People always say they want investment in public services. They even say they'd be happy to pay more tax for it. But when it comes down to it, they do not vote for parties that say they will raise taxes. This has been shown over and over and over again. Labour are just trying to square that circle.

Replies

Fair taxation would be welcomed. Make it harder for the v wealthy to avoid tax, especially non-doms & unearned wealth. Lower the threshold for anyone earning less than 50k. Make the unspeakably wealthy Crown Estate fund public service investments e.g. investments in public renewables will pay back.

Agree with many of your prescriptions, but you're wrong to think these would be welcomed. Look at the massive fuss over VAT on private school fees, IHT on rich farmers, even about the ending of non-dom status - all of which Labour have enacted. And the Crown Estate have literally just announced

£400 million investment in renewables. There is plenty more Labour can do around taxing unearned wealth (I'm in favour of a land tax myself, wealth taxes have been shown not to work) and they ought to be doing it.

VAT on private school fees is not a vote loser at all. The right wing press are very noisy about it but it really only affects a tiny minority. Getting rid of private schools altogether should also be an aspiration. Eton, Harrow, Dulwich etc are holding us back as a nation.

As it’s a minority, screw them eh? Listen to yourself..

Oh my god, lets pity the poor millionaires. Listen to yourself.

Why do you think they are all millionaires?

Mostly inherited wealth, that is taken for granted by people who don't realise most of us don't inherit land, property and old wealth. The less than 10% that go to private school should not be able to dictate tax breaks for themselves, it's a ridiculous privilege.

It isn’t and wasn’t a tax break. My question was lot well-framed. Why do you think all private school parents are millionaires? They are not. Not by a long chalk.

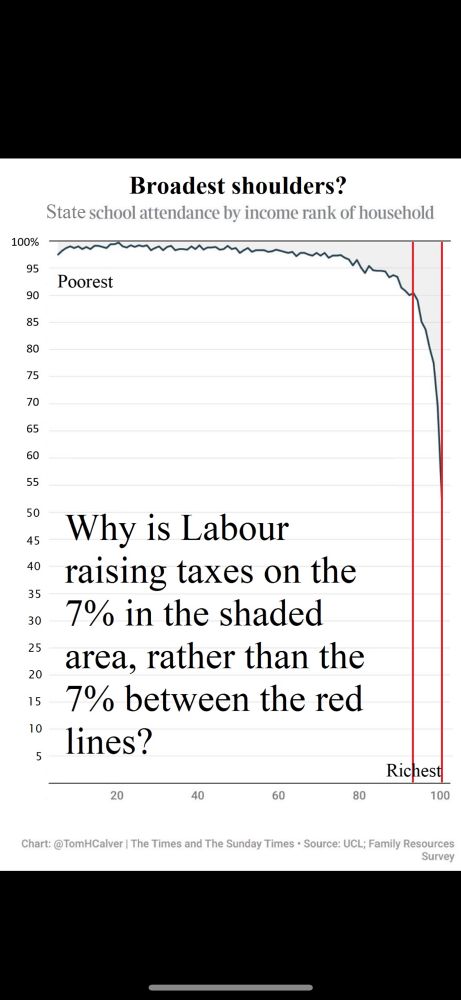

It is a tax break. Private school fees were VAT-exempt, now they are not. And I'm sure many private school parents aren't millionaires; however, they are generally in the top 7% of earners.

They are not the top 7% of earners at all. That is a myth you have fallen for.

Education was VAT exempt. It still is, bar an exception to that exemption for children aged 5-18. Most private school parents aren’t millionaires. 1/3 are outside the top two income deciles (broadly equivalent to basic rate tax) that’s 200k of them. 12.5% are on median income and below.

I work in a borough where the council pay for private school places because their SEND provision is woeful or non-existent. It would make more sense for the state to fund the provision and places allocated based on need not privilege. Eton etc could be excellent residential specialist provision.