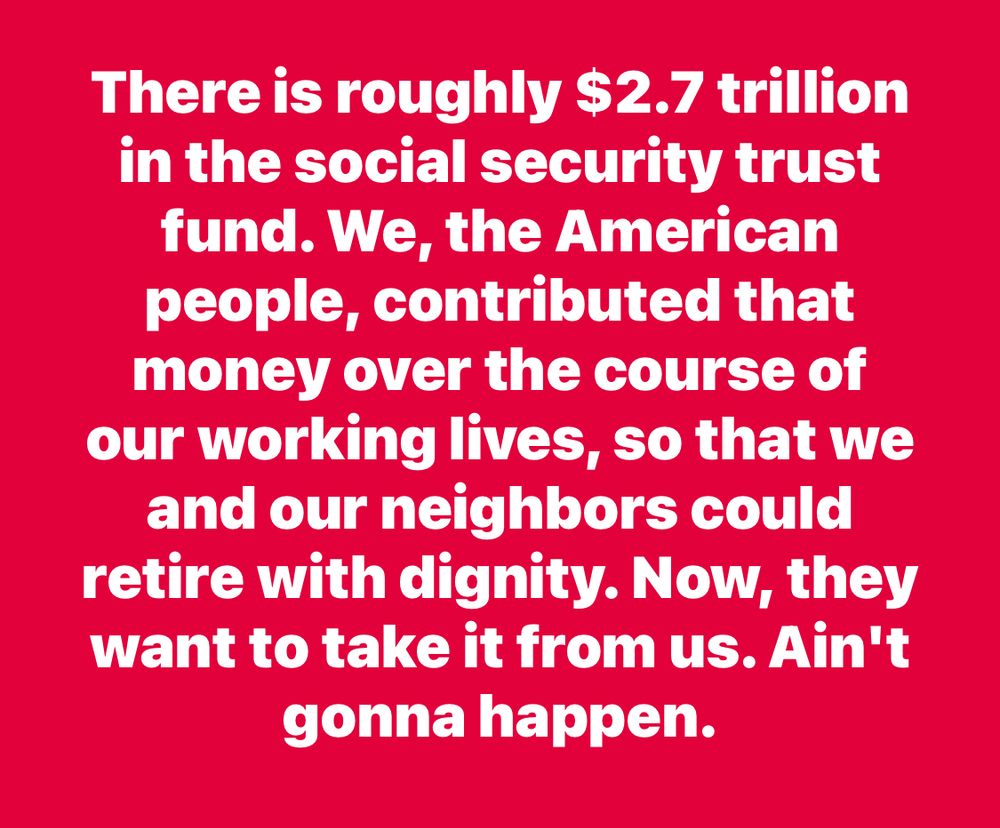

A worker making $50,000 a year contributes to Social Security with 100% of their income. A CEO making $20 million a year contributes to Social Security with less than 1% of their income. Does that sound fair to you?

Replies

They don’t want to raise the cap AND they don’t want to raise the minimum wage.

I definitely agree that the income cap should be raised substantially. However, the person making $20M will not get benefits that are 40 times higher than the person making $50k

They'll go stock options in lieu of salary to avoid it.

It is anything but fair that the CEO is making 4,000 times what the worker is making

Absolutely not

Not sure whether it's fair or not, but either way an additional tax on higher incomes needs to implemented to solve the issue of an aging population. But most outrageous of all is taxing Social Security payments.

Go back to 1960s tax rates.

The rich already have privileges‼️

Seems like something that can be fixed to provide more solvency...

Scrap the cap.

Serious question: What would the person paying social security on $20 million annual salary get back when they retired? I don’t know how to do the calculation, but would they get $50k a month? $100k a month? More?

The maximum SS benefit at FRA is $4018 a month, no matter how much is contributed. The average benefit is $2000 a month.

Thank you for the insight.

But isn’t that maximum based on a salary withholdings cap of $175k? If you removed that cap to collect more in contributions, wouldn’t you also need to adjust the max payout to proportionately compensate those who paid in so much more? Honest question.

That's the point of removing the cap, the maximum benefit would not increase and the high earners would further subsidize the system. Currently the benefit is skewed to lower earners with high earners receiving a proportionally less generous amount.

