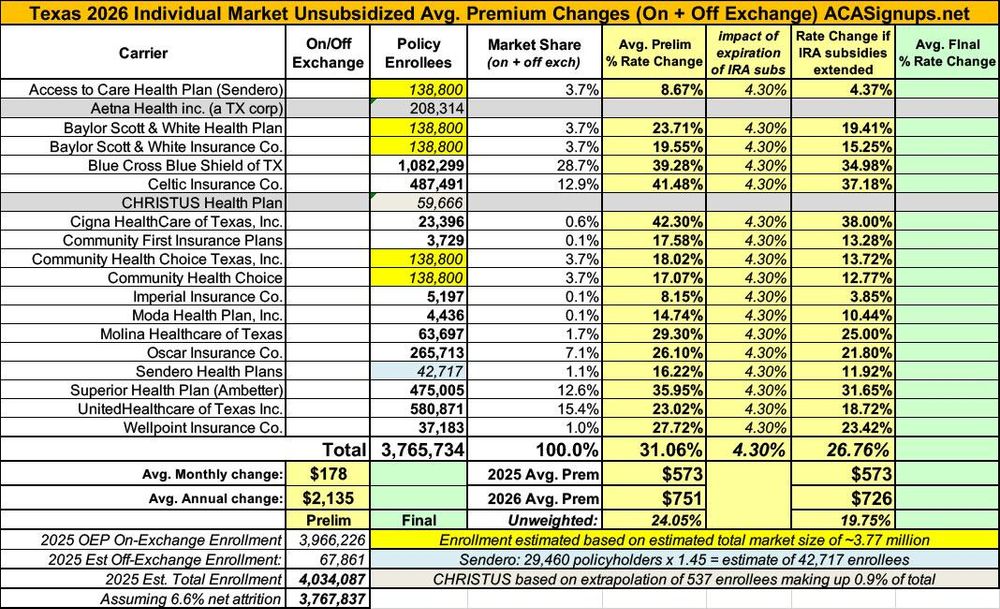

As for the ~3.5 MILLION Texans who are currently receiving federal subsidies: Once again, it's not gonna be pretty. AGAIN: THIS IS NOT HAPPENING AFTER THE MIDTERMS. THIS IS CURRENTLY SET TO HAPPEN STARTING IN JANUARY 2026.

Replies

Well it starting in January is actually beneficial, it might get people thinking.

How so? Considering get cancer at a different time or in a different state?

I think he's talking politically, as in it's happening well before the midterms until being buried until afterwards.

