When she bought the second home, the Loan Officer would have seen the first mortgage on the credit pull and asked what she would be doing with the first property. Under the right circumstances (typically known as the "life happens" rule), it's perfectly normal.

Replies

This. There is no obligation to sell or refinance a property that has been a primary residence when purchasing another that you plan to occupy.

Nor do we know the time period between the purchase of the first house and the second.

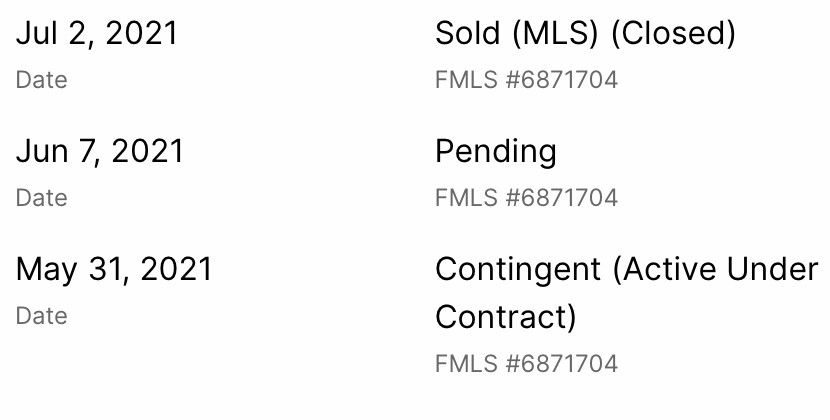

What matters is the time between the most recent mortgage and the purchase of the second. It was two weeks.

For Fannie Mae loans, it's one yr from start of occupancy. Unless, there are extenuating circumstances, like moving because of change of job, health, etc. Proprietary loans depend on the lender rules.

Either way, closing a primary refinance while already under contract for another home you’re claiming as primary is (outside specific exceptions) going to be an issue

If that is the allegation (primary *refinance* while under contract for another), then that is a problem.

That’s the case for Cook

Assuming that's all correct (I did not double check), and it's a FNMA loan, then the only other excuse off the top of my head is the integrity of the lender representatives, especially if it was the same lender

Could be lender error on preparing docs for the purchase, could fall under the allowance for children buying a home for a parent (she’s from GA, her parents would have been somewhere around 80)…or could actually be a problem

Normal period is one year from start of occupancy. However, there might be extenuating circumstances, e.g., a new job in a different state. Typically, there will be a "letter of explanation" as part of the overall mortgage package.

Yes, we do. It has been reported as 3 weeks. Not a good thing.

This. I currently have two primary residence homes. My current home, and my previous, which im trying to sell after renting it out. I needed to get different insurance, but didn't need to get a new loan.

Yes. Insurance can be a thing when the use changes, a tax municipality may not allow a tax break on more than one property in a taxable area, and then there are how they are claimed on income taxes. None of these are mortgage fraud, however.

Also 'principal' isn't 'primary.'

This simply is not correct

Only problem, reportedly the two applications were within 3 weeks of each other. But she needs to have her day in court.

This is completely ordinary: if you buy a new home but haven't sold the old one yet, you may well have 2 mortgages both classed for primary residence for a period of months or longer.