No. It does not, because it is not. Raise or eliminate the cap altogether

👎🤬🤬

No it is not fair

It makes perfect sense to tRump and his minions and everyone who’s supported the “big beautiful bill.” Is this really happening? 🤦♂️

Yes, When you have millionaires in Congress writing laws for themselves & their friends and benefactors. Yes.

Nope.

No

Not at all.

Exactly ☝️ SS is theft and unfair. The workers should manage their hard earned wages outside of government interference. ✊🏼

Actually yeah. As long as the billionaire realizes this isn't a tax, It's a retirement program. A pension. So he can't cut it. It's funded. It's not a freebie. Bonus, I bet few billionaires actually earn any employment income, it's all investment.

Social security is a pyramid scheme - Elmo Musk If by period scheme you mean all of us hardworking people have to build a fucking pyramid you're not contributing to, then yeah.

Raise the cap.

Hell no!! It's never been fair, just another way Rethuglicans reward the oligarch's who refuse to pay their fair share of taxes, increasing the burden on us. We pay 100% of our income toward SS, Billionaires pay a minute amout on their incomes, even if they raised the cap from $176,000 to 1 million

2. That would be more preferable than the present situation, oligarch"s tax rate 90% under Eisenhower, which is why you never hear magats praise him, he made them pay their fair share, and they still prospered, Reagan lowered the rate to 25%, and thus began the great transfer of wealth to the 1%.

The payroll tax should dump its cap. it’s one of the most regressive parts of our income system.

Sounds biased in favored the wealthy - who writes these laws

100%?

@papst-ny.bsky.social

NO!!! how come our Congress is not taking a CUT! in there pay, they make over 100k

SPEAKER of the HOUSE: he protray himself as A righteous man GODLY man. And he takeing from the POOR ???

Do gazillionaires actually collect Social Security? A real question.

Hell No!

I keep hearing fare is what you pay the cab driver.

And yet you keep electing the bozo’s that are ripping you off.

Not even the slightest.

Do we know what % of all income is taxed for SS? I would think income inequality would harm SS finding because less % of all money out there is subject to SS tax.

No

Hell No !!!

Nope

Hell no! And who thought this shit was ok?

The CEOs?

Removing the taxable income caps would strengthen Social Security for years. I'd love someone to do the math on that for us!

Nope. Yet the repubs want to cut the CEO’s taxes and cut social security as well.

Fixing this loop hole would go a long way to shoring up social security.

Definitely no!!!

SS is an INSURANCE program which means the more you put in the more you get back. The REAL problem is the person making $20 million a year will have an effective tax rate of about 35% incl SS The $50,000 earner will have an effective tax rate of 28% incl SS 8% sales tax takes 50K to 31%

Person making $50K needs a lower effective tax rate because they'll need most of their earnings to pay for necessities.

Agree 100% but taking SS amounts higher is not the answer Taking the rich ppls effective rates paid higher is the solution to cutting working ppls tax rates lower

Yes, anything will be fairer and more equitable than the system now when someone making millions pays less than $1K in taxes and brags about it. This goes for corps. too, which have paid zero in some years.

What is not fair is hundreds of millions of our Social Security going to greasy attorneys and country court to fund a welfare program with no income limit. Rich stats show success and poor stats show need. As long as it stays that way, no progress will ever be. This is Title IV-D and E

What is not fair is hundreds of millions of our Social Security going to greasy attorneys and country court to fund a welfare program with no income limit. Rich stats show success and poor stats show need. As long as it stays that way, no progress will ever be.

No!!!!

That would be a no.

No.

Kill the cap.

That’s the cleatrst argument for eliminating the cap. Thanks.

Nope!

Simple solution that only a handful of politicians speak about and I believe they'll do is TAX THE RICH. It's FDR time! AOC, Sanders, Crockett, Buttigieg, maybe Pritzker... but he's a billionaire and billionaires shouldn't exist.

Yes, because the money received by the rich person won't be of much benefit to them.

