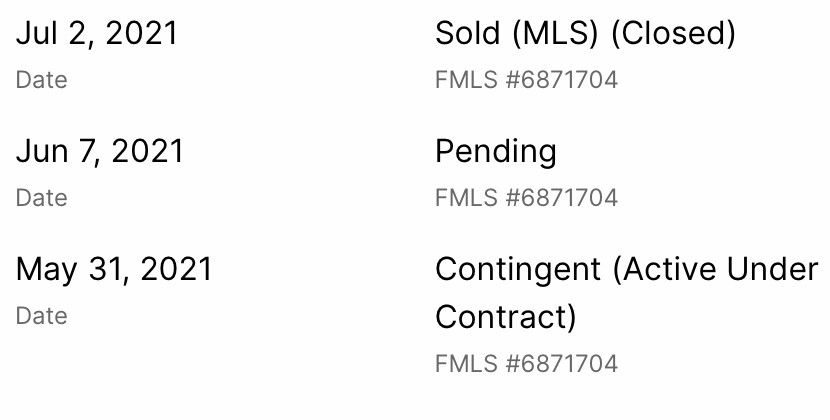

What matters is the time between the most recent mortgage and the purchase of the second. It was two weeks.

Replies

For Fannie Mae loans, it's one yr from start of occupancy. Unless, there are extenuating circumstances, like moving because of change of job, health, etc. Proprietary loans depend on the lender rules.

Either way, closing a primary refinance while already under contract for another home you’re claiming as primary is (outside specific exceptions) going to be an issue

If that is the allegation (primary *refinance* while under contract for another), then that is a problem.

That’s the case for Cook

Assuming that's all correct (I did not double check), and it's a FNMA loan, then the only other excuse off the top of my head is the integrity of the lender representatives, especially if it was the same lender

Could be lender error on preparing docs for the purchase, could fall under the allowance for children buying a home for a parent (she’s from GA, her parents would have been somewhere around 80)…or could actually be a problem