I disagree with a number of things here but will stick to just saying what I said on twitter: My job is to be part of the drumbeat for Powell retaining a spine. So I can't then say the result is a foregone conclusion.

Replies

He's held up better than I thought he would tbh. But imo given a no win situation in which T is wrecking the economy whilst spiking inflation, at least give the guy an FU on the way out. Either way things are likely going in the shitter no matter what the fed does.

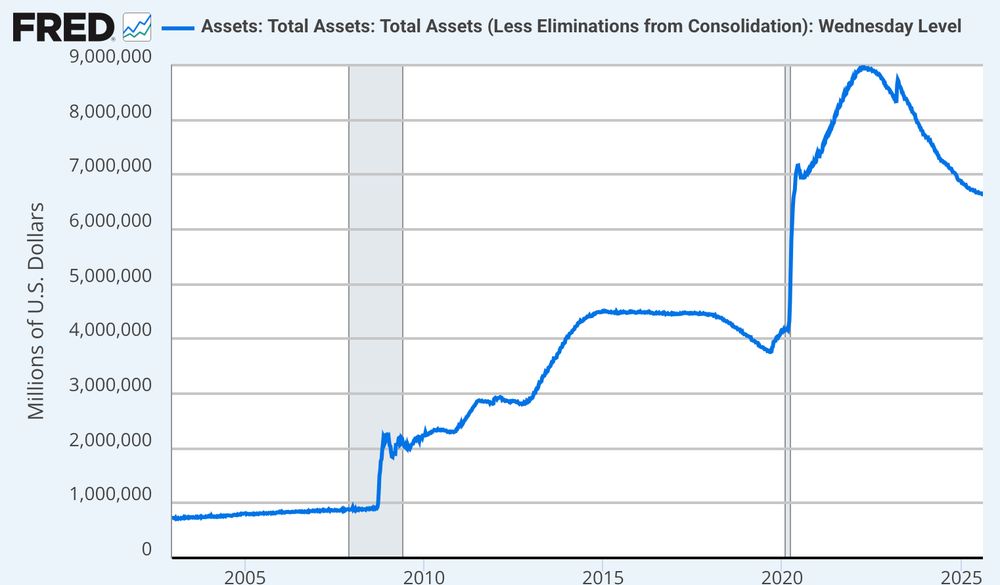

Why is the Fed still holding $7T on its balance sheet? Stocks are overvalued. Real estate is over valued. Cryptocurrency is near record highs.

its mandate isn't to use monetary policy to try to have a negative impact on "asset" prices.

So, it can only inflate asset prices, not deflate them? Sounds like a good deal for asset holders!

An attempt to manage asset prices with monetary policy would make them more volatile and thus benefit large financial institutions the most. Its just not an appropriate tool. This way of thinking is all wrong.

Uh, how is Powell's wealth effect different than trickle down economics? The wealth gap has exploded arguably due to the federal reserves' ridiculous zero interest rate policies and quantitative easing. It seems the only thing the fed can actually do is boost asset prices.

Yes, the top 1% went from earning 20% of all income in 2019 to 26% in 2021, coincident with the Fed’s asset buying binge. Stock and real estate values jumped 35% over a period where jobs were lost. Insane giveaway to investors.

This is the crudest correlative logic

Since when do home prices surge while jobs are being lost?

I am sorry but you are allowed to do the most basic research into what happened in the housing market over the 2020s rather than seeing one graph, assuming it explains it and not doing any more research.

Given the past 20+ years, it's a fact that the Fed views their job first and foremost to protect asset prices. Sure, they talk about their dual mandate of stable prices and low unemployment, but those concerns are clearly secondary. I'm just not sure how anyone can come to a different conclusion

Then they should undo their previous error and sell off the $3T in assets they bought in 2020. The effect of that was a 23% rise in stock value over a period when real GDP growth was zero and 6M jobs were shed. Home prices went on to rise 35% over a 2 year period

This is false. Buying more government bonds is not what did that

Where did the cash to buy the stocks come from if not private investors selling their bonds to the Fed?

That is not how the financial system works. There is no evidence that a greater amount of stock market volumes requires a greater quantity of settlement balances circulating the banking system. Nor do stock market capital gains require it.

Well, a lot of people are scratching their heads about why the stock market seems disconnected from economic reality. And one new thing in the mix is the Fed holding such massive balances. If they sold them, bond yields would go up and money would move out of stocks to buy them.

I've got the post for you! www.crisesnotes.com/the-stock-ma...