Just to hammer the point. CEOs and upper management will satisfy the max contribution in the first January pay check. They are done. Workers spend an entire year paying and may not actually hit the max (which means a smaller return in your benefit).

🤬🤬🤬

This is an issue that we really need to emphasize in the midterms, and if still necessary, the Presidential election. There should be no ceiling on Social Security contributions. Period.

The Big Ugly Bill will make it worse for the middle-class Americans while billionaires buy a new boat!

Depends on whether I make $50K a year or $20m. Since most of us make a lot less than 20 million, I suspect it won’t sound fair to very many. Problem is that those making 20 million- or more - make the “campaign contributions“ that shape tax policy.

Yes

MAGA troll

Nope. Just a Democrat who wants Social Security to continue in its current form with as little change as possible.

MAGA troll 🙄

Bot

Nope

Instead of taxing Social Security and raising the age for full retirement, Reagan should have raised the payroll cap on SS.

Well, there is a limit on how much he can receive when he retires.

Nope

Delete the Social Security tax cap!

No... Spread the wealth around... There have been times where the mega rich have helped the poor and needy without having it be told that it's the right thing to do nowadays they got to tax them cuz they're just running amuck with America's wealth... 💙🇺🇲🙏🌎✌️🙂🕊️

It's like they're playing a different game, where the rules are "who can afford a private island" instead of "who contributes to society".

Nope. The money doesn’t ’trickle down’ like Reagan said it would. People have believed that shit for years. It would be a great concept if the actual workers were paid more, but the 1% Nah. #IMO

Nope. Take off the FICA cap.

Fairness has never been a core principle of America's makeup. If you are able to push back, whatever this is, you will have to push much, much harder and further to get to fairness or equity.

And then, of course, people even richer than those CEOs are calling it a ripoff, but for the exact opposite reason.

That's a big NOPE, good buddy.

The income cap should absolutely be removed and also applied to ALL income, dividends and interest..the tax on SS BENEFITS should also be REMOVED.

No, it doesn't. It's never been fair. We all should pay into SS for our entire pay. The folks on Wall St. who make deferred interest instead of income should pay on every penny of deferment. The CEO's should pay on stock grants.

Joni thinks it's fair. She prayed to the tooth fairy.

No

My only counter would be the more you contribute the more your payout that is capped for a max. What I am saying we need to talk about the cap on the payout too.

While also doing everything possible to get out of paying employees.

Well, while we def need to raise the income level that is still taxed, one's benefits are a function of one's taxed earnings. So if you tax a $20m income, either we have to ALSO pay benefits on that, which is silly/unnecessary, OR just say you no longer get bennies based on earnings past some point.

That income ceiling on the tax should have been raised a long time ago.

It has been, but I think it’s time for a significant increase. Here’s the last couple of decades and the cap amount-

The contributions should be collected from the highest to lowest income brackets, rather than from $0 to the cap. Why cap it? Could someone making over a billion dollars a year even feel that minor tax? Would it make it hard for them to buy milk or diapers?

You might already be following these, but please take a look at these and consider following go.bsky.app/6dCw92a I also write this info on small cards and leave them everywhere I go. You can also checkout handsoff2025.com

I agree. That cap should be removed.

It should be removed and put on steroids to include ALL income .

Nope!

Nope and thanks for pointing that out.

Crumbs from the ultra wealthy, what else is new? Hoarder capitalism is destroying America.

Nope.

Not in the least.

No.

Fair or no...it could be changed pretty easily and shore up SSA trust funds by a huge amount...and really, people that rich won't even notice!

Please see the rule for accurate information. www.irs.gov/businesses/s...

Seems unfair but it isn’t. Both can only receive the same benefits. If you charged the rich on all of their income it would then be considered a ponzie scheme . They just need to be collecting taxes that they owe .

The rich are sitting comfy in their mansions, I don't particularly care if they think paying their fair share is a Ponzi scheme

If the Social Security payment is capped, then yes, that seems fair.

Meanwhile, tax the crap out of their income and wealth.

but maggots don't like their millionaires paying for someone else...even if it's them...

No

Why haven’t they changed this?

Republikkkans 🤬

While reaping 100% of the benefits of US infrastructure, law, military protection and domicile.

