Why did I check the quote tweets on this? I knew they were going to depress me, just wall to wall people who are going to be poorer than they should be in old age who think that “invest more in stocks and shares ISAs” is some kind of spiv’s charter and not, you know, important advice.

Replies

That's obviously true. I think the problem is that the reputation of IFAs, bank advisors etc have been trashed (because of the actions of a sizeable minority) so ppl are scared to trust anyone with their money.

Yup. NatWest tried to “advise” me how to invest the month after they had been bailed out by the government. “Would you like to meet our investment expert “ was their speil. Never trust a bank on investment : look at their records.

Wasn’t one of the aims of Thatcher’s privatisations to create “a share holding democracy?” If it was then it failed. My Dad bought BT and TSB shares and like the vast majority of the public sold them within a few days for a profit.

I’m a financial spud who thinks current capitalism is about privatizing profit & socializing risk (evil), & ‘financial services’ is synonym for tax avoidance (evil): “Hmm, work pension is going up steadily.” “Hmm, work pension lost 20% of its value after Trump had a brain fart.” “Hmm, no thanks.”

? Most responses are just saying they can't afford it. Which is unsurprising.

Aye, but there are also a lot of people who can't afford to invest in the sense that they a) have few savings as it is b) need them where they can get at them ASAP if needed, not in something designed for longer term. The days it takes to liquidate shares in a S+S ISA is no good when boiler go poof.

But those people are irrelevant to this problem, which is of people who *can* save, saving badly.

I think though if you've been in that position, but aren't now, it's still instinctive to want your money somewhere you can get at it more or less instantly if the shit hits the fan again. (That and the idea in this country that shares are Rich People Stuff Not For The Likes Of Us.)

(I am one of these people btw, can't bring myself to put my entire emergency fund in mine as well, especially with the US economy being what it is right now.)

Dunno - my blind pensioner friend had all his money piled up in ISAs and was very sharp about moving it around for the best rates. He'd been a self-employed carpet fitter before his disability. I think you just need to have a big enough pot of money to start thinking in terms of investing.

People become middle class as soon as they have something to be middle class about. That was Thatcher's great insight.

'Aspirational working class' is very much a thing, the fear of being common

A few days ago I was at a funeral. There was a young man there with an earring and wearing a light blue suit instead of a funeral suit. Thank God my nan died years ago, she wouldn't have stopped going on about that suit for the whole of the M5.

Ignore sentimental piffle about "close knit communities" from people who've never lived in them, and consequently don't appreciate why everyone gets out as soon as they have a real opportunity.

That's where I keep falling into the reality gap. The idea that there could be people able to save meaningfully (outside their pension) while they still have enough years to run til retirement to make S&S sensible. And I'd still be wondering why they don't just top up their pension in that case

There are lots of younger people opting out of their pensions as a) money is tight with rents, student loans etc b) they can't see themselves ever retiring anyway c) wanting to save for deposit instead. It's massively short-sighted, yes, but I can understand it too.

You have to have money to invest. After years of austerity who has? WOuld you invest in renewable energy if Reform will deincentivise it? Would you invest in Fossil fuels? Armaments seems a safe bet.

If we wanted risk we could go to the casino.

Funds (active or index funds) are designed for people (like me) that don't understand the stock market.

Saw many comments about the Cash ISA allowance reduction idea saying "stock market bad place to invest because it lost 10% last week and wiped out my retirement savings". Forgetting that the stocks may have risen 50% in the 5-10 years you owned them.

I am sure someone has mentioned it (I did look but there are a lot of comments) but anyone who has an occupational pension will potentially have a reasonable equity exposure.

A big problem is that people don’t see cash as a risk asset. In reality, last ten years, inflation etc the value of a lot of people’s cash holdings will have declined. Yet it’s investing seen as risky!

Trouble is most people probably don't have a clue about investing, (neither do I, I don't even know if that's the right word), but they're going so forcefully on this they're apparently planning a 'Tell Sid' style campaign (for those who remember it). That will up support. I just can't believe a...

... Labour government thinks this is the way to go.

Wish had more detail on these answers- essentially the target for policy should be anyone who answered “no” who has savings that aren’t a) for a fixed nominal sum b) as unemployment insurance c) some other imminent need.

I think all cash *savings* products should have big health warnings that are on par with the “your investments may go down as well as up” on investments. Something along the lines of “You are highly likely to lose value over time in this product due to inflation” or some other words.

Are we counting gilts as stocks or cash for this purpose? 30yr gilts are getting very attractive as a place to park savings.

Obviously keeping all your money in a standard high street savings account is a bad idea unless you need, or might need, access to it.

That's the thing about these discussions - isn't "you need, or might need, access to it" true for most people's savings most of the time?

Per the poll it is only true of a third of respondents!

Per the poll. That's your answer. By the time this question comes around you just want the thing be over. "Stocks are for yuppies/ c****/people with more time/money to waste" isn't an option. You just want to finish asap and collect the points. The first one. "Too risky". Yea, that'll do. Next.

And also we can…see and observe what people do with savings in the UK. (Cash ISAs and amateur landlords, in the main.)

I wonder if that poll was targeted at individuals who have these mythical pots of money lying around in bank accounts or at those of us with barely a penny spare at the end of the month?

Yes, I'm starting to realise that this whole 'tracker' vs. 'savings account' debate is something I don't really need to worry myself about, certainly at the moment 😁

Only people I know who do are recently retired with lump sums sitting in their accounts. One friend has invested in a hogshead of whisky

That's interesting... people will always want alcohol 🙂

Exactly. Important to remember that the average savings for age 45 – 54 in the UK is now £13,318. That's the sort of figure that you *always* need accessible.

I mentioned that age range because I feel like that's a point when having some expectation of saving is fair. Up to age 35, perhaps not, thanks to the housing crisis.

Yes and to the extent it is that makes sense. But if you haven £20k a year to stick in an ISA then that probably doesn't apply....

Most people done have that kind of money. Nor do they have anyone telling them simple good advice of what to do with money. “Your dad” might have that money eventually if by most folks measure they have done “really well for themselve” but the bulk…nope. A months wages or 3 is the goal.

You can get instant access ISAs. And as you know, £20k is the maximum per annum, they should be the default for any saver to be honest. Financial education is simply woeful in the UK. I

I know but that doesn't invalidate what I said! We're discussing cash vs other options.

Yes, my challenge is the widespread public assumption that ISAs are for other people with money to "invest" (meaning something, active, scary and risky), when for even modest savers getting a low, risk-free return, an ISA is a low, risk free return that is at least tax free.

Agree everyone with any savings should have one.

Solution, for Reeves, is to abolished Cash ISA, raise the Interest Allowance to £1,200pa & leave only tax-emption on Shares ISA to promote equity investing.

Potentially overly simplified and you know it, but people without much will get better returns elsewhere and are unlikely to be taxed by enough.

Even then, you can sell funds pretty quickly and funds don't have to mean equities. Plenty of money market and ultrashort bond funds will return more than a high street cash account with minimal price risk.

Yeah though huge price risk there

But you're still locking in an interest rate a lot higher than savings are likely to be. Unless inflation goes boom ofc.

If the interest rate on the gilt is higher than anticipated base rate growth, there's some market mispricing going on? Not all savings accounts offer the base rate. My bank doesn't, but it offers a liquidity fund in a stocks and shares ISA which does, which I'd very much consider cash exposure.

And if you wait to maturity they're as close to risk free as you'll get. If interest rate risk does bother you, but shorter dated gilts - particularly low coupon ones as there's no CGT on gilts.

Yep.

Nothing to make you feel old like realising holding 30 year gilts to maturity isn't going to work. Smh.

Locking in a fixed interest rate versus inflation linked liabilities (spending). Still think a diversified equity portfolio is lower risk.

Index-linked gilt?

I mean, I’m with you given that I’m 55 and still hold c.80% of my public assets in equities…

If you’re holding to maturity, locking in circa 5% for 30 years doesn’t look bad (unless inflation go boom as you point out): you’re essentially buying an annuity.

Yeah if it’s hold to maturity it looks pretty good.

Probably a no brainer. If we're in *end of UK civilization as we know it* territory we're all screwed anyway.

It’s also pretty good if interest rates go down.

