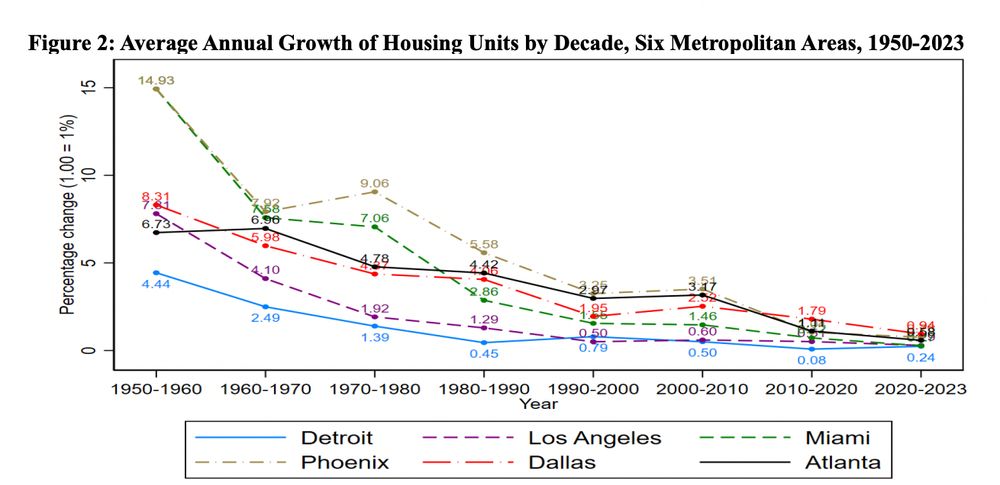

"If the U.S. housing stock had expanded at the same rate from 2000-2020 as it did from 1980-2000, there would be 15 million more housing units." From this very good NBER paper by Ed Glaeser and Joseph Gyourko. www.nber.org/system/files...

Replies

Your link is no good. And this issue is too complex to simply blame on zoning regulations.

You didn't read the study, AND you're confident it's wrong? www.nber.org/papers/w33876

Not at all, when I tried to use the link the page wasn't found. But examining the sprawl currently taking place where I live, I don't think the problem is regulatory - the issue is cost. Not the cost of development, but the purchase cost that excludes potential homebuyers.

Why develop property when labor and materials are so expensive that no one can afford to buy?

I agree that the issue is cost. But the paper takes pains to quantify the roles of materials, labor, and regulation—and finds it's mostly the last.

This is hugely underplayed in the housing discourse. We're not running out of land for suburban starter homes. What's changed—and it really has changed!—is that in the last states where it was still possible to build them, the regulatory landscape has choked off development.

I know I'm a broken record on this, but the inability to move toward opportunity is a profound shift in American life, it's taken place within our lifetimes, and it's *rapidly getting worse.* www.penguinrandomhouse.com/books/700580...

Is there a formula to estimate transportation and other civic infrastructure costs that go with communities for 15 million more houses? Or is it based on the potential property taxes from new homes? Seems like a mindboggling number. Not to mention the environmental impact of sprawl and land use.

What's even more underplayed is the inflationary effect of artificial demand driven by mass speculation by private equity and other corporate players. Until this essential market distortion is dealt with, all the hubbub about bureaucracy is of limited value. www.thesling.org/are-hedge-fu...

How much of that is these cities running out of greenfield land within a reasonable commute distance from job centers? Most people do not want 2-3 hour commutes, you cannot sprawl forever, you have to build infill eventually, which absent major reforms tends to be more difficult to build.

Can you add some European cities? I wonder bc this exponential decay curve-shape is somewhat expected when a city runs out of easily developable space, unless you build up.

And it leads to an important observation... it's not the liberalness of blue states that leads to blocking development, it's primarily the conservatism. It's just the sort of conservatism that doesn't conflict with voting Democrat.

"The oldest and strongest emotion of mankind is fear, and the oldest and strongest kind of fear is fear of the unknown" ~ H. P. Lovecraft en.wikipedia.org/wiki/H._P._L...

I wrote a couple posts on this. I think they are clearly seeing the consequences of the 2008 mortgage crackdown and are misattributing it to local land use obstructions (which I agree are a problem). 1/ kevinerdmann.substack.com/p/more-on-gl...

It’s important that we get this right, because under current conditions, the single-family build-to-rent market in the suburbs is our only potential source of marginal growth in construction, and there is a backlash against it. 2/

We have to recognize that the binding constraint on housing since 2008 has been local obstructions to apartments and a lack of funded owner-occupiers. G&Gs error here will not help inform an appreciation of how important it is to defend the growth of the new rental market. 3/3