Labor’s Franking Credit Changes

@laborsfranking.bsky.social

created January 2, 2025

7 followers 4 following 317 posts

view profile on Bluesky Posts

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

The “cost” of capital gains tax discount is derived by applying a hypothetical tax rate 212% higher than the OECD average and comparing it to the current CGT. BTW the current CGT is 13th highest in OECD and 56% higher than OECD average. www.oecd.org/en/publicati...

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Australian property capital gains, with discount are 13th HIGHEST of the 35 OECD countries and 56% HIGHER than the OECD average. Why would increasing that tax to 212% HIGHER than the OECD AVERAGE be justified ?? www.oecd.org/en/publicati...

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

It’s worrying that you don’t know, or care, that capital gains tax in Australia are taxed at the 13th highest rate of the 35 OECD countries at a rate 56% HIGHER than the OECD average. AND THAT’S WITH THE DISCOUNT. Removing the discount would take the AU tax 212% Higher than the OECD av Dilettante.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Insightful response. Not.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Bowen will never wake up. He will bring Australia down unless he is removed from office.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

I can’t explain away that type of stupidity.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Every law applies to every Australian. Who knows who will buy shares in the future and come face to face with Labor’s inequitable policy.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s policy are designed to disadvantage by deceit.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

And they haven’t been honest either.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s 2019 franking policy was dishonest and inequitable and needed to be called out.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

It was Labor’s 2019 policy based on lies.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s 2019 franking policy was dishonest.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

You just have to click on the image, retard

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

If you can’t manage access to it you shouldn’t be commenting. NPO

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

bsky.app/profile/labo...

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Table 14 in the download Harding, M. and M. Marten (2018), “Statutory tax rates on dividends, interest and capital gains: The debt equity bias at the personal level”, OECD Taxation Working Papers, No. 34, OECD Publishing, Paris, doi.org/10.1787/1aa2....

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Look harder

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

The source is referenced.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Did you bother going to the source? Maybe you should do that before your rant.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Ha! Even allowing for the “discount” Australian capital gains are taxed 13th highest in OECD at a rate 56% higher than average. And you think it’s the “culprit” ? Dilettante

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

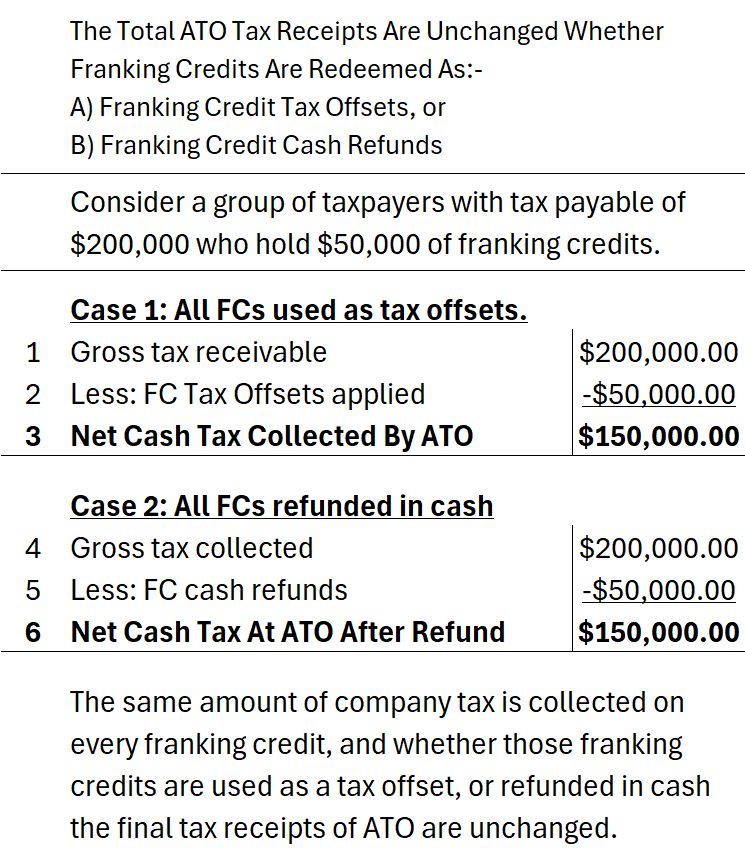

Remember when Labor tried to convince us that franking credit tax offsets were OK but franking credit refunds were so bad they had to be stopped ?