This is my thinking.

Not financial advice etc but a lot of people who held all equity portfolios through ZIRP should probably transition to 60-40 now bonds have value again.

QUITE

Ignoring inflation going boom, The downside scenario is you make 5.5% a year. The upside scenario is rates go back down to 3% and at the same time you get to buy stocks cheaper in a big risk off move. You might make 40% on the duration and then buy stocks cheaper in a fortunate outcome.

If you’re capable of pricing duration accurately you’re far more financially sophisticated than 98% of the adult population.

99.9%

Do you have specific funds in mind for that?

Public investment literacy is so low that of those who hv some clue, the American term "stocks" for common stock equivalent to shares probably has them thinking stocks are shares. U shouldn't think of Gilts as cash - the longer dated the more you're betting on inflation. Short stuff say <2yrs ~yes.

Do think it is a fascinating indicator of both collapse in trust in financial institutions in the long tail of the 2008 crisis and also of collapse in financial knowledge/literacy in said long tail.

Also I know this is going to be a minority, but I would be interested to see how being subject to one of the really restrictive savings caps for a while affects people's views/attitudes here.

(I say this as someone who should be better and better informed about this stuff but "to understand a man look at what was happening in the world when he was 20" and all that. Plus I once nearly went over a savings cap by being too depressed to really spend much money for a year)

There are ad campaigns encouraging risky investments. I've yet to see any for a nice safe tracker.

That's actually a good thing - the management fees for e.g. Vanguard index funds are wafer-thin, meaning no money for adverts in the tube but, more importantly, less profit for "fat cat bankers" (for those who see bankers that way) and more money in your pocket!

Idle thought: is unwillingness to invest in shares a hangover of buy-to-let having been seen as a better investment (and possibly easier to understand / feel you have control) in which case maybe things are going to swing back to equities as that unwinds.

Working in the industry we would run into people with 2/3 buy to lets who would consider themselves not to be wealthy enough to invest…

because "an investor" is someone with millions or billions to spend who wears a suit and works in an office...

Good hypothesis, certainly possible.

But if people were rational they wouldn’t invest in equities or BTL, they’d buy gilts Also “equities” in the government’s eyes is “UK equities” and the British investors do invest in some equities - non-UK ones”

The other issue is that media loves reporting crashes (bleeds/leads) Reporting on how the market rose say 10pc in a year doesn't sell ads. So anyone not engaged thinks its much more risky than it is.

I think there's some truth to that.

My pension took a hell of beating from late January due to Trump. Fully recovered now, as has the market.

The market recovered a while back from the Trump tarrif crash. Outside the FT it won't have made headlines.

The ability to cancel a plan and pivot is worth something!

I suspect it's just people - subconsciously, maybe - thinking about the worst case scenario. With stocks you could theoretically lose pretty much everything, however unlikely that is; with BTL, well, you've still got a house whatever happens. The only way to combat this...

...would be to give actual information about the probabilities of your invested money going down by each X percent. We get warnings that you might lose money - but how likely is it? How likely are you to lose more than, say, 20%? Most people's guesses would probably be quite a way off the mark.

And against that you'd have to be quite old to remember mortgage rates being double digit and house prics ever falling seriously.

I think it's simpler - people (okay, I mean me) don't understand it. It's framed (by critics and fans) as gambling, and the jargon is dense. Plus for most people it's small sums - is it worth investing a grand or two? I've no idea.

Maybe people have witnessed the damage certain stock market investment and investors have made (the race for more profits and dividends over worker and environmental protection, etc) and would rather not be a part of it.

Also, if you have a pension, you are heavily into stocks & shares (and some bonds etc…)

I mean I can be your case study, I have savings in the low five figures and they're just in a highish interest savings account on Monzo because 1) I have absolutely no idea what else you should do with it 2) I assume any investment means you may lose money instead, which I don't want

Rule of thumb: if it's your only emergency money, or it's for a house deposit or something you need cash for soon, that's one thing. If it's for your retirement or something more than, say, five years away, it's worth your while to spend less than an hour of your time at least googling index funds.

give it to me

not, to be clear, an offfer to invest it for you. I want to spend it. for myself

I can see my pension balance on my internet banking because it’s the same parent company, and seeing it crash by nearly £10k because of all the stupid shit happening in America was enough to put me off any kind of stock investing thank you

How is it now

still volatile, thanks for asking

📌

If you are saving long term, expect to double your savings rate on average investing in low risk index funds. Look up FIRE (Financial Independence, Retire Early) people who are people of modest means taking advantage of the system we already live in, because why not. And yes, you will occasionally

see the balance go down, but on average you’ll be much better off. The main thing is that you don’t put the money you may need at short notice into these vehicles, these are for long term savings (5+ years)

2] is my thoughts exactly, why would i invest in stocks when I've lived through at least two, maybe three global financial 'whoops!' moments in my life?

This article by Angry Socialist Blogger Hamilton Nolan is a pretty good overview for the skeptical web.archive.org/web/20191010...

Exact same case here. The idea of loosing some of what we have is just not an acceptable outcome.

Stocks and shares isas are brilliant (important caveat: if you have to file taxes elsewhere as well as in the U.K. consult an accountant and absolutely do not set one up if you have to file taxes in the US because you will get a massive bill). But otherwise, they’re great.

The US tax code gets very aggressive with stocks and shares in non-US companies and it’s not covered by the normal tax treaty arrangement so a relatively small investment can cost you lots of money, as well as a huge amount of paperwork.

This sort of (perceived) complexity and unforeseen circumstance is probably part of the reason why many people just stick to straightforward savings account.

Most people aren’t dual nationals, though.

I know... but this sense of consequence and unknowability when it comes to investing (from the layperson's perspective) is not restricted to dual nationality... it's all 'rates' and 'fluctuations' and 'tracking' etc. It's confusing.

I'd also add the caveat that you should probably be in a position where you think the probability of you having to withdraw from the ISA at short notice is low. My ISA which now has more than £4000 profit was at a loss only this March.

Yes, that’s a fair point. You need to be able to have a lower risk savings account elsewhere as well.

Yes, some cash (ideally 3-6 months of take home pay) stashed away in an instant access account for emergencies.

You are a step ahead of me with this Monzo carry on.

join.monzo.com/c/g9ycmqb2

over in Europe, they have products designed for people like you which offer equity upside with downside risk protection. Unfortunately they tend to be priced based on the psychological value to the customer rather than the technical financial model value, so they don't pass consumer fairness tests

Any thoughts on why US retail investors have been much more eager to invest in index funds than UK retail investors?

Equity culture which is the legacy of long term regulation of sports gambling

In the US? (just to be sure I understand the reply)

Reasons: - John Bogle and Vanguard in the 1970s in the US. Great product, great self-marketer, set it up as a client-owned mutual, conveyed a mission. One of the top 3 fund companies globally now. - Also 1980s legal cases on fiduciary duties for managers gave a bigger incentive to consider low-cost

I think those are some, but not all of the reasons. Great Depression killed US equity culture for 50 years. It recovered in late 1980s early 1990s. Vanguard has $ trillions in AUM but so does Fidelity, Capital Research, BlackRock, etc. 36b cases were all won by the asset management industry

some might call this another example of economist brain ignoring commercial reality, ensuring that people end up with inadequate savings but protecting themselves from being blamed. but not me, I like it.

(I should probably write a blog post on this, but basically the intellectual history goes: efficient markets theory -> very strong belief in index funds -> general suspicion of profitable financial products -> some admitted misselling scandals -> ever tighter regulation of products -> ...

... -> everyone involved has economist brain and doesn't understand marketing at all -> the products that have been designed to address people's actual wants and fears aren't very like index funds at all -> financial services marketing withers on the vine as an industry -> here we are now ...

... basically, the only products that you can get to market in the UK are ones that look really unattractive without a lot of advisory hand-holding in the sales process, and British people absolutely.will.not pay money for financial advice. Let's have another government ad campaign!

(the big problem being that although you might think phrases like "the sales process", "consumer wants and fears" and indeed "marketing" would be familiar to economics graduates, the way it's taught today they really aren't. And it's difficult to get a central bank job without an economics degree.

