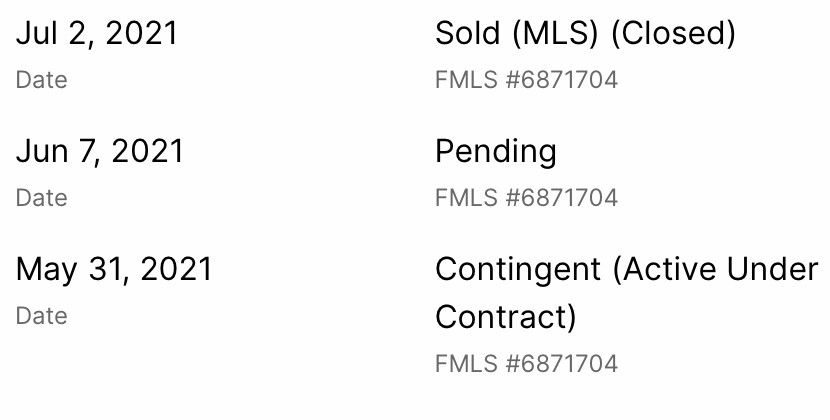

Either way, closing a primary refinance while already under contract for another home you’re claiming as primary is (outside specific exceptions) going to be an issue

Replies

If that is the allegation (primary *refinance* while under contract for another), then that is a problem.

aug 31, 2025, 2:09 am • 0 0 • view

That’s the case for Cook

aug 31, 2025, 2:13 am • 0 0 • view

Assuming that's all correct (I did not double check), and it's a FNMA loan, then the only other excuse off the top of my head is the integrity of the lender representatives, especially if it was the same lender

aug 31, 2025, 2:22 am • 1 0 • view

Could be lender error on preparing docs for the purchase, could fall under the allowance for children buying a home for a parent (she’s from GA, her parents would have been somewhere around 80)…or could actually be a problem

aug 31, 2025, 2:28 am • 1 0 • view