On clean tech, the CID only offers an action plan for automotives. Like the CID, it's a decent strategy, but does not commit the EU to game changing measures yet - i.e. level of actual ambition is still an open question. (6/n)

Replies

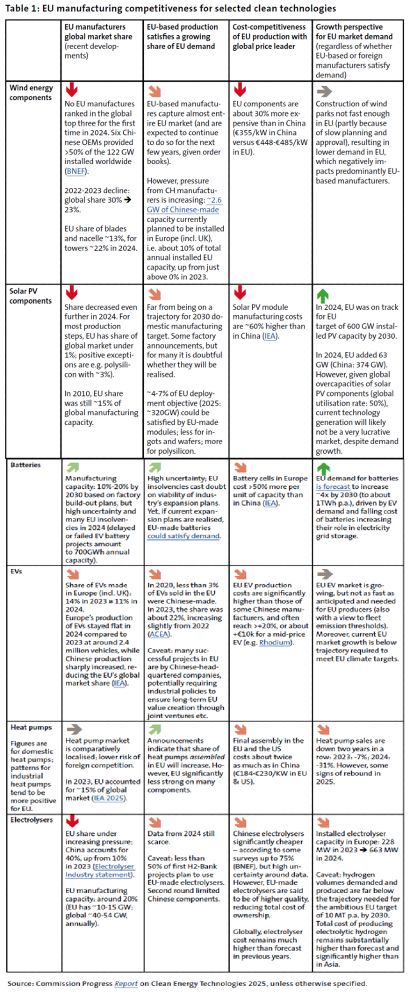

Beyond the transport value chain, there are no sector-specific strategies for clean tech; nothing to tackle the sector-specific bottlenecks for wind turbines, heat pumps, or electrolyzers, for instance. (7/n)

That means many strategic questions for clean tech still remain unanswered. The extent to which clean tech will be covered in upcoming legislation, like the IDAA, also is open. Overall, it's unclear which EU policy is supposed to help turn the tide for clean tech (8/n)

On energy-intensive industries, the CID again provides sharp analysis on high energy prices, challenging international markets, and decarbonisation costs. In March, two action plans, for metals&steel, and affordable energy, were published. (9/n)

But both action plans are rehashing, for the most part, policy measures that were already on the EU agenda before (like expanding renewables quickly) - and unless they are implemented with much more vigor than before, it's doubtful they will now bring about a sea change (10/n)

One exception to this, and a promising tool, is lead markets. But their scope remains unspecified so far, to be spelt out in the IDAA. To make a noticable difference, lead markets must go beyond what the NZIA has done for clean tech - but the action plan says NZIA will be the model. (11/n)

So, what's needed to ensure the CID is actually turned into hard-edged policy? The brief gives four recommendations (12/n)

1️⃣Implementing proposed instruments forcefully. As the CID remains vague, it will be crucial that the EU is bold when deciding the specifics of its industrial policy tools. In the paper, I illustrate this with lead markets, state aid rules (opex subsidies!) and EV purchasing schemes. (13/n)

2️⃣Widening the coverage of sector-specific policies to additional key industries For key industries, COM should develop additional sector-specific strategies - e.g. for batteries and wind, as well as for energy-intensive industries such as paper and cement etc (i.e. NACE 17 & 23). (14/n)

3️⃣ Increasing speed of implementation Doing industrial policy is complicated, and rushing it has risks – but so too does being slow. One example: The first EU lead market strategy is from 2008 (!). We can't wait untill 2030 for the public procurement revision to be implemented to get them. (15/n)