I Vote for to write up that blog

Monzo has 14 pre made funds you can pick from. My rule of thumb is if I need/could need those savings in the next 6 months they stay in savings. If they can sit longer into an investment. My savings get 4%. Investments 16% in the last 3 months.

I've opened stocks & shares ISA twice; once was just before Truss became PM and once was just before Trump announced his tariffs. Lost money on both almost immediately as stock markets crashed and took months to get it back. It's hard for me to think "I should just check back on this in five years"

A Monzo-specific thing: open a stocks & shares ISA and set up "round ups" i.e. whatever change you would get from any transaction gets put in that account. Rather than moving your savings significantly towards investments you'd just have a little investment that grows on its own without risking much

All investments involve risk. Savings accounts are seen as "risk-free", but you still take on risk by a) losing the value of your money to inflation and b) missing out on the opportunity cost of investing. The S&P has an average ~10% growth rate in its history. Isn't it a risk to miss out on that?

I don't know what "the S&P" is lol

US equity index. The key point here is that it entirely depends on what the money is for. If it’s a separate nest egg for retirement then absolutely stick it in equities. If however it’s an if stuff goes wrong reserve then keep it in cash.

In that regard I think what can be helpful is to split your savings into multiple pots and have both cash and stocks savings. But I get people don't always want the hassle of managing things in that way

Technology has made it almost hassle free, monthly automated payments and broad passive funds ftw

Absolutely re the different pots

This but also limit the size of the cash pot to maybe a month or two of income (if you’re in a job). I think people massively overestimate their need for *instant* access to cash.

yeah it's a mix of the latter + money for if I end up eventually getting knocked up (inshallah!) while still self employed, as there's basically no mat pay for people not in jobs, so I guess I should prob keep it close at hand?

We can talk about if pff main if you like. And while it’s true that you lose a little money via inflation etc if you think you might need the money in the reasonably short term then equities are less attractive because of higher volatility (ie risk of going down).

also I guess it depends how you define risk - I'm not necessarily entirely wedded to my way of things but I won't lose any cold hard cash right now, and that inherently feels more low risk than maybe getting more money but also maybe getting less

But you literally have. The cold hard cash you have right now is worth less than it was worth a year ago.

yes I know how inflation works but my point is that if I make a bad investment then surely I'll lose more than if I don't invest at all, that's my point about seeing risk differently

I wasn’t trying to explain inflation…. It’s not about choosing a bad investment, you don’t have to stock pick. Just choose literally any tracker fund managed by eg Vanguard and like that’s absolutely fine.

Concentrated risk that then is amplified into the biggest Ponzi schemes through market cap increases - i.e. what will suffer most when the market turns. No one should invest in any asset that has rallied multiple 100% in a short space of time. Just put in bids -50% / -75% etc and wait

Everyone has different risk tolerances, for sure. There's a wide gap between investing in crypto (high risk) versus a speculative growth stock (EV battery maker) versus a blue chip company (Apple) versus an index that pools together 500 of those blue chips (S&P).

Generally the higher the risk, the higher the potential reward. But indexes generally provide stable growth, with the exception of massive downturns (recessions, god forbid a depression). Even so, historically if you haven't sold during those times, the markets have recovered over the long term.

Am I right in saying that there has never been a 20 year period where markets have ended lower than they started? That might be specific to the US. Not sure.

While this is technically true, the answer is to invest in a globally diversified index fund. If *those* end up as "bad investments" that don't recover in time for retirement, the entire world has imploded and savings of any kind would be the least of our concerns.

You'd be surprised how quickly a small bit of money a month into a S&S ISA has enough growth that you'd need a really massive drop to lose more than the growth. And try not to "invest". Use nutmeg or a service where you can specify risk level and they invest in tracker funds for you.

If you want a simple recipe. 1. Build Savings like you have ✔️ 2. Open an account with Degiro or similar. 3. Every month buys some ETF like “FTSE All-World”. Even small amounts but keep doing it. Repeat. Bonus points start a pension. That’s it.

If you’re buying in regularly and your investment goes down 30%, keep buying. You own the shares/etfs you’ve bought. If they drop in value you still own them you haven’t lost a penny. You gain or lose when you sell.

A 30% drop in share prices to a young person is a thing of joy. It means you’re buying at a discount. “30% off at the stock market”. Who doesn’t love a sale!

Especially since the same people pushing into investments "now" after a 16 year 700% rally in the S&P 500 were warning of dangers back then. It is the "definition" of a Ponzi scheme right now, and good for people to see it. Of course, I am not saying one should not buy when the market drops 90%

It mostly matters in terms of time horizon - if you only want to save for a couple years then use it, carry on doing what you’re doing. If you’re saving long term, odds are you will end up with less if you keep it in cash.

But I think the time horizon is the part that most people struggle with? They/we know what inflation is, but there’s a whole big murky space between “I need to buy a car next year” and “retirement” they’re trying to plan for.

Basically all of the financial advice you get as a young adult is ‘how to save for a house deposit’ so not really a surprise that people flounder with other savings.

I tell people to set up multiple train tracks. One is for your pension. Set it up and pay in. Job done. Separate to that is saving for maybe I’ll buy a house or car. Don’t try to think short term and long term at the same time.

That’s definitely true and remember having the same issue when I was younger - being asked “what do you want to do with this money? When do you anticipate you’ll need it? And just being like, I have absolutely no clue.

Having a pension is investing in stocks and shares, isn't it?

Yes, but per all the research done around 2012, most people don’t realise that. Previously was one of the biggest contributors to ceasing contributions when they found out. Also vast majority of uk pension savers are totally inert.

Sure you already know, but there's different funds with differing risks. My bank S&S ISA offers a range, with their "low risk" fund being 75% bonds/cash and 25% shares. You can mix funds in their ISA too, so you can have £1000 on high risk and £2000 on low-risk.

I'm not qualified to give financial advice but general sentiment is it's good to keep some cash set aside (~6-12 mos) for emergencies and invest the rest depending on your risk tolerance. But the point @stephenkb.bsky.social is alluding to is without investing, you are likely to end up worse off.

You could lose cold hard Euros by having your savings in Sterling (or vice versa). [There's no way to fully protect against that risk - you can technically hedge it, but you'd need seven digits of savings for that to be legal and eight digits for it to make sense].

This was my view for ages too then I realised that 1. I kept getting stuck in old interest accounts that were effectively losing money and 2. Even 4% interest when inflation is 5-10% I was losing money

I slowly started moving money into S&S ISA's and quite quickly you've made enough growth to weather even quite big drops (and every time I did a big move it dropped - I time terribly - but recovered) I try view "normal high interest" for emergency cash and all ISA's are now S&S for longer term.

Don’t worry too much about inflation, S&P or any other terminology. Everyone has different attitudes to risk and many have an “I have other shit to think about” attitude. That’s fine. Don’t let anyone tell you your attitude to risk is wrong. When you’re ready it is less hassle than you think.

The only thing I can PROMISE is that you don’t need to become an expert on ANYTHING finance related to put yourself in a much better situation long term. You may find that if you do take steps in that direction you naturally get more interested in it. You’ll be boring people before you know it.

Shorthand for the S&P 500 - an index of the top 500 companies listed on US stock exchanges. It's updated regularly so that better-performing companies are included and worse-performers drop out. Essentially takes a lot of the guesswork out of investing for people that don't want to stock pick.