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Those who really understand refundable franking credits would never support Labor’s 2019 franking credit policy. The simplistic and erroneous claim “ tax offsets are OK, refunds are not” is totally without merit.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Surely you can’t expect people to support bad policy just because it doesn’t affect them? Shouldn’t policy have merit to warrant support?

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

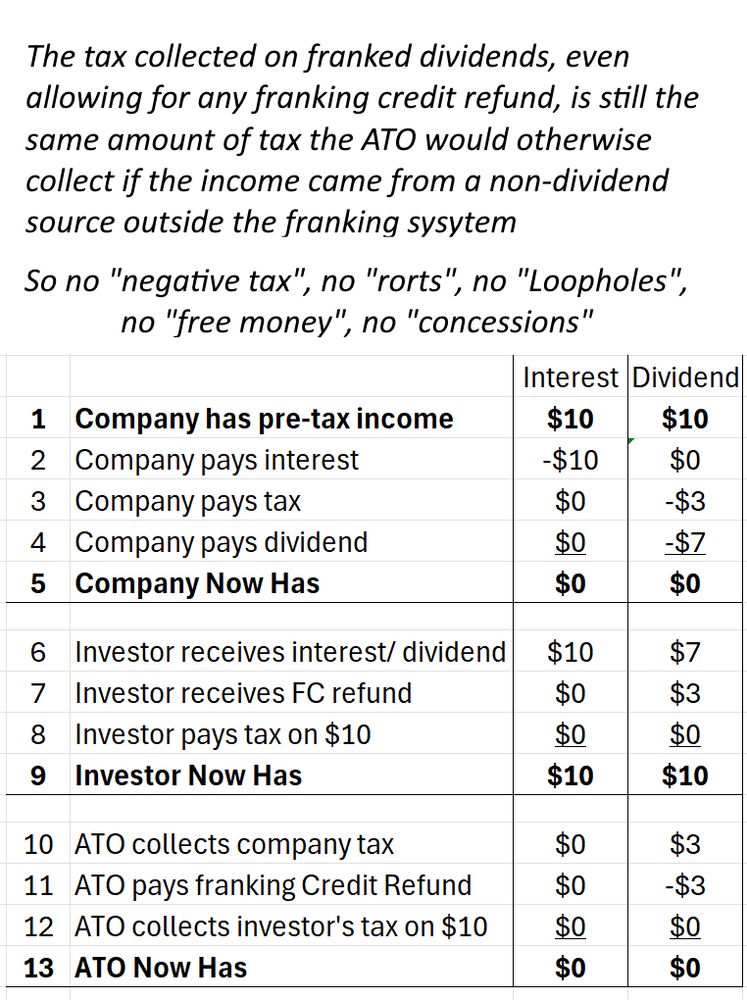

Franking credits result in dividends being taxed at the receiving shareholder’s full, normal tax rate. Even if the franking credits are refunded in cash or offset against other types of income. How can you sustain your claim it’s a “perk”? Can you back that up?

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

I’ve got some shares and am still waiting to pay the “negative tax” Labor said I was already paying.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Another pearler from you ! Life’s too short to waste on tryhards like you.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Maybe you should contact the countries which don’t even tax capital gains and bring them up to date. You could charge them your normal weasel fee.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Some people drive cars for 35 years and still don’t know how they work. Your petty attempt at intimidation is laughable. As are you views.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Do I ? 🤣

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Even so. The tax in Au is higher than most. Even allowing for the 50% discount.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

So? The comparison uses 24.5% Still 13th highest in OECD. Still 56% higher than the average OECD CGT.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Because many years capital gains are taxed in a single year and added to all other income received in that year it is more likely than not that the maximum MTR will apply. That is a quarter of CG goes in tax. And you want HALF? That’s about 3x higher than the average OECD TAX. Sit this one out.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Are you really saying that a quarter of capital gains paid in tax is not enough? And that HALF of capital gains should be paid in tax? Making Australia the HIGHEST taxed country in OECD at a rate significantly higher than the average tax? Some countries don’t even have a CGT. E

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

airhead

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

For maximum untruthful, hysterical campaigns, look no further than the lies used by Labor and their supporters to support Labor’s 2019 franking policy.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

The irony is franking credit refunds are refunds of overpaid tax.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Many, like you stand for ignorance on franking credits. Many have confected ignorance as the arrogantly ignore the reality of how franking credits really work.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

The term “50% discount” implies a bargain. It’s no bargain to be taxed 13th highest of 35 OECD countries at a rate 56% higher than the average of all countries.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