We found the flaw in the system.

Exactly, they became Billionaires through a system they refuse to support.

THIS👆🏻💯%‼️

Reagan did this. Every Republican since has made it worse

Would you want to pay SS on $20M out every month?

This has got to change.

Now imagine if you will how much Social Security would have to be paid to the CEO making $20 million a year if the cap was removed. Still wouldn't be fair.

There is no way to make that make sense.

To be fair, the $20 million annually CEO will also get no more than around $4,000 a month when he/she collects their SS. But I agree with your point: to keep SS solvent we need to raise or abolish the salary cap.

They collect using the workers that fuel their money machines. They just get the pay up front, unlike us.

No!

📌

Never forget - each and every pay check we earn - we pay a part to SS. Social Security is not an entitlement- it is earned by Americans and the gov owes them a stipend for this pre collected money- paid in to SS 👇👇

Imagine - Pollsters: "Your President is a stupid, incoherent and vindictive man-baby who is wrecking your country. What do you think of him?" 40% of the US population: "He's okay, I guess."

The Democrats see what he does- we are working to hold him accountable ! Fewer and fewer of his own party support him.

It’s happening

We must fight for our rights, protest, remove administration that steal what is rightfully ours!

Too bad Republican presidents have already stolen from that fund with no repercussions twice. We need to have stricter laws in place to protect OUR Money from greedy politicians who want to use it as their personal piggy banks.

What’s even worse is that most wealthy people don’t have income that is actually subject to SS withholding You only pay SS on earned income

Nope. The wealth inequality in this is shameful, destructive and anti Christian.

No

Not one bit…they could and should do more for society as a whole.

No, nothing fair about it. Politics changed FROM early on serving the country short term and returning home to family and work TO lucrative lifetime positions so enriching that they serve money and greed above all else, and integrity is a concept of the distant past. O

Nope

No

no, and taxing my wages going in, AND coming out sounds unconstitutional. But Raygun pushed it through.

It sounds like bull crap to me

Fuck no

It was the only they could get the rich to go along with it when it was passed we need to fix it because it isn’t fair

👎👎👎👎NO

No, it’s not fair but it is worthy to note that the $20 million person is not really gonna need or draw from Social Security.

They also are a significantly greater burden on the environment, and they have gained significantly from the infrastructure of this country. We educate their employees, we provide them roads, fire, police, etc. If not for this country they wouldn't BE billionaires.

Further, even though they don't "need" the money billionaires are able to apply for AND RECEIVE social security money.

All good points

But they can & often do negatively impact the retirements of employees - my own boss stopped 401K matching 10 months and promised he'd make up for it, but he hasn't done squat except travel the world with the 500+ employee company paying for it. Yes, I've been keeping eyes open for a new job.

Agreed 👍🏻

Of course NOT!!!

Given that the benefits are similarly limited, yes.

Just pointing out that to become Licensed Social Worker (the label “Social worker” is used so loosely as to be meaningless—we can’t treat doctors’ or lawyers’ titles so disrespectfully) requires two years’ postgrad studies and usually a thesis.

Nope

NO! These wealthy corporations should be paying all the taxes - time to give American workers a break 💥

Remove the cap!!

It actually does make sense. The CEO‘s benefits are capped commensurate with their contribution. In addition, wealthier people get a smaller percentage return on what they put in. Payments are slightly progressive. Turning SS into wealth re-distribution will ultimately erode support for it

SS is not based on “income” but on earnings from employment. There should be no cap on SS contributions based on earnings from employment. SS does not apply to “income” from investments. Let’s be accurate.

Nice that you admit that returns from investments are not "earned."

Right. Those are not earnings from employment.

And as people get more income from investments, maybe that should count toward Social Security?

NO! 😡

The cap on SS is outrageous. $176,100 is to low and exempts a lot of income.

Yes, it’s that low for a reason so only the working class pays for it. The cap needs to be at least $1 million.

The wages have advanced higher than the little steps it has taken. Then there is the pensions that can be wiped out by the whim of the Boards.