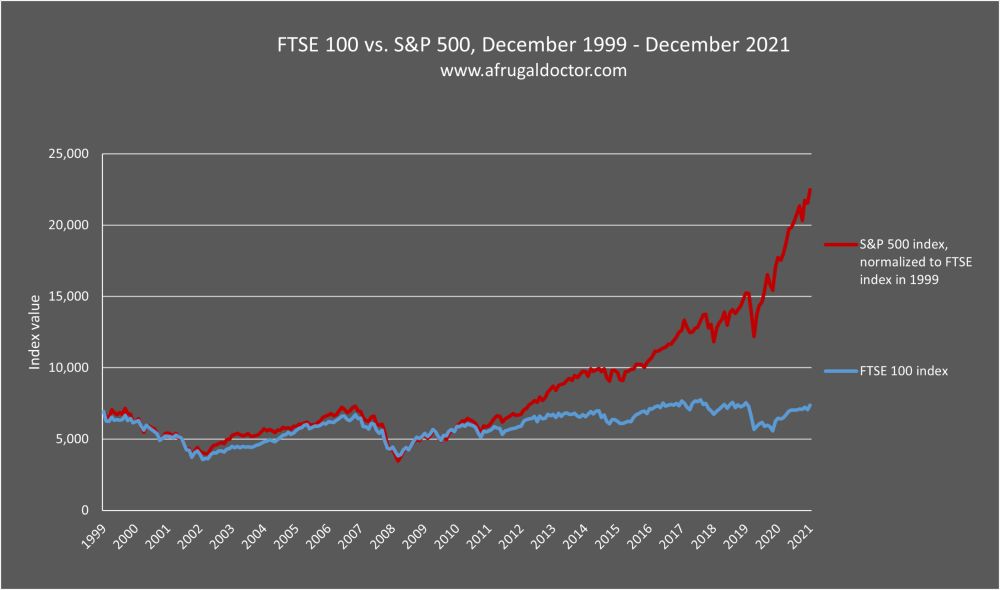

Meanwhile, in blighty. If you're not going to convince ~50% folks to take on FX risk (you're not), then? UK perceptions around investment risk, loss aversion are a problem - but it is true and shit that S&P is the outlier at one end, and UK stocks/equities at the other. (Which is linked ofc 😅)

Even in the UK, even in our lost two decades, a stocks and shares ISA has outperformed cash.

I mean imagine if it didn't? 😅 Just pushing back a bit on the default opportunity costs for UK savers being in the order of 10% a year S&P - it's v real, but not quite that for anyone much under 45.

The 10% average is totally a shorthand, and that's a historical average over the past ~100 years (and assumes relative stability in the US market/leadership, which, well...) But if you want to reduce risk further you could split between US equities and international, etc.

I appreciate you're selling the long view here - and acknowledging 'past performance, future returns' etc 😊🙏 I'm just saying for an average person who read the same 100 year stat in 2000, and sensibly invested in a nice high street available index - he 'you're an idiot not to' factor is 🇺🇸>🇬🇧.

Brits can invest in the US market, so I don't see the issue. Though what with Trump tariff nonsense, US equities have definitely become riskier and generally more volatile in the past 6 months.

People who arent financially engaged want 2 save in something simple and close. For UK, S&P a complexity too far. It's one of the reasons S&P is so successful - a massive pool of Americans doing the default! Trying to shift UK saving norms via the opportunities of US return is a tough route (imo).

I believe you only get £85k back if the savings outfit goes bust, too. Small risk, perhaps, but those who lived through the 2008 crisis will remember how real and in our faces that risk became. And a chancellor siding with those in the financial sector seeking deregulation makes my hands go clammy.

I've done very well ethically investing in Green bonds, through Abundance, and Fidelity's GIA.

Yes, there are vast numbers of funds to choose from and you pick the risk profile you want. Great for cautious or newby investors.

But having said that, I moved my cash ISA savings to a Stocks and Shares ISA a few years ago, and I definitely do not regret it. It has done a lot better than any savings account - and the gains are tax free. The essential thing, of course, is to get good independent advice when you start out.

it's 85k if the money is held as *savings* as a bank deposit in cash ISAs - if your money is in stocks and shares, your *investment* is segregated/ringfenced so it's not affected if your bank crashes.

Agreed, my sincere apologies if I gave that impression!

No worries, and sorry if I gave the impression of "correcting" you, which wasn't intended at all.

Not at all, it's a very valid point to make.

I hear what people are saying about this and they're probably right, but I think a lot of people find ANY financial risk a source of anxiety? I just looked at the five-year performance on the stocks ISA my bank offers and they all took such a hit in 2022 I'd have been stressed to fuck by it.

Yeh I’ve not idea what I’m doing and, especially with a massive personal expense myself and my partner have done, I’d be terrified of risking the little we have left. Not that long ago where the rent was a worry like.

I simply don’t trust fund managers. I’ve been through 3 recessions. I accept I have to trust my two pension providers to invest on my behalf, and both have a derisk period as they approach maturity. But that’s as much risk as I’m willing to take.

The cultural issue is that housing is the most dependable investment but is increasingly beyond reach. If most of your income goes on having a home, you’re not going to invest in something like shares whose value may fall as well as rise. Cash feels safer.

Obviously, property values can go down as well as up. When I bought in 1996 it was in a slump so I got a two bed house for a £3K cash deposit and paid less than the seller had for it. I suspect that same £3K put into stocks would not have returned roughly £100K over 28 years, given market crashes.

And there’s a class dimension. If you look at the social grade demographic in the full results, you can fear of the risk is significantly higher in C2DE. No amount of middle class “but it’s *fine* can override a fear or precarity. ygo-assets-websites-editorial-emea.yougov.net/documents/In...

The thing is, the “fear of precarity” is not the problem here! Those people are right to save in cash! The problem is that British middle class people save in a less sensible way than the American working classes do.

It’s a worthwhile thing to get young people sensibly knowledgable about. My savings life transformed once I siphoned a chunk off to investments. There obviously have been big dips. But it’s an amount I don’t need imminently, so can afford high risk funds.

Which will be for a range of issues, including how it is reported* and the lack of financial education. *I frequently despair of hearing “the markets” on the news as if they are strange godlike forces. It’s alien.

Also on the news - layoffs etc in various industries to boost shareholder value. Not terribly keen to grab a slice of that action tbh.

I wrote a short story about this very thing last year!

Those child trust funds the Blair government did should have been 100% equity-only. Spending the first 18 years of your life watching a basket of equities would teach you a lot.

Yeah, agree. In an ideal world would bring those back and part of the curriculum ask would be 'at 18, school leavers are equipped to make useful decisions about their nest egg'.

I was surprised to see my bank doesn't appear to offer any kind of mixed ISA, and it strikes me if you want to encourage people to invest, that would be an easy way to do it? Let you adjust how much of your savings you want to put in stocks and shares.

I mean you can just have... 2 ISAs?

If you don't trust fund managers (you're right not to - none of them justify their fees by outperforming the overall market over the long term), you can take them out of the equation by investing in index funds/ETFs.

I think this, combined with people's general lack of savings, is probably the reason - "I haven't got that much money, I might need it and there's a chance it won't be there" sounds like a powerful deterrent. Plus, recent headlines about the stock market probably don't help.

yeah that's where I stand too I think!

The minimum period to consider investment for is five years, 10+ is much better. Ideally you want to drip feed money in so you are more insulated from and can even make the most of dips (pound cost averaging) and then NOT look at it (assuming you use an index tracker). Best of all get real advice

A good financial advisor is like a good accountant, they earn you much more than what they charge (and free advice off people on the socials is worth what you pay for it)

since I have a mail from my IFA to hand, here's the last 3.5 years in a FTSE tracker (pink) versus the funds my IFA manages for me (red): cumulative performance is 28-29% for both over 3 years, 21-22% over 3.5 years and 51% for the FTSE tracker over 5 years (managed fund hasn't run that long

but if you look over different periods, you see the impact of a market slump; over 3 months it's 7.7/10.9%, over 6 months it's only 0.67/6.94% - v poor return from the FTSE and you can see the advantage of a managed fund.

on the chart you can see a number of times when the returns are negative - but they recover and over the long term returns remain high

the discrete performance - how it does within a single year rather than since the beginning of the investment - is smaller numbers: 4.7/8.4% in the first year, 13/12% 2nd year, 8.9/5.9% 3rd year, -2%, 20% -11% years 4, 5,6

My first financial advisor started cracking a joke after the 2008 crash; remember, the value of shares can fall as well as plummet!

But again, getting a financial advisor (or an accountant) feels like it something *other people* do.

It feels like something that costs money, and we're only having this discussion because we don't have enough in the first place

financial advisors don't (usually) charge you money up front; they make a small ongoing charge (maybe 1.75% compared to the 0.9% a pension fund charges or the 0.4% a stocks and shares ISA charges, so they all cream a little off). that reduces your return slightly rather than you handing over cash

but then you also have to find a reputable financial advisor. And not feel ridiculous going to them.

changing that view would be the best way of making investment more accessible to people; it should be right up there with starting a pension (I have an accountant because I have a company, most people won't need that as much)

The thing is: in the long run, cash is actually the worst investment possible. You don't have the yo-yo thing but you also (a) barely follow inflation (b) every ~100 years a country just fucks its currency up and if you're holding cash you're left with nothing. Long term, stocks are...safest.

