this is basically how most European VATs work, though

Replies

The UK's carveouts are mostly sensible. Most food, books, children's clothing.

This is such a revealing reaction on Sen’s part imo

1) the coffee tariff is in fact matryoshka bullshit, unjustifiable even if you accept arguendo an implausible pile of defensive premises 2) the affirmative program of a party simply is not constrained by its negative critiques, cf Reps and federalism, deficit

3) let Warnock talk to the public, damn

But consider how the Dems I imagine might act in some future hypothetical scenario that I can use to make vague charges of hypocrisy today!

It also feels like. Hm. Part of the same dreamworld that Trump lives in, where he’s not really president? Like “of course the REAL policy work is something that happens during once-a-dodecade D-trifectas, everything else is a sort of incoherent sideshow.” But I live here!

Right?! VAT isn’t even in ANY platform, it’s just eurowonk coded.

The amount of incredible good policy that would come out of a D party with the political power to push a fed VAT through the Senate and the Court beggars imagination tbqh.

Sincerely think we’re closer to UBI than VAT today.

I'd even go so far as to say that if you had the political capital to pass a VAT then spending it on a VAT any time in the first decade would be malpractice.

Oh eight hundred percent agree.

If you had a launch package with the throw weight to handle a FEDERAL VAT you should be lobbing like fifty other things with it first, one after another.

Confiscating all billionaire wealth over a billion would be our first priority. A VAT would be many decades into Reconstruction 2.

Every tax code is like: 1% a sensible, cogent structure designed to “maximize milk, minimize moo” 9% thoughtful, complicated modifications required to make the core system work in practice 90% hilarious, self-interested bullshit

Taxing coffee is like taxing tea, and we all learned in elementary school how un-american that was

It's not that bad; per EU rules there is a maximum of 3 different rates (standard, reduced, minimum) and it will be something like: - durable consumer goods at std rate (<=25%) - services, some food at a reduced rate (half of maximum or less) - most food at 5%, some other stuff like books too

And that’s bad

True but also is drinking coffee a special interest lol

It’s also how a lot of state-level sales taxes work tbh Idk specifics in other states, but Virginia exempts sales tax for most motor fuels; audiovisual production equipment; seed stock, livestock, agricultural equipment, veterinary medicine; aircraft parts, railcars; school textbooks; etc. …

Yeah, I was going to say that. Often it's good-government ideas (no sales tax on food!) but the edge cases get messy. Related, and rather more evil, is the policing of what can and can't be purchased with EBT/food stamps. Also, and rather vile: grocery bags.

Supermarkets in Southern California can't give away bags, have to sell them (I always carry my own, don't know the price; a quarter or two). EBT customers get them for free: same material, same weight. But clear, instead of colored. For visibility and public inspection, in more than one sense.

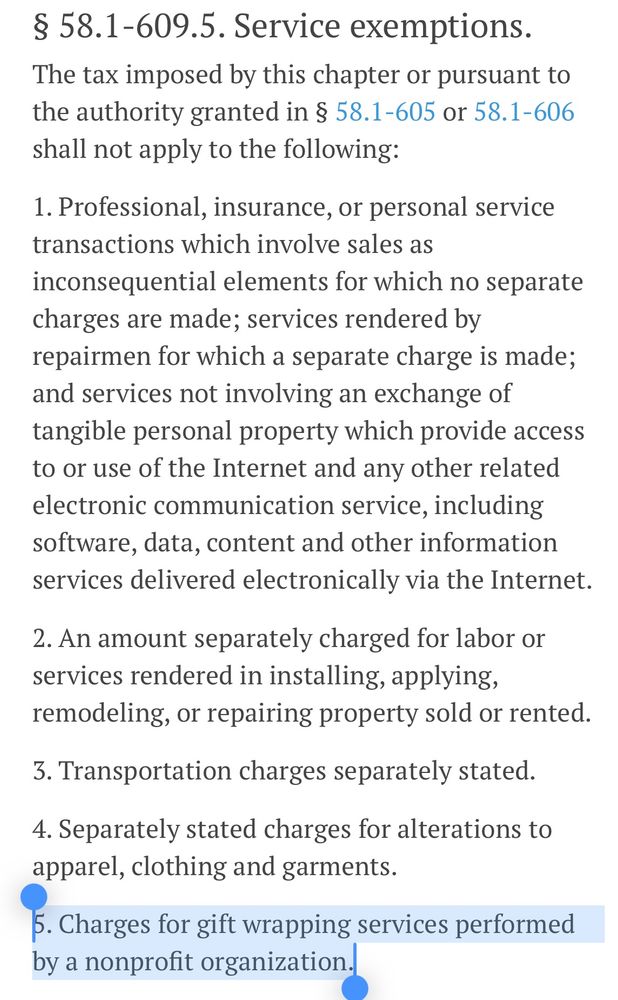

The Commonwealth of Virginia has a statutory sales tax exemption for gift wrapping performed by a nonprofit organization law.lis.virginia.gov/vacode/title...

or, indeed, how existing sales taxes in the US work