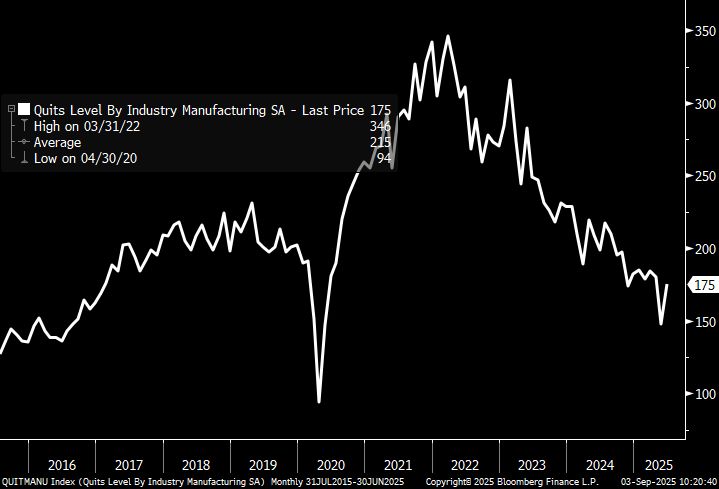

One place where the labor market looks genuinely weak and deteriorating is manufacturing. Tariffs not helping.

Anecdotally been fielding a marked increase in job apps and networking requests from folks in mfg in SEATAC area, and also lay offs / slow downs from data center builds in ID/Columbia basin

every new proof of concept vibe coded by a product manager requires another engineer to take it over and fix it

It looks like hires are near the lowest level in ten years

the thing I'm noting is that they're sideways over the last 18 months, not making new lows.

So stable, got it

Does "private" in the graph title mean that this data is only for private industry? I'm hearing a lot about job losses and hiring freezes in the education sector, and of course much of that is "public" (govt-run)

yes, this is non-government. focusing on private because it's much larger and not being driven by policy shifts which can obscure the larger picture of the economy.

Gotcha, thanks!

Continue to feel like we’re in a house of cards, held together simply by inertia.