It usually depends on your timeline for using the money invested: "not going to touch it for five years or more" is reasonable for a stocks & shares isa but usual advice is to keep 6 months costs in cash before you think about that.

They have recovered, but the "low-risk" one has ended up paying more or less what their cash ISA does over the five years.

The fun thing about our modern world is that we now seem to fairly regularly have massive shocks to the financial system which mean you can be quite unfortunate with anything stocks related, another slightly offputting reality

Risk is correlated with reward. The issue is if you hold a diversified portfolio for long enough the chances of loss are very low indeed.

This thread is moderately depressing as it hammers home the gloomy reality of my pecuniary situation, which is essentially the same as when I was about fifteen. No mortgage, no savings, no investments, nada. I will therefore wish you all well and look ahead to the first drink of the day.

The standard advice that I got when I started working was: Make as big a pension contribution as you can afford up to the maximum that is tax-advantaged.

lmao I don't have a pension

Yeah, I long for the days when my lack of one was a major worry. Or a worry at all.

You’re far from alone in that. You’re also most DEFINITELY far from too old to start. If you’re self employed like a lot of journalists are, it might make even more sense. Plus think of the columns you could write about the whole experience.

Put three months post-tax income in a savings account; if you're self-employed or freelance, make that six months. Do not do any other investments (except the pension) until you have that; if you have to dip into it, stop adding money to investments until you have refilled.

Put the rest of your investments in some sort of long-term diversified stocks and shares fund with the best tax advantages you can (this is currently called a "stocks and shares ISA"). You need to be able to forget about the money in there for years. Only look at this every 3-5 years.

Note: if you put money in the day before the 2008 crash, you'd still be up today by more than putting the same money in a savings account - and that's after investing on literally the worst possible day in the 21st century.

r/ukpersonalfinance 👍

If it helps, the official policy stance of the FCA was, more or less, designed to make you feel this way

open a stocks and shares isa, buy ftse 100 etf, keep dripping money in , yes you may lose money short term but over long term if you keep dripping money in should beat bank interest/inflation

1) You should invest it in something that returns more than a high interest acct. That usually means equities 2) If you invest in 1 equity (e.g. M&S, or BP), then you only lose (all) the money if that company goes bust. If you invest in a portfolio, you only lose (all) the money if they all go bust

There is a well-known and well-evidenced phenomenon by which people take too little risk, and therefore have too little return Basically when you're young, take risk because the higher return pays off over time. When you're older, take less risk because there is less time available to regain losses

The basic version I've heard a lot of variants on is: the further away the purpose of the saving (house, retirement, etc) the less should be in cash To minimise risk, diversify, which for a non expert means find a tracker fund with low fees But yes, can go down as well as up, just look at April

You have access to so many people that would love to explain this to you. I respect your commitment to refusing to let men enjoy themselves.

:)

Finance bros are THE WORST.

If it’s emergency funds in case you have a low patch work wise or need a deposit, that’s not necessarily a bad thing as you can actually access it

If you invested $10,000 in a total market index fund like Vanguard Total Stock Market Index (VTSAX) in 1994, and held it until 2024, the average annualized return would be approximately: ~9.7% per year

Rule of thirds. 1️⃣One third in the market in a fund like VTSAX 2️⃣One third in a short term high interest CD LADDER that provides liquidity opportunity every Quarter 3️⃣One Third Emergency Cash in the highest interest bank account you can find.

As a minimum, put it in an ISA so you are not paying tax on that interest.

Bunch of good finance youtube channels out there. Also a bunch of terrible ones. Do you want some links?

A lot of people can't afford to lose their stake AND more importantly might need access to it in a hurry.

The people who answered “no” and qualify for a), b) and c) probably fit in a phone box.

(Or are pensioners!)

(That came across snarkier than intended.)

Feel like targeting the 'don't understand' people with 'let me tell you about tracker funds' is the easiest win here?

Yeah, agree. I didn’t think the proposal to drop the limit was a good one and they are right to have dropped it IMO. It is a public info problem (and also a regulatory one about how we provide financial advice).

Possible hot take but I think at least some of public opinion, particularly after the GFC/'08 associated stocks & shares ISAs Vs Cash as "why would I pay management fees to rich people in the city playing casino" The existence of very low cost ETF trackers without active management hasn't filtered

Passive management sounds utterly counterintuitive. Pay less and have a 90pc chance of getting more...?

Make it clickbait "here's the secret bankers don't want you to know" "one weird trick to beat the bankers"

"Fat Cats hate this one trick..."

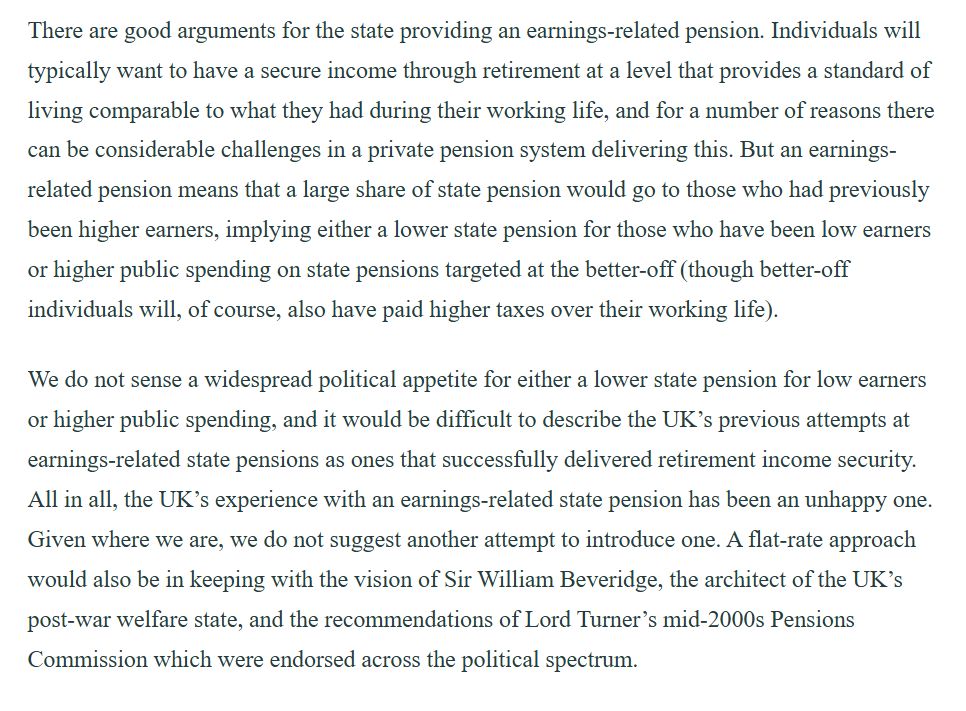

I mean, it would make the policy question much simpler if people didn't need an ISA as a substitute for unemployment insurance in the first place, as is the case in most other European countries!

Indeed. UK message to households is basically “if you’re laid off, you’re on your own, but when you retire, we’ll provide you something”. Unsurprisingly this leads to sub-optimal use of savings.

The previous message was you're on your own but when you retire you will get something *and it will be enough*. At least they're being honest about that now... too late for my generation...

Higher earnings-linked UI would be expensive and less redistributive than the existing flat-rate system arguably (screenshot from the IFS's report on the future of the State Pension):

Let's not get ahead of ourselves, no one said anything about an earnings link! At the moment unemployment insurance *does not even exist* in the UK. The closest we get is 'new style' JSA, but that only lasts half a year (and is only worth £2393.30 in total) and you have to sign on at a job centre!

What I'm arguing is that if we had a flat-rate contributory unemployment insurance system, akin to the state pension – at a decent rate, that lasted perhaps a year or a year and a half – you would get a much better allocation of savings. It wouldn't be redistributory but that wouldn't be the point.

I think if we were in the 2000s that might be something to contemplate, but in the current fiscal climate it feels like it wouldn't even fit onto the 'nice to have' list.

