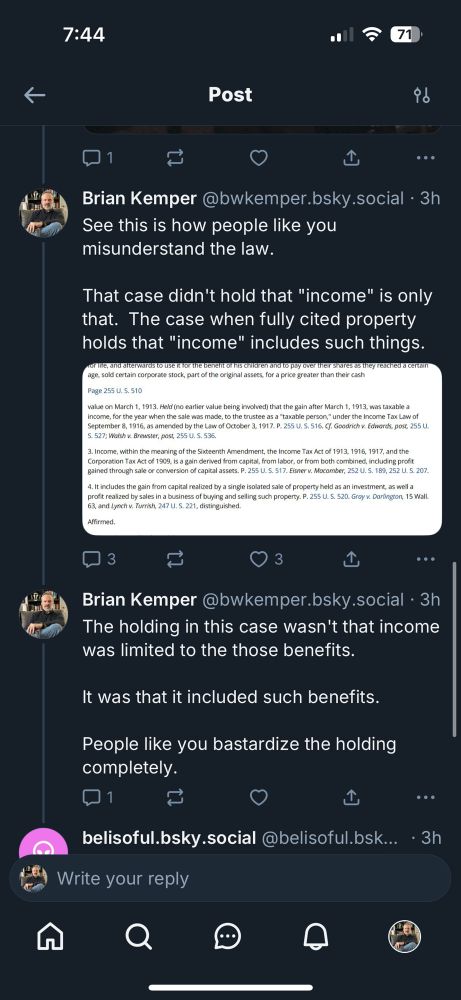

He’s citing a SCOTUS case in the ‘20ms that sas that income includes corporate benefits. Contrary to his belief, he thinks it limited “income” to corporate benefits.

Replies

“Contrary to his belief, it does not say that income is limited to such benefits.” Further, the intepretation was a statutory one of the statutes at that time. The code has changed drastically.

aug 27, 2025, 11:46 pm • 1 0 • view

bsky.app/profile/beli...

aug 27, 2025, 11:44 pm • 0 0 • view

Oh my. Okay.

aug 27, 2025, 11:44 pm • 1 0 • view

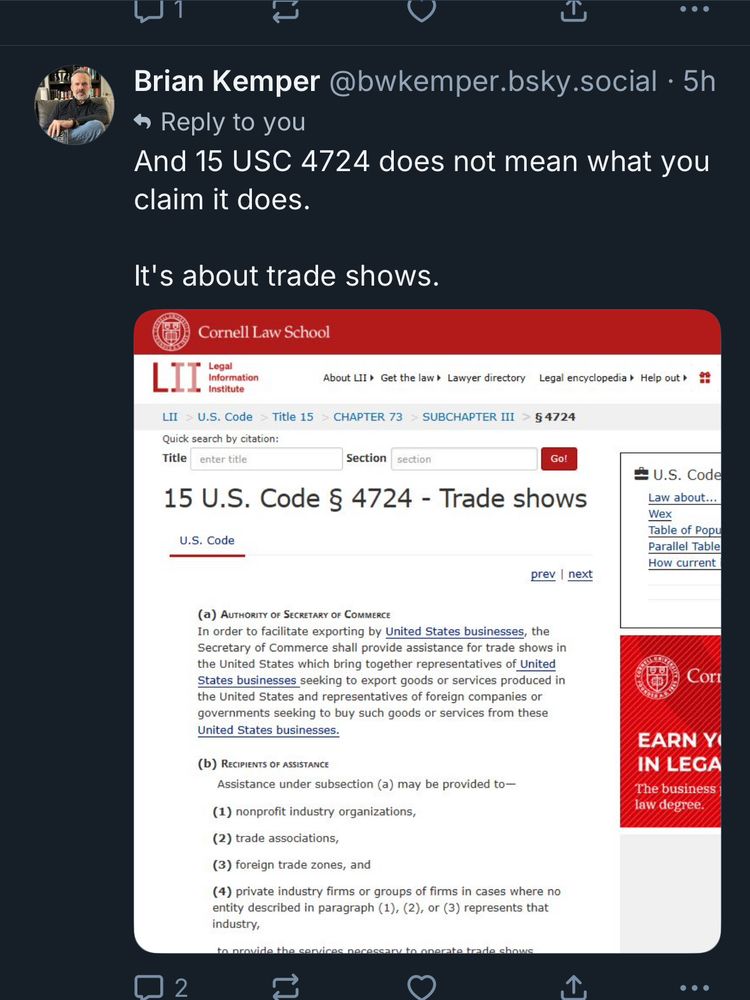

His arguments not only take disparate meanings from unconnected sources, he also misinterprets them as well. Hell, he said that 15 USC 4724 defines US citizens as “businesses” for purposes of the tax code. It clearly does not.

aug 27, 2025, 11:50 pm • 1 0 • view

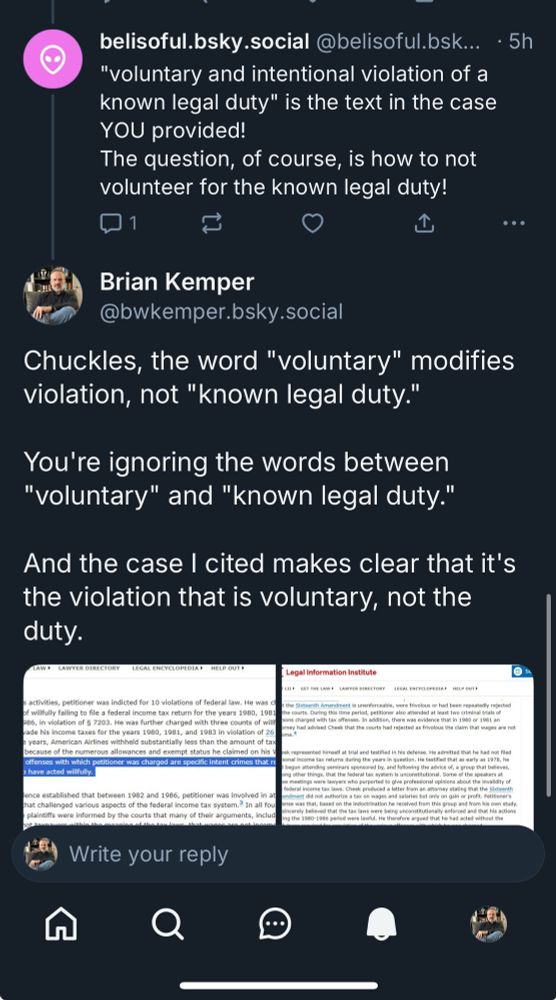

Take a look at his attempt to take the definition of “willfulness” as a “voluntary and intentional violation of a known legal duty” as proving that paying taxes was voluntary. As if the word “voluntary” was characterizing “known legal duty” as opposed to violation.

aug 27, 2025, 11:59 pm • 1 0 • view