OK, but it is hard to argue that things are getting worse when data clearly says they are getting better. Do you have data to back up your assertion? Things have always been bad for some, and we DEFINITELY can do better, but that means you can always find data that makes things look bad.

Replies

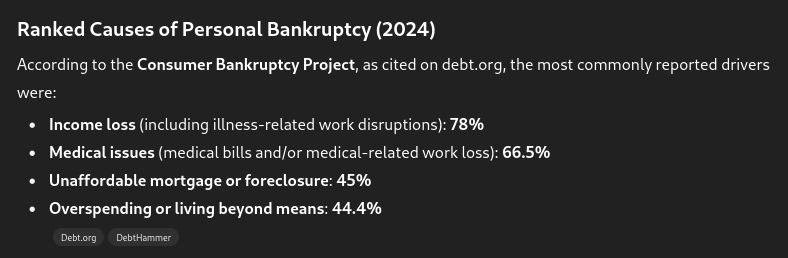

www.debt.org/bankruptcy/s...

Thank you for that. I think this page proves my point; you can always find that things are bad for some. In this case, it is a sliver of the overall population. 500K is only 0.5% of the total number of households, 131M. And, 2024 numbers were lower than 2019!

No, it really doesn't prove your point. You can always find things that are good for some, as well. It's called Wall Street. Median wage data is literally a glass half full/half empty metric. Bankruptcies are just one indicator that shows correlations between non-inflationary economic stresses.

My point is that you have to look at the scale of the data to determine it's relative importance. You pointed at a sliver of the populace and a limited number of years. That's bad data analysis. You are focusing on what is more likely noise rather than signal. Please, read Claudia Sahm's analysis.

Home prices and mortgage payments going up is news? That is sort of what you expect in a growing economy. We do need to build more homes.

I know it's difficult for you to hold two thoughts simultaneously, but when one of people's biggest concerns are housing affordability and mortgages keep going up, that results in negative consumer sentiment.

www.federalreserve.gov/publications...

Bad data analysis my ass. I never said the whole country was going bankrupt. The sample sizes are within the total number of bankruptcies. I merely stated it's an indicator that overwhelmingly correlates with non-inflationary economic situations (including expenses outpacing real wage growth).

Yes, bad data analysis. Who said anything about sample sizes? Even granting your assertion, then, the data suggests the past few years have seen the best real wage growth over expenses in the past 20 years. See this graph: www.debt.org/wp-content/u...

Just for the sake of argument, I'd also point out here that you either intentionally or incompetently failed to mention that bankruptcies were trending upward all throughout Biden's presidency. But I guess that's just you being objective and me filtering out good data, right?

We've effectively come full circle though with you still parroting real wage growth while discussing factors not included in those calculations.

The original snippet I posted was the number of bankruptcies, among all bankruptcies, that were related to non-inflationary economic reasons. Not the number of bankruptcies against all US households. You just keep moving goalposts. Not everyone struggles with these costs files for bankruptcy.

You are still trying to say a small sliver represents the whole. A fallacy you repeat time and time again. The aggregate numbers matter when you are talking aggregate changes in policy. Look at the Fed Reserve report you posted. Essentially, things were great...

...financially for people in 2021. This is because the govt sent lots of money to folks. Things returned back to pre-pandemic as govt support pulled back but were on an upward trend again in 2024. Plus, some of that govt support, esp refundable child tax credits, should be restored.

Yeah, I never said bankruptcies represent the whole. I said they were AN indicator. Not THE indicator. The only fallacy here is you continuing to push a metric that doesn't factor in substantial causes of negative consumer sentiment. I have now shared multiple sources of data that support this.

I never said things weren't getting better. I suggested there are reasons people weren't "feeling" it. The point isn't to just drum up negative data, either. It's to explore why consumer sentiment and macroeconomic data isn't matching up. These are real factors. I just shared data with you. More:

People weren't "feeling" it because they were being told things were bad. Even if consumer sentiment said things were bad, consumer purchases said things were good. Check out what Claudia Sahm, a noted economist and one who cares about people, has written: www.newstatesman.com/business/eco...