It's a bit like discussions about UBI, which I have a certain philosophical sympathy for, but which feel like thought experiments rather than realistic scenarios for the future of the welfare state.

It's entirely realistic.

I hugely respect your passion for this subject and the intellectual rigour you show in evaluating UBIs, but I'm afraid I still don't see how one could be implemented without placing significant pressure on other critical areas of public spending, or without harming particular classes of claimant.

Most UBI models I've encountered work well for about 60 - 75% of people, but there are minority groups - notably those with disabilities - where the UBI model is a relatively weak fit.

To reiterate, I don't disagree in principle, but we're a long way off this being practical: bsky.app/profile/nath...

Unemployment insurance exists in loads of countries through, and has done for decades! It's not an abstract idea at all! It would be to everyone's benefit if you did the absolute minimum amount of research before commenting.

I lived and worked in a country that has a Ghent-system unemployment insurance model, and it has advantages (and disadvantages) that I'm fully aware of.

I'm also very conscious that trying to transpose a model that developed under and is sustained by, very different labour market conditions to the UK's, is unlikely to succeed without a lot of effort and resources that could have greater benefit elsewhere.

Were I to respond seriously I'd say that you could institute a separate levy at a pretty low rate for this, that countries significantly poorer than the UK already do, and that you'd save workers money in the medium term. But your mindset is so cynical and defeatist that I might as well not bother.

It's not 'cheems' or defeatist to point out that spending relatively scarce public resources on a state-backed insurance scheme that would predominantly benefit middle and upper-middle class workers, isn't the optimal fiscal policy when things like the benefit cap and the two-child limit exist.

As I've tried to make clear, I'm not opposed to the idea in principle, I just think now is not the best time to be funnelling public funds in its direction.

It would just be far more efficient to have a collectivised system of unemployment insurance than to carry on with a situation whereby everyone on middle incomes is obliged to hold c.£10k in cash savings lest they lose their job.

I'm actually surprised that the Old Labour Right hasn't latched on to contributory unemployment insurance as a policy idea yet, given it aligns so well with their ideological priors (i.e. something for something, deserving over undeserving, etc.)

There was a Fabian Society paper sometime in the last year or so, but it didn't get any traction

It also proposed a state run one, whilst one of my own more Old Right-ish reasons for supporting it is to use the Ghent model to increase union density

That's a fair point, and that might actually make it an easier sell politically – in the same way that auto-enrolment was an easier sell than mandating workplace pension contributions

I know, I read it!

Sorry

You and I are among the few Labour members obsessed enough to have read such a thing lol. Idk about you but I find our party's general disinterest in welfare policy very frustrating. Initiatives like the Commission on Social Justice are remarkably rare exceptions to that norm.

It's part of the proposal for out-of-work disability benefits in the White Paper.

Liz Kendall's not in the old Labour right!

(Tho to be fair, Shabana definitely is and is pro-contributory principle too.)

Ah, my MP (technically, based on my last English address)...

I think we should be trying to bring in a Ghent model as a Trojan horse for quasi-mandatory union membership while getting it past the public as right-coded benefits cuts ngl

But I guess it's a sign of how moribund the 'new' right has become that people struggle to tell the difference. And in Kendall's case, the fact McSweeney ran her leadership campaign doesn't help.

And am I right in thinking Kendall's proposal is some weird thing where you have to pay it back like a student loan?

Not that I recall - it's just a consultation about the idea and mechanism, and AIUI it's a real one rather than a 'building a case for a thing we already want' one.

This is what I was thinking of – one of her current advisers proposed a loan-style scheme back in 2013 www.newstatesman.com/politics/201...

I don't remember reading that in the White Paper, but it sadly wouldn't surprise me to see some aspect of the Active Labour Market Policy stuff being like that

I wonder if there's an amount that is a tipping point, above which people are more willing? Average UK savings are about £10,000. 1 in 4 have less than £1,000. Which box have they ticked? I bet a lot of us assume stocks & shares are not for those kinds of sums. www.raisin.co.uk/newsroom/bet...

Okay, so - there is a portion of the population (I am one) for whom this stuff just doesn't go in. I don't understand any of it, it's all unreal and the idea of having to learn about it makes me tear up. It's just this stuff, I can figure out, like, tax and mortgages.

That's downstream of poor maths teaching that means people are not as numerically confident as they could be, there's nothing in-born in Britons that makes us less able to grip this stuff than Americans or Canadians.

I don't think it's really to do with maths. Can only speak for myself, but I can do maths. For me at least it's about grasping financial structures which don't stick in my brain at all. I presume I'm not alone.

It's something I've been meaning to get around to but my working assumption is that if I give my money to yer average British stockbroker they will promptly spend it on cocaine

Look at low cost passive index trackers. The fees aren't high enough for anyone involved to develop any sort of cocaine habit.

I want to meet the 59% who do understand the stock market.

Media coverage of equities tends towards the 'casino' aspect, and never mentions dividends. This is a shame.

The thing is... who has savings over and above the rainy day 6 months worth they advise you to have, and their pension? I never did until R was approaching the end of her undergraduate course and my mortgage got close to being paid off. 1/

My wife does have money from the sale of her mother's house but as she's an American citizen she can't just invest in stocks & shares based investments as the IRS reporting is punitively complicated (you pretty much have to report every transaction a fund does to them!)

And now I do (well, I did but, new roof)... but I can't think in terms of 10 years. Or even 5. So investing in stocks and shares other than through my pension is just not on. I might increase my pension payments now that I can but that's it and it will be, I suspect a short term thing. 2/2

Like, if I put cash in the bank then I have capital, I can do things, I can address immediate concerns. If I invest it then I have to wait ten years for there to be significant growth and in the meantime I can't touch the money...

Ten years is a very pessimistic time frame. Look at low cost index trackers in an ISA, drip feed into it on a regular basis, try not to touch it but if you need to access it, then access it.

I don’t think I could even survive 6 months and I have more savings than almost all of my friends.

Same and same (if you include pension pots otherwise probably not anymore but I do have a nice new roof).

Your comments are really helpful & interesting. I'm definitely somebody who would fall into the "feeling ignorant & frightened of stock market + worried about how ethical some of Investments might be so just avoid the whole thing" bracket. It doesn't feel as tho there is anywhere to get good advice

It certainly doesn't help that we hear "if you own X-company stock then you're personally responsible for whatever vicious bullshit X-company does..."

I recently set up a child’s Wealthify Stocks & Shares ISA for my toddler. Lots of different options depending on the level of risk you want to take, and have ethical investing options too

That's really helpful to hear, I'm definitely in the category of "unconscious incompetence" where I don't even know what I don't know or where to begin! I lost a lot of money in the 2008 crash that was supposed to be in safe stocks and shares and I've just stayed away from it since.

We just signed up and deposited money. They charge a tiny % fee, but do everything, so we can just leave it and come back when she reaches 18

Rebel Finance School is really good...free, on YouTube, and they have a Facebook group as well. They tackle all aspects of finance starting from eliminating debt and building a gap, all the way to how to understand investment fact sheets and platforms and how to invest/how it works. Really rate them

Thank you, this is really helpful. It's one of those things where there seems to be so much advice out there and I don't know who is reliable or what might be a dodgy scam so have not even known where to begin. Really appreciate your tip and you taking the time

You're welcome. I find the yt videos a bit long and a bit boring sometimes but the actual content is useful imo.

That's really a helpful comment thank you. I think I am definitely responsible here too, I think I need to put the work in to find out about this stuff but day-to-day life is always so busy that I don't & I haven't even known where to begin. You've given me a good place to start so thank you!

It'd also be interesting to see how this correlates to household debt, given how high this is in the UK (even excluding mortgages).

We would put our money in the Royal Great British Trust available through post office books.

You would want to know who out of those surveyed actually have savings / are in debt.

You're never going to be entirely rid of the people who think that cash = money and that burying jars of coins in the backyard represents "savings".

Maybe, just maybe, because the City has repeatedly behaved like a bunch of spivs. Paying themselves extraordinary amounts from the fees they charge. Having seen the City close up for many decades

Ah yes, and their American counterparts are all humble, honest joes that have done so much to earn the trust of the American public…

There’s a lot of interbreeding there!