There are always exceptions. Even in the countries compared. Some of the 35 OECD countries don’t even tax capital gains at all. The comparison remains valid.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Multiple years CG are taxed in a single year and the MTR is derived by including all other income. The comparison is all countries’ maximum rate, so valid. The max rate of 24.5% shown in the table provides a valid comparison to other countries.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Are you sure we need to “fix” the “50% discount” on capital gains. As is, Australian property gains are taxed 13th highest of the 35 OECD member countries. Furthermore, allowing for the discount, our capital gains tax is 56% higher than the average OECD tax. We should be careful what we wish for

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Access to franking credits only results in the same tax being paid on dividends as would be paid on any other income outside the franking system. Tax is paid on all income at the same tax rate. Whether the tax rate is appropriate or not. You aren’t addressing this issue in good faith, so good bye.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

BTW, why do you think $1,000 of franking credits refunded in cash is more beneficial than a $1,000 offset against otherwise fully payable tax? Isn’t it a $1,000 value either way? What if the investor with the offset “needs” it less than the investor with the refund? How would you adjudicate that?

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

🤣

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

How are franking credits uniquely contributing to a broken system? They do no more than deliver tax to ATO at the rate set by gov. An argument to change rates may have merit: but not to change a system which delivers tax to ATO at any rate set by government.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

You don’t Government sets tax rates & franking credit offsets and/or refunds deliver tax at exactly that rate. There’s no basis to overtax some shareholders on the the random perception of the “needs” of the investor. BTW what do you propose for those who pay $0 tax on rents & interest ?

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Just go nuclear on power supply.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Those figures are mine and you can’t debunk them. Go ahead and try. There’s line numbers for you to reference. Where’s it wrong?

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

👋

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Abuse 🤣

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Oh. So to your knowledge my claims have NOT been debunked by any fact checking. OK. I’ve got nothing more to add.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

OK, so if it was up to you you’d lodge fraudulent returns. Noted. Fortunately you don’t speak for everyone.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Just direct me to any FactCheck that disputes my claim that the tax remaining at ATO after any franking credit refund is the same amount of tax ATO would otherwise collect if the income was received from any source outside the franking system. I’ve found no such claim in your citation.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

The auditor has to be independent from the accountant. So not the same.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Good. In addressing the “inequality” how did ABC deal with the fact that the tax on franked dividends, even allowing for any refund, is no less now, than the tax which would otherwise be collected if the income came from ANY source OUTSIDE the franking system? I can’t see how that can be omitted?

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Not an accountant. An independent auditor.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

SMSFs must be independently audited annually.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

It is self evident that if government sets 0% tax rates for a tax entity $0 tax will be collected on income received by that entity. If ALL income was received by entities with 0% tax rates then NO TAX WOULD BE COLLECTED ON ANY INCOME. Hello

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

The ABC factCheck confirmed franking credit refunds were “negative tax”? I missed that. Please supply a link, thanks

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Sure, all the company income was paid out to shareholders as dividends. All dividends were taxed at the receiving shareholder’s government set tax rate. In your cherry picked scenarios, that’s either 0% or 15%. Your issue isn’t FCs, it’s the low tax rates. FCs are delivering tax at the set rates

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

All Superfunds in pension phase pay 0% tax If ALL interest was received by them $0 tax would be received on ALL the interest If ALL rents were received by them $0 tax would be received on ALL the rents If ALL income was received by them there’d be $0 tax AT ALL COLLECTED. Why r divs different ?

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

I’m talking about Labor’s claims. The example is based on current tax rules. If you disagree with it, cite the line # you disagree with and provide reasons.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

You will note that at the start of the analysis the company has $10 of pre-tax income. After disbursement of those funds as either interest ( or any type of income) OR franked dividends, the final outcome is:- Company has $0 ATO has $0 Investor ( interest OR dividend) has $10

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

My little analysis is to defeat ignorance. You will note it clearly shows the ATO collects the same amount of tax on franked dividends, even when there is a refund, as it collects on any other type of income.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

“Yup. Those chasing franking credits ………SHOULD be taxed more” Why? The point is “why”? Even after any FC refund the ATO still has the same tax it would collect on any other income. On that basis EVERYONE should be taxed more.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Why would they ring Centrlink about franking credits ? Franking Credits are part of a legitimate tax adjusted administered by the ATO.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