Ah, I failed to discern. *hat-tip

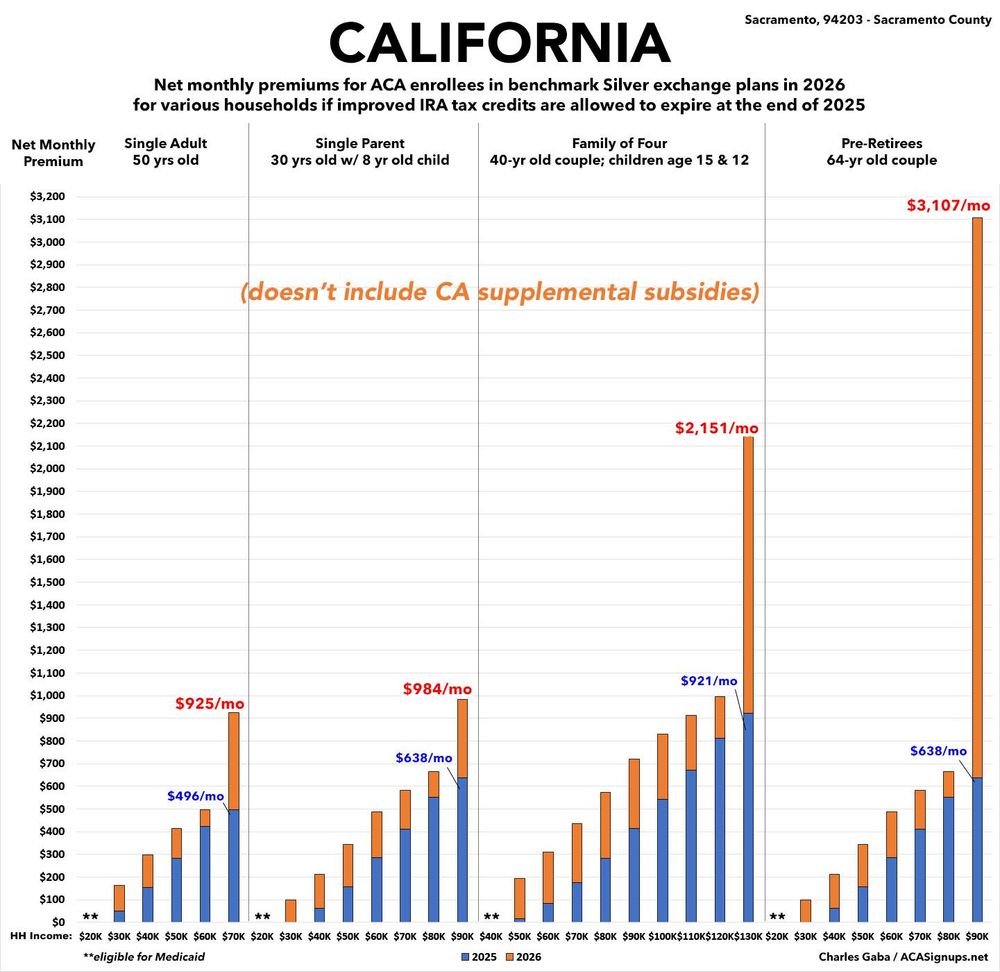

I should note that the example on the right side of the graph above (the 64-yr old couple who earn $90,000/yr) would cost them $38,664/year in premiums alone, or 43% of their gross income.

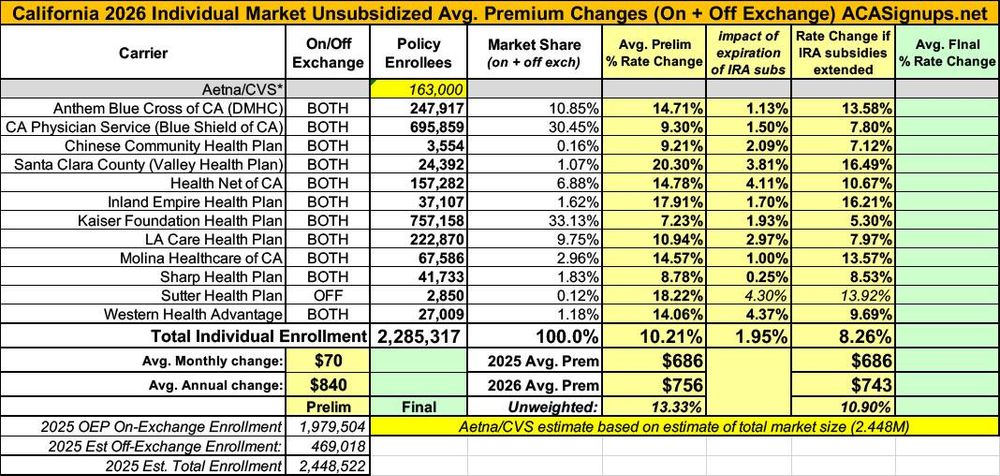

OK, next up: CALIFORNIA. Despite having 1/3 higher population than Texas, California actually has ~40% *fewer* ACA enrollees. Why? CA expanded Medicaid under the ACA; TX hasn't, which means a lot of Texans who should be on Medicaid are in ACA plans instead. acasignups.net/ira-subsidy-...

Expansion only explains part of it While I don't know what Medicaid coverage/charity care gets you in Texas (underfunded seems a good bet), California's "safety net" hospitals are pretty good options, unless you wish to avoid Zuck General on political grounds

CA still has a LOT of ACA enrollees, however: Around 2.45 million, give or take. The good news (such as it is)? CA carriers are only asking for avg. rate hikes of around 10.2%. Any other year that would be considered high; for 2026, it's actually among the *lowest* statewide increases nationally.