There needs to be no cap. I don't know why billionaires get all the special sauce that the rest of us paid for with our taxes

It should be reversed. Why should someone who is already at the poverty line even despite working full-time have to spend anything extra at all, while there are million and billionaires who exist and own multiple mansions, yachts, and launch celebrities into space for fun?

Agree 1000% WHY have a cap?

There should be zero cap

And if there was zero cap, the percentage taken out of employee and employer paychecks could probably be reduced a little bit.

True.

Elon Musk doesn’t pay into Social Security at all because he “doesn’t take a salary.”

Nope

🤬

No CEOs should not exist

Especially since those CEOs are responsible for the people making $50k a year or less not being able to save money for retirement, since all their income goes to living expenses.

NO

Would be best to make incomes up to $1 million contribute to social security. Sure it should be higher but this alone will be sufficient to keep SS solvent. It is currently capped at income of $176,000.The social security benefit will probably be gobbled up by medicare IRMAA if income remains high.

No but the system lets the CEO bribe politicians - it's really the corrupt unfair system that is the problem. The rich use it to get wealthier and kick the poor down into the gutter with no ethics or human decency at all.

NO.

Raise the cap or remove it entirely. Problem solved.

Raising the cap is the simplest, fairest solution to the problem of SS running out of funds. It is absurd that it is not done.

Eliminate the cap.

In my 50+ years of paying SS taxes, I never once hit the salary cap. I paid the maximum SS amount every payday for over 50 years. In addition to paying all the other taxes. The Social Security tax is based on the gross pay minus any deductions not subject to Social Security tax--not taken out pretax

End the cap

A friend spent nearly 4 hours on hold with Social Security just to book an in-person appointment. When he arrived, only 3 of 25 windows were staffed. Imagine someone in their 90s dealing with this mess. “We won’t cut Social Security—just the services.”

SS doesn't pay anyone close to $200,000 per year. The supposition/analogy here is mind-boggling stupid or purposely designed to misinform the mind-boggling stupid.

Your supposition. The rest of us get it. Sorry you feel it necessary to carry water for the oligarchs. I'm sure they appreciate it.

That's not what's being claimed here. The post is stating that Someone earning a salary of $50k/yr pays 6.2% of their full income into SS. Their employer pays the other 6.2%. A person earning a $20M/yr salary pays 6.2% on only $176,100 of their income. Less than 1%. www.irs.gov/taxtopics/tc...

Yeah, I misread it.

It happens to all of us.

System sucks. Always has

They both get back the same amount. That's the rationalization. Given that supposition, if a flat tax is regressive then why isn't the Social Security tax regressive as well. In both cases the taxpayer gets back the same services for their money.

Hell NO! Fix it Congress! This is Insane! Just make the $Rich Americans pay their Share of their income!

Now they get to collect it despite never paying in so called federal workers...you know legislator, judges, etc. All federal workers will just get benefits without ever paying in. And Republicans want us to not be aware of it

Non

🙄

They need those tax breaks so they can afford to buy our politicians 😉

It does not sound fair

Hell no!

They need to pay back to the country and system that made them without question.

No and since more of the GDP goes to the top 5% than it did 50 years ago due to supply side economics it’s caused Social Security and Medicare to be underfunded.

#RaiseTheCap

Right?! Just fix that!

HELL NO!

It is time to tax billionaires into Millionaires. Let them pay their share into this nation's coffers.

MAKE THEM pay their fair share. Other than Buffett and Gates, none will do it willingly.

If you want to protect Social security call your Senators ASAP. Members of Congress are being threatened if they don't pass the reconciliation budget bill. It must NOT pass. The repubs are desperate to pass it with sec 70302 sec 80121(h) 43201 (c) and the tax cuts for the rich intact.

A rounding error for a millionaire

Increase the contribution to 100% for all.

I favor raising the cap but not eliminating it. Why? Removing the cap could lead to income restructuring to avoid payroll taxes—e.g., reclassifying wages as dividends, capital gains, or using pass-through business structures.

Unless these loopholes are fixed, then removing the cap likely will not fully help with solvency.

And let us not forget that employees pay 6.2% in for their employees. Eliminating cap would likely suppress wages, admittedly for higher earners.