But he did call out Labor’s inequitable 2019 franking credits policy.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Unfortunately the reality of arithmetic does not support Labor’s 2019 claims that franking credit refunds are “negative tax”.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

There was nothing justified about Labor’s 2019 franking policy. Other than it was rejected, of course.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Nevertheless, Labor’s 2019 franking policy was inequitable and supported by lies.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

It’s a pity you don’t comprehend basic arithmetic. It would be best to have someone explain franking credits before making a fool of yourself on here.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Shameful? Labor’s 2019 franking policy was based on outright lies such as the one that claimed tax refunds were negative tax.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

They are self funded. Franking credit refunds represent tax paid on their income and deducted from their dividend income. They paid the tax. If too much is paid, it’s refunded. Get a brain.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Refundable franking credits a joke ? Hardly! Franking credits represent the tax paid by the company AND DEDUCTED FROM THE SHAREHOLDER. If the tax so paid by the shareholder is in excess of the shareholder’s actual tax is refunded. Just like PAYE tax.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Why don’t you finally take the time to comprehend franking credits ? Here’s a quick 13 step example.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

It’s a pity you don’t know what you are talking about. How are snouts in troughs ? Because some random told you?

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Do know how it works? Many drive cars without knowing how they work.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Funny you say that. I distinctly remember Labor lying that franking credit refunds were “negative tax”.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

No it isn’t, The tax is paid by the company but withheld from the shareholder. If the tax paid/ withheld is more than the shareholder owes, the over paid tax is refunded.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

There's no messaging which supports Labor's 2019 franking policies.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

It wasn't rejected in the nat's electorates.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Nice of you to say so :)

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Furthermore, the tripe they carried on with claiming that franking tax offsets were OK, but franking credit cash refunds were not, just puts a spotlight on their innumeracy. It is self evident that a $1 refund has the same effect as forgoing $1 of current tax.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

There was nothing "justified" in Labor's 2019 franking policy. As dim as they are, it's possible even they know that now. The same tax is collected on franked dividends, including where there is a cash refund, as would be collected on any other income received from outside the franking system.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Well changing franking credits won’t fix that. All other income will still be tax free, including interest and rents received. The “tax break” is the 0% tax on all income. To fix that the tax rate needs to be increased.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

On what basis should he “do the franking credits”? Where’s the problem with franking credits ? They result in the same amount of tax being collected on franked dividends as on any other income. Why is that a problem ?

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

There are still many who don’t understand the franking system. Maybe this will help.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Those people would benefit from a crash course in franking credits.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

People who were confused by lies regarding Labor’s 2019 franking policy could do with a crash course on the franking system. Here’s one that may help

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

The people who rang Centrelink about franking credits could do with a crash course on how the system works. This might help.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social)

Labor’s Franking Credit Changes (@laborsfranking.bsky.social)

Defined benefits pensions should be taxed along the lines of the proposed changes to tax large superannuation accounts. Similarly large DB pensions should be taxed on a similar basis in the interest of equity.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

It's very frustrating because the system is so simple.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Well for a start, Labor's franking credit policy was only to stop REFUNDS. Just REFUNDS ffs. The policy was dumb since no less tax is collected by ATO whether franking credits are used as tax offsets or are refunded in cash. The innumerate, and the perpetually ignorant don't acknowledge this.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

What is even more bizarre is that Labor based its whole 2019 on the claim that franking tax offsets were OK, but refunds were "negative tax", "rorts" and "loopholes". All false claims. Whether ALL the franking credits are used as offsets or refunded in cash, ATO's net tax receipts are unchanged.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Very true. Moreover, the ATO tax receipts are unchanged whether ALL the franking credits are refunded or used as tax offsets. Labor's whole FC policy was based on smoke and mirrors deception.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

The meetings were about franking credit REFUNDS. Labor's policy was a sham supported only by innumerates and the perpetually ignorant. No less tax is collected when FCs are refunded compared to the outcome when they are used as a tax offset. ATO's collection is the same.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

There's no basis to remove franking credit refunds as proposed by Labor in 2019. No less tax results.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

The same as Labor screaming franking credit refunds were OK BUT refunds were “negative tax” Labor and their retarded supporters were too innumerate to comprehend the budgetary effect of both is identical.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent

Remember the retards who thought franking credit tax offsets were OK but not franking credit refunds. They were too dumb to know they are budgetarily identical.

Labor’s Franking Credit Changes (@laborsfranking.bsky.social) reply parent