The other good news is that along with several other states, California has their own *supplemental* financial subsidy program for ACA enrollees, which will help mitigate SOME of the massive rate hikes. However, they're completely retooling this program so I couldn't include it in my analysis:

(note: I know the layout of the graph for CA looks different; I've decided to go with "stacked" columns instead of side by side as it looks cleaner & clearer to me; it's still displaying the same data, however--Blue = net 2025 benchmark premiums; Orange = net 2026 benchmark premiums)

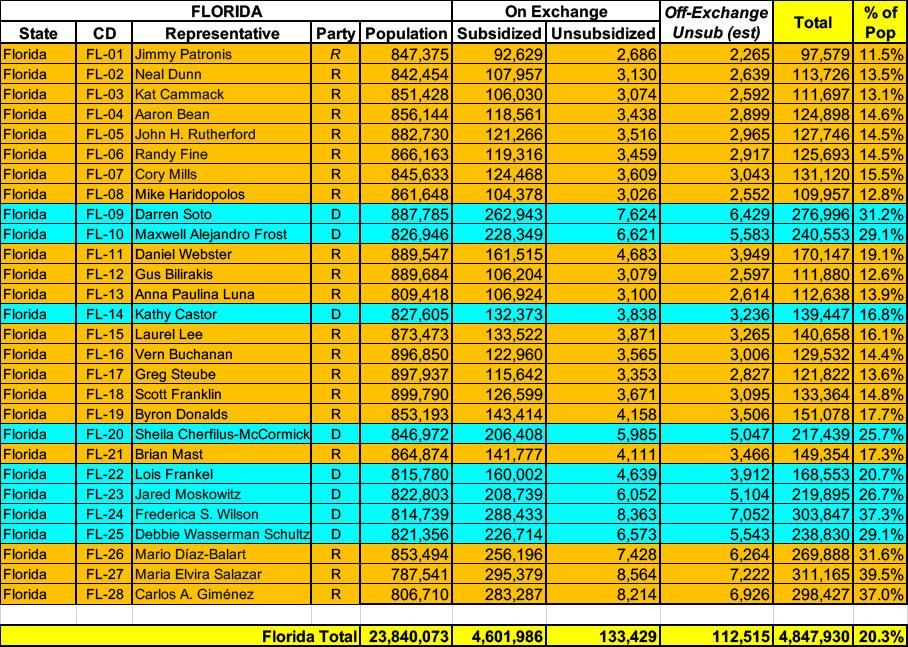

🚨 OK, NEXT UP: THE BIG ONE: FLORIDA. 🚨 cc: @davidjolly.bsky.social @maxwellfrost.bsky.social acasignups.net/ira-subsidy-...

I wish I could feel sorry for low information white voters that voted against themselves and for the top 1%, but I just can't. I don't.

Officially, over 4.8 MILLION Floridians enrolled in #ACA individual market plans this year--a stunning 20% of the TOTAL population. Of those, ~4.6 million are subsidized; ~250K are unsubsidized either on or off the exchange. Realistically, the total is likely more like 4.5 million at the moment.

Take a closer look at those numbers, especially the percentages in the right-hand column. Statewide, ~20% of Florida's total population is enrolled in ACA plans. In some House districts, however, it's higher. Much higher. Check out the last three:

FL-26: Mario Diaz-Balart (R): 31.6% FL-27: Maria Elvira Salazar (R): 39.5% FL-28: Carlos Gimenez (R): 37.0% That's right: Nearly 40% of FL-27's ENTIRE POPULATION relies on #ACA exchange coverage. That's nearly 300,000 people in Salazar's district alone.

Hialeah is going to explode when the ACA goes away.

That would be me in the $638 —> $3170 column.😕 I hope CA offers some assistance or I’m just going to have to do without for a couple years until I reach Medicare eligibility. At the very least, it could waive the penalty for not having what it considers a comprehensive insurance plan.

the mandate penalty is waived if the lowest-cost Bronze plan costs more than around 7.3% of your income (they haven't posted the 2026 percent yet). That'd be around $550/mo for a couple earning $90K/yr. www.coveredca.com/learning-cen...

My examples are all based on the 2nd-lowest cost Silver plan (the "benchmark plan") but my guess is that even the lowest-cost Bronze plan is gonna be a lot more than $550/mo for an older couple earning more than 400% FPL.

Yeah, I've checked & based on last year's rates, even Bronze is about 30% of my income. Obviously impossible. Supposedly you can get an exemption number that will let you get a catastrophic plan, but it's extra effort & reportedly takes a long time.

I'm a health journalist who has been keeping track of all this & starting the process early, but I know that's not the case for a lot of people, some of whom aren't even aware of the subsidy cliff they're facing at the end of this year.