Correction and clarification:. employers also pay in 6.2% along with employees (also 6.2%)

It is incomprehensible that they don't raise the amount of income in which they collect social security. Even raising a little could help shore up SS.

you could remove the cap completely and it still would only delay the upcoming shortfall a few years.

What if the government pays back into it what Reagan and Bush took from it.

Raising the cap to $250k would extend the trust for about 20 years if there were no other changes in that time, after which benefits would drop about 20%. But that's 20 years to seek additional solutions, like a wealth tax or cutting waste out of the bloated military budget.

But those solutions don't affect Soc Sec. That would req a law to authorize funding of Soc Sec with income taxes. 1) Eliminate the cap 2) Reduce increase in benefits for high earners, resulting from cap elimination 3) Make pass through income subject to the tax. Those 3 get us close if not fixed.

How does raising the cap to $250k of wages not affect SS? This has been analyzed by multiple entities including the CBO with the results I mentioned. Benefits remain capped as they are, income increases, and the trust fund gets extra years before risk of running out.

No the part about the defense budget and the wealth tax (which will never happen).

That’s not the math I’ve seen. Do you have a link for your statement please?

Hopefully the math you have seen is not from Bernie. He says it and is wrong. www.ssa.gov/policy/docs/... manhattan.institute/article/prob... www.cbpp.org/research/inc...

The 1st is from 2009 and the Manhattan Institute is conservative, so I’ll start with your 3rd reference and work back from there. 😂🙏🏽😂

www.usatoday.com/story/money/...

the first is from social security administration. You can not find a single source that says it fixes it, because it doesn't. What difference does the age of the report make. Do you think people were not aware of birth rates and the age distribution of the population? 🤡

😂No, not Bernie. But I’ll look at your links. Thanks. Some models don’t include putting a cap on the payout benefit amount, which is obviously a necessary component to make it work. 🙏🏽

Gotta keep in mind that the insolvency projection is due to theft of monies, not the system itself. Agree that more money going into the system from high earners is fair.

Tax billionaires to extinction. Let's revert the tax on the rich to what it was in the 60s, 90%.

Even at 99%, it’s completely pointless if we don’t close the countless loopholes they’re allowed to endlessly exploit.

Many of our elected reps are bought by the rich to legislate on their behalf. That is the root. The new tax bill just passed by the house cements the robbing of the 99.9% permanent.

Been that way for a very long time. www.vox.com/2014/4/18/56...

Since time immemorial.

If you want to protect Social security call your Senators ASAP. Members of Congress are being threatened if they don't pass the reconciliation budget bill. It must NOT pass. The repubs are desperate to pass it with sec 70302 sec 80121(h) 43201 (c) and the tax cuts for the rich intact.

Being threatened with what? Most of the time integrity is more important than threats.From their votes, they look complicit .If they all voted No they could have more power together and threats would mean nothing.

Do you have any idea how expensive yacht fuel is?

Of course. BOAT stands for Break Out Another Thousand.

YACHT stands for I Am Filthy Fucking Rich.

no

Nope

What doesn't sound fair to me is people making under $12,000/yr paying taxes AT ALL.

NO

When we finally get the dictator wanna be out we need to keep protesting to change this f’ed up system

The entire system is rigged in favor of the wealthy

Social Security contribution cap is arbitrary. Want to fix SS...raise the cap!

unfortunately, that is not enough to fix it.

True. Some benefits will also need to be scaled back (such as raising the retirement age by a year or two). But raising the salary cap to something like $500,000 would be a good start.

REPOST this daily

First principle of income taxation must be, income is income is income. Wage is not different than dividend, than short term capital gains, than long term capital gains, than passive rental income, than stock options, than bonuses, etc. treat it all the same.

Not if the millionaire collects more than 1% of the amount the worker gets on retirement.

My husband and I told our eldest son this and that Social Security would be completely self sustaining if there was no cap. He hadn’t known there was a cap.

Most people don't know.

Math isn’t a strong suit for maga.

It doesn’t make sense, I’d love for someone to show me the statistics on how many people turn down SS benefits. When they retire, everyone takes it. The wealthy don’t turned down an EARNED benefit. They paid in, they take it. Raise the CAP.