It is good advice for those at a particular point in their lives. If you have an adequate income, can afford more risk in your portfolio and have time on your side to recover losses, then fine, you may well build your capital by investing. Not great advice if you live off limited capital though.

I wonder if question wording has distorted the answers: "invest your savings" sounds very all or nothing. I have feeling that "invest some of" or "invest any of" might have attracted different answers?

I don’t know that that’s the reason tho. For me it’s all about the risk and lack of knowledge and understanding on how to protect myself in a riskier context

Same. I’m retired, have a savings account and an ISA (which deceased husband set up) but no clue/less understanding of finance. Just happy I live comfortably on my pensions.

Most of their money in savings accounts is invested in markets by the institutions holding the savings. The difference is the institutions make money, not the individuals.

For those of us who lack financial literacy but are willing to learn, where would you advise starting? I'm largely held back by my incapacity to separate bad/malicious advice from good advice

It's telling that, after 5 hours, no-one has answered this perfectly reasonable question. For money info in general I recommend Martin Lewis (there's a mailing list). Beware of imitations. For stocks and shares, prob the best way is to know someone already in the business!

Strongly recommend monevator.com. Although they do talk about active investment for the interested/expert, the strong message for us average Joes is ISAs, pensions and index funds. Lots of useful info on what is available, and how .to invest. Check it out

I will never understand how people can be terrified of fairly basic relatively risk free investment but not terrified of their savings value being wiped out by inflation.

It’s I think a product of a number of British problems (coyness about money, bad mathematical and financial literacy education). Note how the people getting angry in my mentions are a cross-section of Brits while a bunch of Yanks are just rting or liking the post!

The irony that we actually have enormously generous tax breaks for investing…

Confidence. Or not.

Just get every school kid to read Warren Buffet. And I’m not even joking.

I think "terrified" is overdoing it, as is "wiped out". We're not talking Weimar Germany / Zimbabwe; I doubt many British people have had their savings wiped out by inflation in living memory. The interest, maybe. But that's the difference, isn't it. With investing, people worry about losing the lot

"relatively risk free" = all your capital is at risk "wiped out by inflation" = loses some of its value

If I lost all of my money that is put diverse index funds, I don't think the cash guy would be doing so hot either, because that would mean the breakdown of the entire world economy. If you invested in the DJIA at its peak before the 2008 crisis, then lost a ton in the crash, but took it out just

10 years later, you'd have a ~64% return. Meanwhile, inflation in the US in that time period was ~18%. That's a massive swing.

How about the four stock market crashes in the last 38 years.

None of those crashes would negate the performance of dollar/pound cost averaging and progressively transitioning to bonds in later life.

Wouldn't that take a more active approach ?

Technically, but it's a really small amount of work. Many platforms offer the option of setting a schedule of automatic deposits and then purchases of an index fund with a target retirement date that will gradually shift to more holding of bonds.

It's properly depressing. My mum (67-year-old recently retired teacher) refused to invest in anything but cash savings accounts (deeming stocks too risky), and as a result I imagine has lost in real terms ~30% of what she originally saved over her career. Sad to see people repeating that mistake

"Imagine" doing a lot of heavy lifting there.

Okay, perhaps not 30%, but still a significant sum given her peak earning years had such low base rates. £100k in the bank in 2008 earning 2% would end up with £140k in 2025; £140k is the equivalent of £85k in 2008 purchasing power, so a 15% loss just in those 17 years.

Poor financial education is part of it. But consider that young professionals who should be starting to build a portfolio grew up in the shadow of the financial crisis. Theres a distinct and understandable lack of trust. I know I put myself in that pot.

I should be investing more but my cash ISA 'feels' saver. Especially since the worlds largest economy is being run by conspiracy nut jobs

it's not irrational to be afraid of uncertainty

Everybody needs a cash hedge. If all you have is money for 6 - 12 months living expenses the number of stocks you should buy is zero.

But it is irrational to think the alternatives - such as holding cash while inflation erodes it - aren't uncertainty as well. Everything is uncertain! That's life! The good news is that things like S&S ISAs reduce that uncertainty as much as feasible.

Indeed. It is not good that people, including most of the replies I am getting, don’t understand the fundamentals of how this stuff works!

I can excuse not understanding as long as someone is open to learning, but I can't excuse some people (& I've seen this irl as well) having a viscerally emotional reaction to *any* advice on savings. Not sure if they view it as criticism of their lifestyle, or...

it's a visceral emotional reaction to be the expectation that we manage our lives as though they are portfolios. Clearly if there is some "set and forget" s&s option that's best for everyone that should be communicated, but it's not exactly the most dangerous ignorance available just now, is it?

There *is* a "set and forget" S&S option (dollar/pound cost averaging a target retirement index fund that's globally diversified). I don't know why whether it's "the most dangerous ignorance" is relevant at all.

Also, the theory here seems to be to react with visceral hostility to advice on this topic to, what, save openmindedness for bigger issues? Could just…be openminded in general!

these replies are ignoring my point about the emotions involved in being required to treat our lives as portfolios... Anyway, I'm going to look into a s&s isa now since you're so vehement, but for everyone else the only way you're going to achieve change is to get Martin Lewis to talk about it.

Martin doesn’t give investment advice. He’s always very clear about that. What we need is someone equally trustworthy to give investment advice. I can recommend Investment Chronicle (Magazine & website) & their various podcasts.

Your life isn't a portfolio, but your savings are. It's just that some of those portfolios are very low-risk, but make up for that by being extremely low-return. And that is fine for those of us with very few savings where it's there to deal with crises, but a much worse deal for those with more.

So what does 'dollar/pound cost averaging a target retirement index fund that's globally diversified' mean to someone with a spare £500? (Or more basically, what does it mean in lay terms?)

I don't think schools give them much steer on personal finance. Wells Jnr did A-Level economics, which seemed to be 50% personal finance, yet still emerged clueless on it

On that - anyone aged 14+ will have the Child Trust Fund thing maturing when they hit 18 to give them a kickstart on this, so it is actually practical advice shools can give. If they were born in the UK, they will genuinely have a small savings pot coming to them at 18

(Sure many or most will want to spend it on something rather than re-invest, but still, it is a chance to teach something real)

No, they add a second order uncertainty. Stick £500 in an account, you know you'll get £500 + uncertainty back. Invest and you'll get £500 + uncertainty x uncertainty.

But, but Targeted Support I wail from my Ministerial Office

What do they think their pensions are in?

The legacy of 2008 will last two generations. Not much you can do about it except try a new marketing scheme that removes the words "stocks and shares" entirely

Most people who kept their building - soc. privatisation windfalls saw their value fall to nothing, or close to it.

1987,2000,2008,2020. That is 4 stock market crashes in my lifetime. I see it all as a scam unless you are rich.

2008 wiped out entire life savings for some though, including my grandparents (luckily my grandma was too old to follow what was happening and my Dad decided not to explain, but it has definitely affected his financial choices since) .

That sounds very tough 😔 Maybe we should all do what Jennifer Arcuri suggests and invest in gold.

And we should remove those words. Because direct investment in actual stocks and shares is more risk than most individuals should take most of the time.

I don’t disagree, but pensions aside there is currently no product that offers security and growth.

Most people think that this is still what you get from property, though - BTL seems to still be the first thing people think of when they have a windfall and want to 'invest the money in something'

And pensions aren’t really that secure either - before people pile on

This lets the FCA off the hook a bit too much. They spent a decade focusing almost exclusively on risk disclosures, which had the effect of scaring investors away from mutual funds and, with RDR, ensuring no one could get financial advice. Real a perfect combo to break people’s minds

Fair point.

Seriously, if you have any kind of private pension at all it's invested in stocks and shares. How do people not know this?

Auto enrolment/ Nest has been quite a success, and perhaps could be leveraged more in public understanding/discussion

My stocks&shares isa barely performs better than my high interest cash isa - and that only because I've put some money into nvidia a few years ago.

Education is needed, lots of it. For most of the 20th century the govt took care of it, and people didn’t need to see or understand how it worked. When people did get involved, privatisation conditioned them to expect easy profits. And in the 21st century millions don’t trust any govt advice. 🤷♂️

American living in Britain* advice: Don’t bother trying to invest because nobody you can afford to invest with will touch you because of financial reporting requirements. *who isn’t a high net worth individual

Truly one of the few things I think growing up in America prepared me better for than my fellow Brits is investing in your pension (401k). I am always astonished when friends and colleagues in their 30 and 40s are like yeah I should start thinking about that.

It's absolutely enraging, as is the stuff about the supposed insane generosity of the tax break.

What are 'savings'?

People buy into the idea that shares go up and down more than they do the fact long term the stock market almost always goes up. Both are true, but to the risk averse the fear of loss prevails.

I managed my mum's finances when she developed dementia. She had money in a stocks & shares fund described as low risk by . It was badly affected by the turmoil after 2008 & was worth significantly less at the point she needed money for care. I am very wary of stocks& shares as a result!

Exactly. There's increasing potential for similar shocks in the future, not least because of climate change. People's thinking also seems to be affected by the past two decades. But they were marked by rather unusual central bank policies and there's no reason to think current trends will continue.

And I have some shares as the result of building societies becoming banks & which are still hardly worth the paper they were written on! Long memory makes me wary!

Well quite. Recent experience hasn't been any great advertisement for stocks as a store of value. If you're not fussed about ethics you can but tobacco companies for the high yield.

Cancel that advice! They've risen a lot in the last few years.

I am fussed about ethics.

Nobody's got any savings, Stephen, we can't afford to live let alone invest, thanks to successive crooks lile Reeves

I know it's not terrible advice. It's a good idea for people that have small but regular amounts of cash to put it in a tracker for at least 5 years. It's just... I'm mid 40s, and in that time I've had a buffer of 3 months salary saved up once for about 9 months. I now no longer have that buffer.

I've got a stocks and shares ISA. Even with my stated risk-averse approach, it's given me far more in interest than my husband's cash ISA. Took a massive hit during the Truss debacle but has bounced back since.

if having individual UK savers is bad for the economy, regarding crappy GDP metrics, what is it when pretend patriots/execs actually remove money from the UK and stash it in tax havens?🤔

Some of these people genuinely believe that on their retirement they get a bucket with all their past pension payments in and that’ll be enough to keep them going for decades.

No one believes that. No one who is under 40 imagines they will get a pension at all. It will be working until death or assisted suicide.

All the more reason to invest your savings.

I am in the group that has no savings.

Yes, and that’s another ticking timebomb. Given the cost of living, housing, student debt etc, it’s quite privileged to blithely assume people can just “use their savings”.

Yes, fair enough, many people do not have any savings, which is an important but separate issue. But we are talking here about how people that do have savings use them - and in every case they should invest them rather than leave money sitting in a bank and losing value over time.

One in ten UK adults have absolutely no savings at all, a stat that increases considerably among the younger population. Overall, a quarter of the UK adult population have low financial resilience. Talk about your index trackers all you like, but if you can’t save, you can’t invest.

I agree that is very concerning and should be a priority for the government. But what is also true is that the 90% that do have savings should ALL have a stocks and share ISA as where they can increase the value of their savings year on year

Fair point. But there are plenty in their 50s who still believe the State will somehow magically provide. It’s a toxic cocktail.

I think the humidity has got to people’s heads today.

Yep they're unwise. But I'm actually surprised the numbers aren't less hostile. If you'd asked a question such as "The government wants to limit the amount of money you can save tax-free in instant-access cash ISA accounts and make you put it into shares instead" I would guess 75% opposition.

Unwise or anxious? Why assume it’s lack of wisdom rather that knowledge, advice, support and above all confidence? Bit rude.

Didn’t Woody Allen say something like ‘financial advisors invest your money until there is none left?’. This was our experience in the 90s when advised to invest in Japan just before they crashed.

*More* hostile. Doh.

Maybe because the much discussed reduction in cash isa allowance is not actually policy?

And even though she's *said* it's not policy, the Telegraph still try to get away with this nonsense

The Telegraph fired most of its journalists. It is now staffed by libertarians from lobby groups posing as journalists who generate Tufton St aligned ragebait.

Perfect summary. Cf ‘How They Broke Britain’, James O’Brien.

For me if there was a lifetime limit on cash isas but not on share isas I wonder what the balance would be

Counterpoint: had she made that change in April, the 28% of people who would have moved into stocks would have done very well so far from the bounce back from the Trump chaos. A rapid demonstration to the electorate of the merits of the policy

Oh we are unwise? You guys are so patronising. I don't need to take risks with my money and I won't. How would I even begin to assess the risks of any scheme? "Don't trust financiers not to ruin me" became a useful slogan in 2007 and it is still written on my wallet.

It's good that you personally don't need to take risks. But riskfree returns are meagre and unlikely to build the kind of pension many will need. Are you on a DB pension by any chance?

What kind of pensions will be built by those who take the risk and come unstuck?

It’s all about time in the market not timing the market. One should be more aggressive with respect to risk when pension saving as a younger person, then as you get older you should be transitioning to a less risky mix of assets in a portfolio (think moving from stocks more towards bonds)

As a younger person I barely earned enough to pay my rent. Your advice is fine for the well-paid! As a pensioner, my 'full new state pension' suffers a 4-weekly £103 claw-back due to opting out of SERPS (as advised), in return for a princely private pension of £184 (adjusted to 4-weekly).

Literally everyone now has to have a workplace pension, with respect I’m talking about people of my own age now. If you save it in a safer manner now then 30-40 years down the road that’ll make a huge difference! Obviously at your age someone should be an awful lot safer with their investments

I'd guess that a substantial percentage of cash-ISA holders are pensioners.

Yes - I have two DB pensions 😇 which came with lump sums that now live in Cash ISAs.

Lucky you. Alas the rest of us depend on the economy growing.

The problem is the economy might grow - but not one's own investments.

We all already invest in the stock market through pensions!! It's so maddening that no one explains this!

When Lawson introduced PEPs they were about encouraging share ownership. The picture became more complicated when Major introduced TESSAs (tax exempt special savings accounts) which rewarded cash savings. Brown introduced ISAs which combined the two: the rest, as they say,is history.

Na, spiv's charter. The scum who consistently creamed off working people's profits have poisoned the well. I remember the big bang and pension deregulation, I remember paying for the financial crash, your complacency and complicity with Reeves is quite remarkable.

I think it’s the lack of overall awareness/education about investing and I don’t mean uni, just basic societal awareness of what investing does. They teach that in high school in the US, you literally start watching the stock market at 16.

Just saw a tiktok in this, madness. People have convinced themselves a stocks and shares ISA is a form of gambling.

Everyone is terrified of “risk”. Even though it’s clearly better than just losing the spending power of your money year on year. Avoidant culture. Always interesting difference between US and UK

I already do and have done since my early 30s. You get a much better return than in a savings account.

Thing is that almost anyone who has a workplace defined contribution pension >does< invest in the stock market. That they don't realise they do and that they don't understand why this is a good idea is a terrible failure of education.

*for reference that's ~80% of eligible employees

Investing sucks, give me a good pension any day

Pensions are invested?

Your pension is funded by investing, and they always have been! Your post reads “Investing sucks, give me good investing any day”.

It’s obviously different than having to have a personal portfolio. There’s no reason people need to engage with personal investing to get by.

Yes, I would read you as talking about defined benefit vs defined contribution plan (the latter is now most common in the US via 401k and I think leads to various social ills)

That said, I would say UK people would benefit from understanding the best financial order of operations in the current environment (6 month emergency fund -> maximize share and stocks ISA yearly contribution in low cost index fund)

British people think about finances almost exclusively in terms of their house price, but frequently that is not something you can easily sell or sell in a piecemeal fashion for retirement costs

There would genuinely good systems and neoliberals ruined it to line their pockets

Pensions are invested, you're just one step removed from said investment.

Good!

True but the funny part is pensions actually invest in several different markets.

I mean, that’s what a pension is…

As someone who has a cash ISA and is very averse to putting money in a stocks and shares ISA, my reasoning is that I use my ISA as a form of longer-term contingency savings - and I suspect a lot of other savers do too - rather than a future retirement income source.

Granted, I am a member of a pension scheme, but I don't want to risk the nominal value of my savings on a sudden market downturn when I might need them for a more immediate contingency (redundancy, serious ill-health, etc.)

Which you have acknowledged, I realise: bsky.app/profile/step...